Many investors are worried about inflation. How long will it carry on rising for? And what sort of impact will it have on returns? As LARRY SWEDROE explains, the best strategy is probably to stay invested and focus on your long-term goals.

Inflation is making a comeback this year. The Consumer Price Index for All Urban Consumers (CPI-U) increased 5.4 percent before seasonal adjustment over the last 12 months ending June 2021. This is the largest 12-month increase since the 5.4 percent increase for the 12-month period ending August 2008. The index has been trending up every month since January, when the 12-month change was 1.4 percent. Naturally, many investors are worried about inflation.

Increased investor concerns about inflation are justified because the effects of unchecked inflation on purchasing power can be devastating. The loss of purchasing power over the last decade — a period when U.S. inflation has been benign and stable, averaging 1.7 percent per year—reduced $100 at the beginning of 2011 to roughly $85 dollars by the end of 2020. If a decade of below average inflation can have that kind of effect on purchasing power, imagine what could happen if the current trend continues. If we have 5.5 percent inflation for the next decade, inflation will reduce that same $100 of purchasing power to roughly $60 of purchasing power after ten years. It is no wonder investors are scrambling to protect their portfolios.

When seeking inflation protection in your portfolio, it is important to make the distinction between assets that hedge inflation (have returns that move closely with unexpected inflation) and assets that outpace inflation over the long term. If your goal is to fund short-term consumption that is tied to inflation, you will want to consider hedging assets. If your goal is to fund spending over the long term, investments that outpace inflation are more appropriate. And chances are you need some combination of both in your portfolio to help protect current consumption and long-term spending needs.

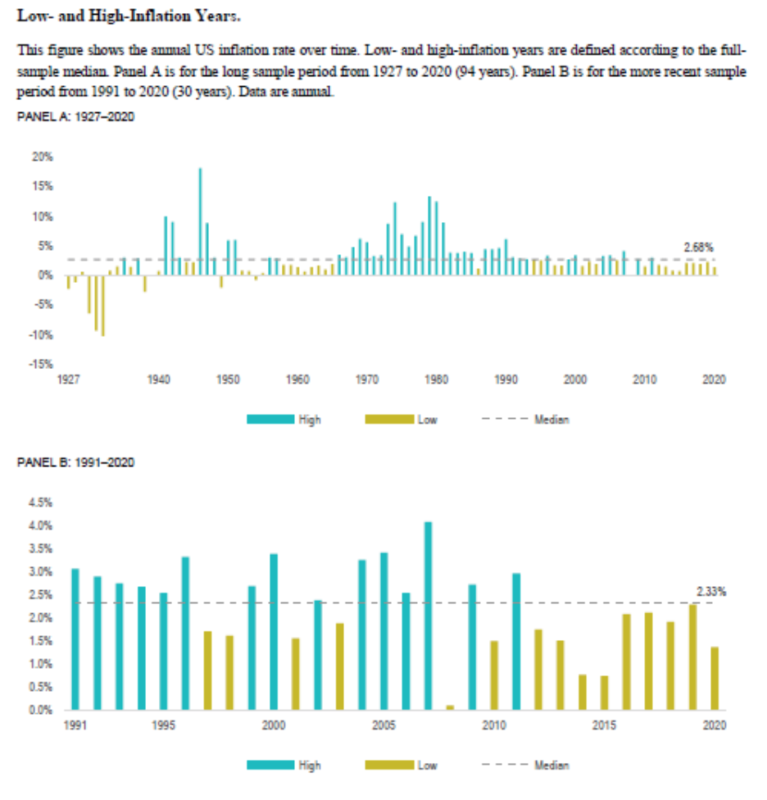

If you are worried about inflation, the recent paper US Inflation and Global Asset Returns by Dimensional’s Wei Dai and Mamdouh Medhat provides some helpful insights. It also contains some sobering facts for investors trying to hedge against inflation through alternatives to inflation-indexed securities. My colleague, Sheldon McFarland, vice president of portfolio strategy and research, reviewed their study, in which Dai and Medhat examined inflation over two distinct periods: a long-term sample period of 94 years (1927-2020) and a more recent sample period of 30 years (1991-2020). They also studied the relation between inflation and asset returns—real and nominal—over the two sample periods in both the high inflation and low inflation years. High inflation years were defined as years with above-median inflation for the sample period, and low inflation years were defined as years with below-median inflation for the period. Inflation averaged 2.7 percent per year for the 1927-2020 period and 2.3 percent per year for the 1991-2020 period. Exhibit 1 below shows the evolution of U.S. inflation over time, with an indication of the years with low and high inflation during each of the two sample periods.

Exhibit 1

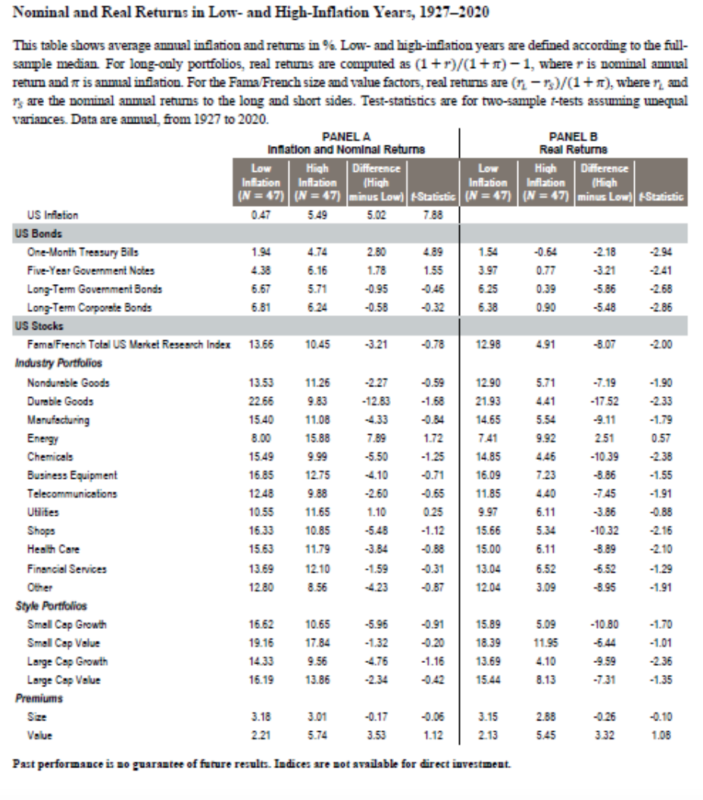

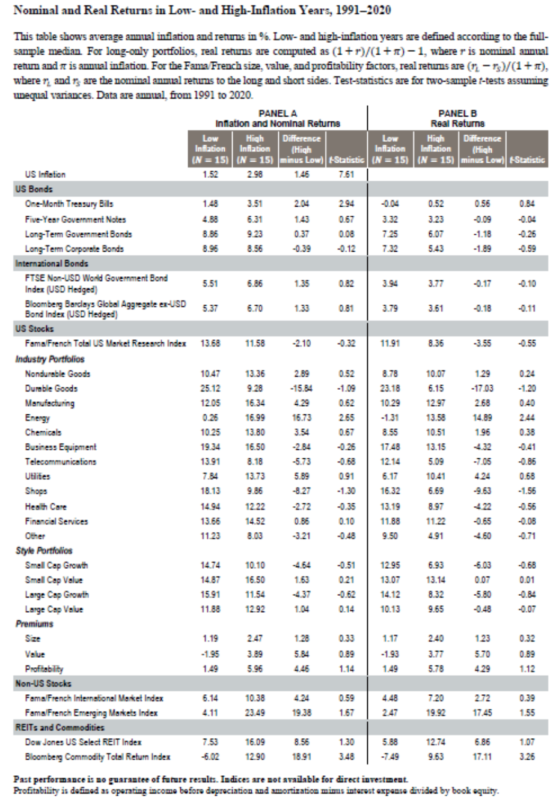

For investors looking to outpace inflation over the long term, the results of the paper are reassuring. The authors found that most assets studied in the paper had positive average real returns (the asset return after reducing it for inflation) in both low- and high-inflation years. This is true over the full period 1927-2020 as well as the most recent 30 years (1991-2020), a period of modest inflation.

For investors looking to hedge against inflation by investing in assets that move closely with it, inflation-indexed securities — such as Treasury Inflation-Protected Securities (TIPS) and inflation swaps — are natural candidates. Some, however, have argued that commodities, real estate investment trusts (REITs), stocks in “inflation-sensitive” industries and value stocks may also be good inflation hedges.

Dai and Medhat suggested that investors considering alternatives to inflation-indexed securities, such as commodities, REITs or other assets, should do so with caution. They found mostly weak correlations between nominal returns and inflation. In the few cases where the correlations were reliably positive, such as for energy stocks and commodities over the period 1991-2020, the assets’ returns were around 20 times as volatile as inflation and more than half of their nominal-return variance was unexplained by inflation. Thus, if you are seeking to hedge inflation with these assets, do so with caution because their relatively high volatility can lead to a large dispersion in future consumption outcomes. See Exhibits 2 and 3 for the complete results of all assets studied.

Exhibit 2

Exhibit 3

Investor takeaways

Here are the important takeaways for investors who are worried about inflation:

— TIPS are the most effective instrument for hedging inflation.

— While energy stocks and commodities delivered higher average real returns in high-inflation years compared to low-inflation years, they have been much more volatile than inflation, and most of the variation in nominal returns was unrelated to inflation.

— Most of the assets studied have been able to outpace inflation over the long term.

— Simply staying invested may be an effective long-term solution for inflation concerns.

The information presented herein is for educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Certain information may be based on third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® or Buckingham Strategic Partners® (collectively Buckingham Wealth Partners). LSR-21-137

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

Are enhanced index funds genuinely enhanced?

Hedge funds: the end of an era?

Paying attention to “online buzz” harms returns

© The Evidence-Based Investor MMXXI