By JOACHIM KLEMENT

I have written before about how education trains us to think in a specific way. Back then, I mentioned that I like to follow the maxim of Carl Jacobi to “invert, always invert”. By teasing out from market prices the assumptions needed to justify these prices, you can learn a lot about these prices.

It so happens that markets have been in a somewhat volatile phase lately and a colleague of mine at work asked me to check what is priced into global stock markets today.

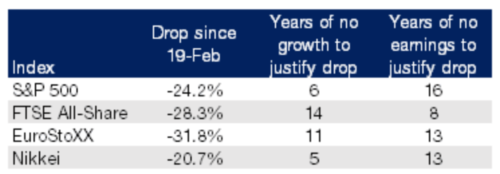

I have taken a simple dividend discount model and applied it to the S&P 500, the FTSE All-Share, the EuroStoXX and the Nikkei. Assuming a weighted average cost of capital of 8% for all markets, I can tease out the implied dividend growth rate for each market.

Then, I can do a nice little experiment and test, for how long dividends would have to stay at current levels to justify the drop in stock markets since 19 February 2020 (the last day before markets really went crazy). In essence, I can calculate, for how long corporate earnings should show no growth to justify the share price drop (I assume a stable dividend payout ratio so earnings growth equals dividend growth).

A second exercise I can do is to assume companies will have zero earnings over the next few years, stop paying any dividends and then resume paying dividends after the crisis is over. In essence, this is a simulation of the end of the world and how long it would have to last to justify the share price drop.

Below are the results, and they are fun:

Markets are currently pricing in between 5 and 15 years of zero earnings growth or the complete collapse of earnings and dividends for the next 10 to 15 years. I know that Covid-19 is bad and the economic repercussions might last a while. But, I have a hard time believing that we will see a multi-year recession due to this pandemic. This is not the zombie apocalypse, even though stock markets seem to price in just that.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

Are you interested in reading Joachim’s other articles for TEBI? Here they are:

Investors who smoke earn lower returns, study shows

Are we seeing a green bubble forming?

Does our obsession with property make financial sense?

Picture: Daniel Jensen via Unsplash