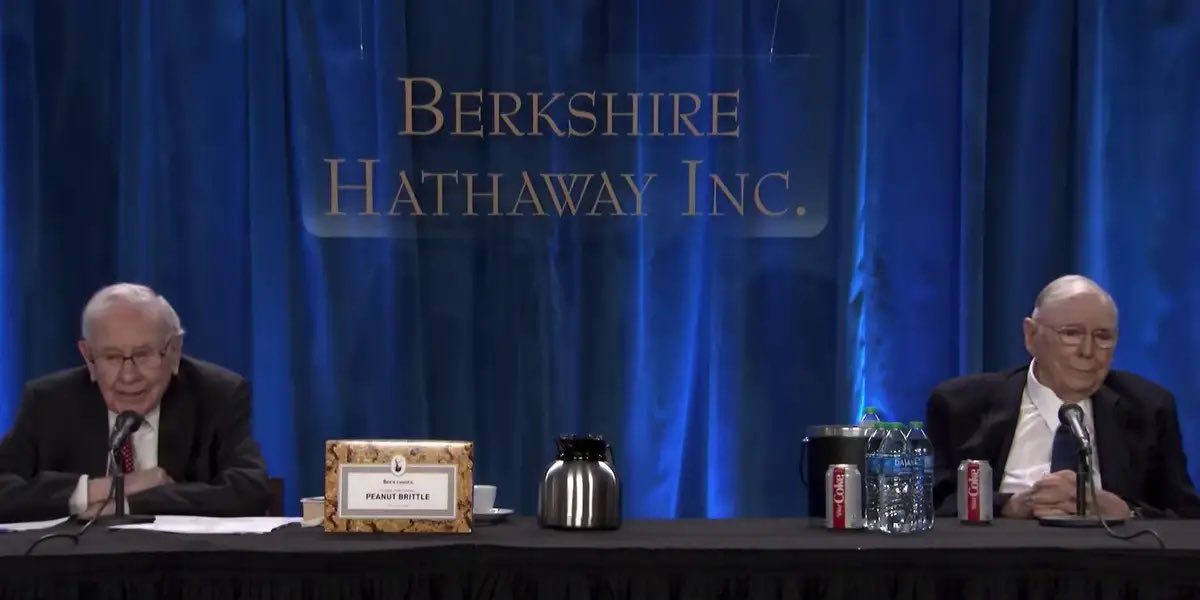

Warren Buffett and Charlie Munger were once again on top form at Berkshire Hathaway’s annual shareholder meeting on Saturday. With a combined age of 191, Buffett and Munger have a wealth of experience to share. Here are their latest tips on money, investing and life in general.

On money

Answering questions from the audience, Buffett and Munger agreed on the golden money rule: “You should spend a little bit less than you earn.”

Charlie Munger added: “Do a lot of deferred gratification.”

Buffett cautioned against taking on unnecessary debt. Otherwise, he warned, “you’ll never get out of debt. I’ll make an exception in terms of a mortgage on your house.”

On investing

Warren Buffett has consistently recommended that investors use low-cost index funds. He has himself instructed his trustees to invest 90% of his estate in an S&P 500 index fund for the benefit of his wife when he dies. And he repeated his advice on Saturday.

“Index funds,” he said, “are a great investment tool because the costs are low.” Investors, he said, shouldn’t expect to outperform the index: “Looking at money management, the game is not performance, it’s assets under management.”

Buffett also advised investors to avoid stupid mistakes, and particularly “mistakes that will take them out of the game”.

Munger added: “While it’s good to learn from your mistakes, it’s better to learn from other people’s mistakes… In the 58 years we’ve been running Berkshire, I would say there’s been a great increase in the number people doing dumb things, and they do big, dumb things.”

The crucial thing, said Buffett, is to stay rational: “We may make bad investment decisions plenty of times. The key is to try to stay as rational as possible”

Munger also urged investors to know themselves, and to understand their strengths and limitations. “We’re not so smart,” he said, “but we kind of know where the edge of our smartness is… That is a very important part of practical intelligence.”

On life

Buffett and Munger also had some more general advice to impart on how to lead a happy and successful life.

“Keep learning all your life,” Munger said.

Buffett suggested focusing on your legacy: ”You should write your obituary and then try to figure out how to live up to it.”

He also encouraged people to be kind. “I’ve never known anybody that was basically kind that died without friends,” Buffett said. “And I’ve known plenty of people with money that have died without friends.”

The final lesson Buffett and Munger shared is to avoid toxic people. ”You need to know how people can manipulate other people,” said Buffett, “and you need to resist the temptation to do it yourself.”

”Oh yes,” Munger chipped in, “the toxic people who are trying to fool you, lie to you, or who aren’t reliable in meeting their commitments — a great lesson in life is to get them the hell out of your life. And do it fast.”

”And do it tactfully, too, if possible,” Buffett added. “But do get them out of your life.”

You can watch the full meeting here:

PREVIOUSLY ON TEBI

Active managers perform better when they’re on holiday

One definition of risk for all of us

Why does active fund performance deteriorate over time?

LISTEN TO ROBIN POWELL SPEAK IN LONDON

TEBI founder Robin Powell and his co-author Jonathan Hollow will be speaking about the murky world of investment fees and charges in London at 5.30pm on Wednesday 17th May 2023.

They’ll be explaining you may be paying for a nice retirement for people you don’t even know, and what you can do start funding YOUR dream life instead.

The event is free, but places are limited, so book early to avoid disappointment:

© The Evidence-Based Investor MMXXIII