By PATRICK CAIRNS

There are some obvious reasons for investors to use index funds.

The first is their low cost. The only thing that you can control when investing is the fee you pay, and the less you have to hand over to the fund manager, the more of the return you get to keep for yourself.

With passive funds charging fees of 0.1% or even less per year, investors have a compelling reason to use them.

Secondly, there is an overwhelming amount of research that shows that most active managers struggle to beat the market index. Those that do, also tend not to do so consistently.

Instead of trying to pick which managers are likely to out-perform from one year to the next, it simply makes sense for the average investor to buy an index tracker. They know that it will always give them the market return.

One more reason

These two reasons are well-understood. They are also so irrefutable that often there is no need to think about any other argument for using passive funds.

There is, however, a more under-appreciated benefit of index investing that doesn’t get as much attention. It was highlighted in a recent research paper put out by the Federal Reserve Bank of Boston.

The main purpose of the paper was to examine whether passive investing is a threat to markets. There have been many concerns raised about how index funds distort stock prices, increase volatility or harm liquidity.

The paper dealt with these questions in some depth. It largely found that while there are some aspects of the industry to watch, passive investing does not pose an imminent threat to market stability.

Investor behaviour

As part of this study, however, it also produced some very interesting analysis about the behaviour of investors in index funds.

What the authors found was that flows into passive investments were less sensitive to performance than those into actively-managed alternatives. In other words, someone who had invested in an index fund was more likely to stay there for the long term.

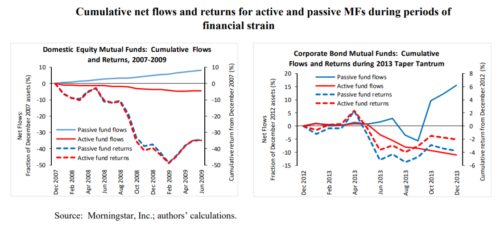

This is illustrated in the two graphs below, which show investor behaviour during the financial crisis in 2008, and the market dip during the “taper tantrum” in 2013.

(Click to enlarge)

“In both cases, even though passive mutual funds’ returns were at least as poor as those of active funds, passive funds had cumulative inflows and active funds had cumulative outflows,” the authors noted. “This suggests that the net flows of passive funds may be less reactive to poor returns.”

The behaviour gap

This is not just significant in the context of the research paper. There, the authors concluded that if passive investors were more likely to keep their money invested, this was good for market stability.

It is also extremely positive for long-term investor outcomes.

One of the biggest threats to any investor’s long-term returns is their own behaviour. This is a phenomenon known as ‘the behaviour gap’.

What happens is that investors who keep an eye on their returns, will inevitably notice that there are investments performing better than theirs. This encourages them to switch funds, ‘chasing’ the better returns they have seen elsewhere.

This is particularly prevalent when stock markets go through a bad period. Investors are easily spooked when they see share prices falling, so they pull their money out to put it in the perceived safety of cash or something they believe is more stable.

Staying invested

However, this almost always leads to investors ending up worse off than if they just stayed where they were. That is because just because an investment has performed well in the past does not mean it will do so in the future. Often, the reverse is true. Putting their money where performance has already happened means that investors are often too late to see of that return. What caused it has already played out.

Similarly, pulling money out of the stock market and putting it into cash means that investors lock in the losses that they have made. They also miss out on the recovery, because they are generally too timid to get back in.

Passive investors, however, seem less prone to this behavioural problem. That is because, going in, they accepted what they were going to be getting.

They understand that they will be earning the market return, and there is therefore no need to try to chase whichever manager might have been a recent top performer. They also understand that short-term market volatility is part of being invested in the stock market.

Having accepted those two things, they are also prepared to stay invested for the long term. Because, ultimately, they are confident that the market will do what it has always done and deliver inflation-beating growth for their money.

One of South Africa’s most respected financial journalists, PATRICK CAIRNS is a trusted commentator on the world of investments and the quirks of behavioural finance. Over more than a decade he has built a reputation for keeping the industry honest, and putting the interests of investors first.

If you’re interested in reading more of Patrick’s work, here are his most recent articles for TEBI:

An investment lesson from the US election

There is such a thing as too much choice

Investing shouldn’t be a gamble

Do you think you’re smarter than Terry Smith?

What do investors and trial juries have in common?

Investing is not a competition

FIND AN ADVISER

Did you know that TEBI can put you in touch with an evidence-based financial adviser in your area?

If you’re looking for advice on your investments or on your financial situation in general, simply click on this link and enter your name and email address. You will then be sent a short questionnaire to complete. Your answers will enable us to identify a suitable firm for you to speak to.

We will only recommend advisers who share our evidence-based investment philosophy and who we know and trust. If we can’t help you we will tell you.

© The Evidence-Based Investor MMXX