What you choose to see depends less on the object and more on the eyes you’re using to look at it.

.

Posted by TEBI on October 3, 2019

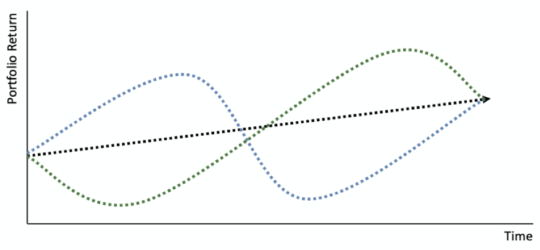

In the graph below are three investment journeys. They all start and end in the same place, with the same return. Without overthinking it, what is your intuitive answer to these questions:

Which investor would be happiest with their returns at the end? Which would you have rather experienced?

They’re simple questions, with a complicated range of answers.

For over a decade, I’ve shown this graph to hundreds if not thousands of people all over the world. The answers are remarkably consistent.

About 5-10% pick the green line, with the remainder equally divided between black and blue. Abstaining is also an option, but as near as makes no difference, no one ever picks it. Not only does everyone have an opinion, those opinions tend to be strongly held.

There are myriad reasons to pick each line, the main ones being:

Green: The House Money Effect. You’re only losing winnings, so the dip doesn’t feel like a loss. It simply feels like a smaller gain. You’re still ahead and you may even enjoy rolling the dice along the way.

Black: Loss Aversion. You don’t like to accept something worse than you’ve become accustomed to. Few do. You probably also think investing has quite enough ups and downs as it is, even if you accept that short-term volatility is the price of long-term returns. This line is the most ‘comfortable’ for most investors.

Blue: Recency Bias. You, like anyone that’s thought they’ve lost their wallet only to find it in another pocket, know the joy of jumping from the abject misery of loss to the cool, calm, rarefied air of relief. The last leg of your journey has a disproportionate influence over your satisfaction with the whole. Inherently, recency bias tends to be more popular during times of more market volatility.

No answer, nor any specific reason for any answer, is “correct”. There is, however, an answer that is incorrect.

Classical finance asks us to believe the journey does not matter. That is a mistake. Viewing the investing world through blinkers that ignore the strong intuitions of the humans who have to endure the journey is always a mistake.

Ask not what you can do for your questions, ask what your questions can do for you.

The answers themselves don’t matter. The fact that different people see different answers, and that these reflect their personality, does.

In the words of Alain de Botton, “The worth of sights is dependent more on the quality of one’s vision than of the objects viewed.” Your investment return comprises both the money and the emotions you attach to its movements along the way.

Asking the question and attending to the answer matters more than the specifics of the response. And the reason is matters is because investing decisions, like all decisions, are ultimately made by our emotions. How happy the three investors are at the end is merely interesting; but the fact that their different emotional states will affect every investment decision they make next is crucial.

When we lack comfort with our portfolio, we will act in costly ways to acquire it. And not all of those ways are created equal. Not investing at all is more costly than paying for an adviser to hold your hand through the journey, which is more costly than simply not looking at your portfolio so frequently.

This is where behavioural science comes in. Until now, looking at personal responses to the journey could only describe what was going on; a proper profiling process turns these descriptions into prescriptions for how to invest better.

Behavioural profiling is important because it allows us to predict in which ways we’re likely to make poor decisions, and helps us to avoid them. It helps us to acquire the emotional comfort we need in a cheap, planned, and efficient way, rather than the knee-jerk and expensive methods we tend to clutch at when left to ourselves.

Because ultimately making better decisions isn’t just a theoretical exercise.

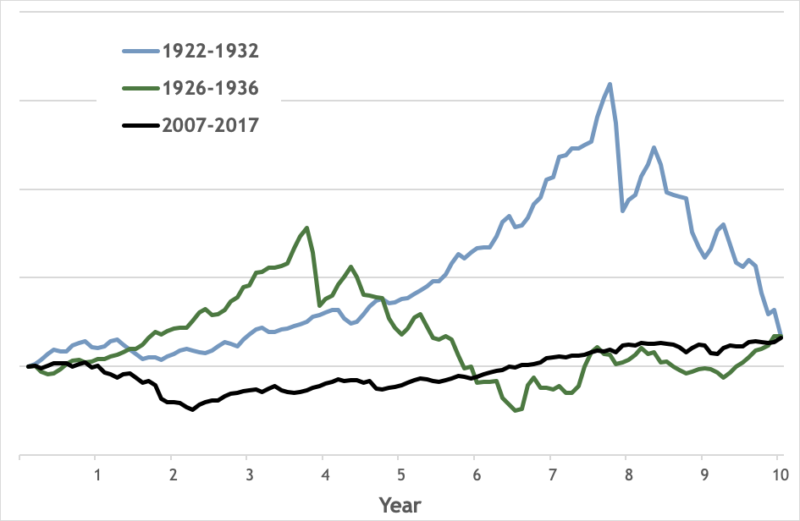

The graph below shows three real-life journeys that match our theoretical scenarios. In each of the 10-year periods investors received the same returns, and each involved a traumatising market crash, at the beginning, middle, and end respectively. But most important is what’s not shown: the investor’s emotional state and its longer-term consequences. Despite having doubled your money, you would feel vastly different in each case. And you’d likely make a very different, and emotional, decision as a result.

Investing has after-effects. Early investing experiences can profoundly shape later ones. This makes it even more important to manage bad emotional experiences, in whatever form they’re most likely to arise.

Returning to our theoretical journeys, a final lesson is that with some effort we can all turn the green or blue lines into the black one, if we wanted. Simply avert your gaze for the duration of the journey. If a portfolio falls and you’re not watching, did it really fall for you?

What you choose to see depends less on the object and more on the eyes you’re using to look at it.

.

It’s only human to ignore the evidence in front of us

Don’t be tempted to join the stampede

We don’t like losing. Ask any sports fan

© 2020 The Evidence-Based Investor. All rights reserved.