By JASON BUTLER

I was recently approached by a chap at my gym who listens to me regularly on the FT MoneyShow podcast. He wanted to know what I thought would happen to the stock market over the next six months or so, as he had a large amount of cash sitting about, as a result of a recent property purchase which had fallen through.

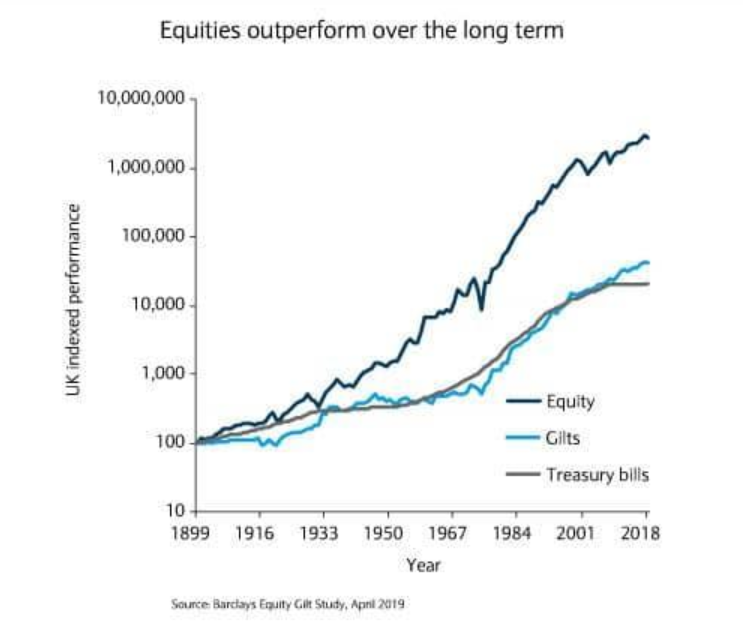

I told him that I had no more idea than he did what would happen to stock markets over any period of time, but that data from the past 120 years shows that UK equities (with income reinvested) would have turned £100 into about £2.7M, compared to £42,000 from government bonds (gilts) and just over £20,000 from cash, as the chart below illustrates. Obviously inflation would have reduced the buying power of these returns, but equities over this time period were the clear winner, as the chart below from the Barclays Equity Gilt Study shows.

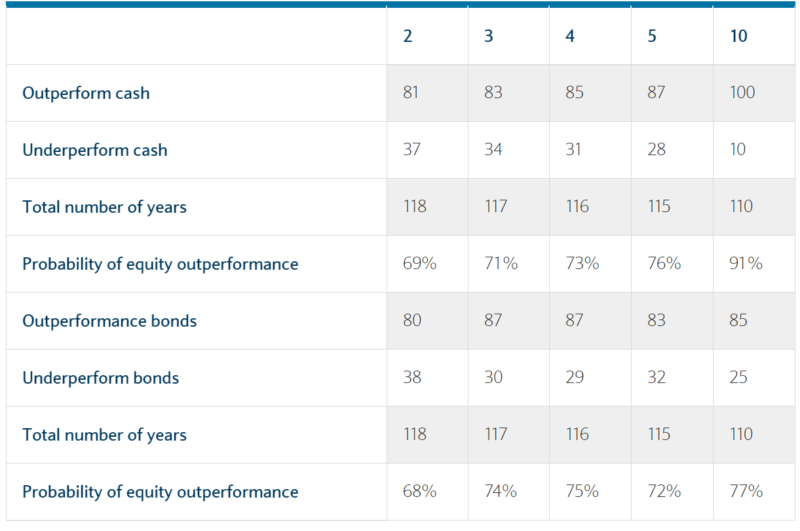

Although taxes and charges would have reduced the actual cash returns to investors, the case for equity investment is compelling over the very long-term. But what about over shorter holding periods, which relate to the needs of individual investors? Helpfully, Barclays has also calculated the probability of equities outperforming cash and gilts over shorter holding periods, as shown in the table below.

UK equity performance statistics since 1899

Source: Barclay Equity Gilts Survey, April 2019

Over one-year periods, equities have a 69% chance of outperforming cash (and a 68% chance of out- performing bonds). However, over 10-year periods the probability of equities out-performing cash increases to 91% (and 77% for bonds). These are pretty good odds if you are still accumulating wealth for financial independence and have at least ten years of further regular savings to make.

But if you need to access your cash before ten years, or you are unlucky to experience that 1 in 10 period of equity underperformance (compared to cash and bonds) during the first ten years that you start making regular withdrawals from your pension or other capital to fund life after paid work, this could see you suffer significant losses and potentially run out of money or even have to borrow to meet your living costs.

Analysis of a range of UK-based returns since 1970 shows a range of portfolios falling 37% of the time, recovering 20% of the time, and rising 43% of the time (you can read the analysis here). And we should expect a significant fall about every four years or so. The fact that we’ve seen mainly rises in global stock markets over the past 10 years or so, suggests that the odds are increasing that one of those nasty falls will happen. But equally we might not see one for another ten years or more.

It’s precisely this unpredictability of the stock market that is the source of its higher expected returns compared to cash and, to a lesser extent, bonds. To be a successful investor you need to avoid being a forced seller of equities during one of the periodic, but inevitable, periods when markets are falling, or returns are below the long-term average.

Although cash returns are currently at an all-time low, having enough cash reserves to meet your known and unknown lifestyle spending needs is an essential foundation upon which a successful investment experience is based.

In a capitalist-based economy (with all its flaws), cash acts as a lubricant, rather than a store of value. You trade return potential for certainty that your capital (at least before considering inflation) is safe and can be returned either immediately or within a matter of weeks or months.

Having enough cash on hand enables you to:

be able to meet the cost of emergencies such as unexpected car or home repairs or temporary loss of regular income due to illness or redundancy;

to meet fund shorter term priorities such as the deposit on a home whether rented or purchased with a mortgage;

to take advantage of opportunities such investing in your (or someone else’s) business, or training to improve your personal skills.

Having cash available to meet these types of shorter-term spending will enable you to have a higher allocation to equities than might otherwise be the case and for you to be able to leave it alone for the long-term, thus increasing the odds of you having a great investment experience.

Make your cash work

Where your cash reserve is purely to meet emergencies, and not larger amounts of shorter-term spending, it makes sense to hold the capital in a competitive instant access deposit account – the most competitive of which pay around 1.50% pa variable. For cash that you can tie up a bit more, and are happy to give notice to access, you can achieve between 1.4%pa to 1.8%pa depending on the notice period.

In the UK you can hold up to £85,000 (£170,000 for joint accounts) with any one institution and your capital is underwritten by the UK government if the provider goes bust. The Savers Friend website from Moneyfacts gives details of current best buy savings accounts and you can access it here.

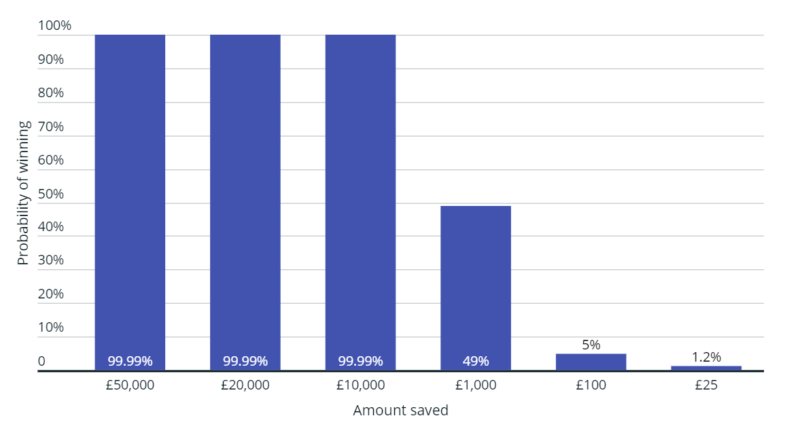

If you are prepared to accept the high chance of little or no returns, in return for a monthly 24,500 to 1 chance of each £1 winning between £25 – £1m, you can put up to £50,000 in National Savings & Investments’ Premium Bonds. In the latest draw, out of the 3.47 million prizewinners, nearly 2,100 were for between £1,000 to £1M as the table below shows.

Source: Moneywise, NS&I

Although the prize winnings average about 1.4% across all bond holders, you’ll most likely receive a fraction of this return over a year, and possibly none. In effect you are giving up the certainty of a return from an instant access or notice savings account for the small chance of winning big. The chart below shows the probability of winning based on different investment amounts, with those with the largest holdings, not unsurprisingly, having the highest odds of winning.

Source: Which? and NS&I

Premium Bonds make sense when you have a larger cash reserve, want 100% capital security and are happy to give up the certainty of a low interest return for the possibility of a bigger win each month. My wife and I tend to hold between 15 to 35% of our cash reserve in Premium Bonds, depending on our short term spending priorities. This video from NS&I explains how they work in more detail.

Cash is a great asset class because it enables you to be a committed long-term investor, by giving you the ability to ride out the inevitable and unpleasant stock market gyration and periods of underperformance.

Investing in the stock market is never certain, and it never will be. What is certain is that having enough wealth to provide you with independence and dignity when you can’t or no longer want to work for money is an expensive and inevitable financial need for which you need to plan.

Having enough cash to hand will help you get your fair share of whatever returns stock markets produce in the future.

JASON BUTLER is a former financial adviser, based in Suffolk. He is a personal finance columnist for the Financial Times, and is Head of Financial Education at Salary Finance. You can find out more about him on his website.

If you’re interested in reading more from Jason, here are a few of the other articles he’s contributed to TEBI:

Learn to embrace the challenges

Beware investing in serviced accomodation

Time to face up to your money mistakes

Five steps to achieving financial freedom