By HORTENSE BIOY

European ESG funds experienced another strong six months: In the first half of 2019, more money poured into them and assets reached a record high. Also, more products hit the shelves, making it easier than ever for investors to put their money toward sustainability and impact.

We detail these trends in the European Sustainable Funds Landscape report. Below, explore some of the report’s main findings.

European ESG funds had substantial inflows and assets

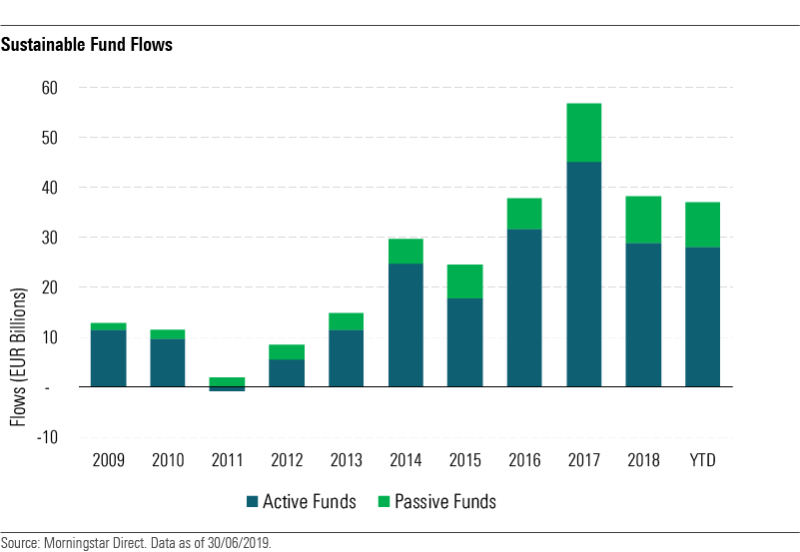

In terms of flows, the chart below shows that sustainable funds pulled in net flows of EUR 37 billion in the first half of 2019, more than any other semiannual period. It also closes in on 2018’s net flows of EUR 38 billion for the full year. It’s notable that sustainable equity funds have experienced inflows while conventional equity funds had net outflows over the past year.

These numbers confirm the growing popularity of dedicated strategies that incorporate environmental, social, and governance considerations. Sustainable investing is fast becoming a mainstream pursuit.

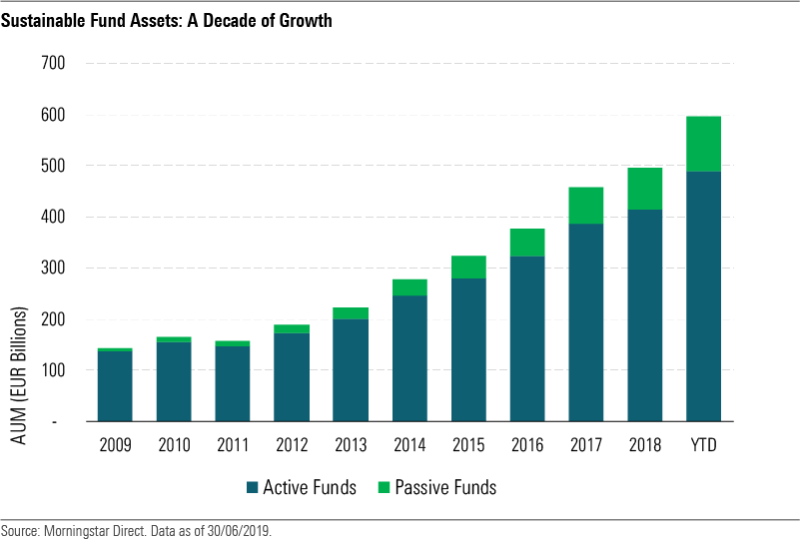

Supported by strong flows as well as positive stock market returns, sustainable European fund assets also reached a record level of EUR 595 billion (shown on the chart below).

The launch of new European ESG funds

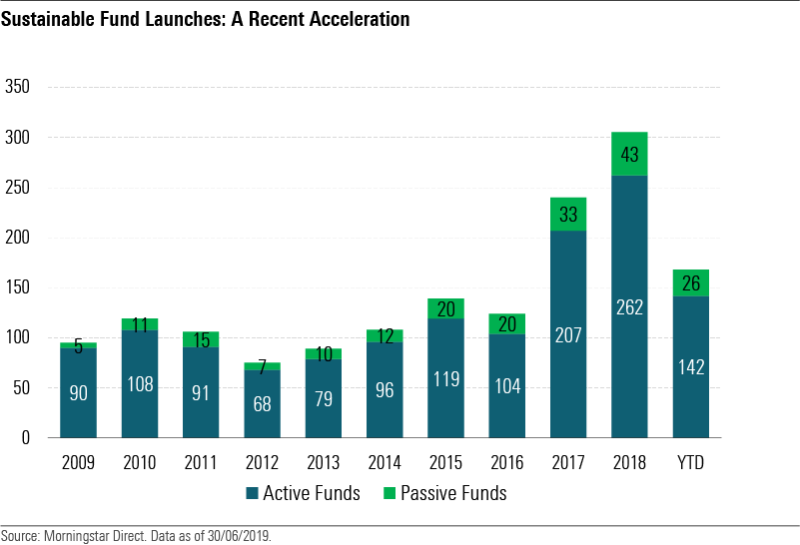

Meanwhile, product development continued apace, as asset managers positioned themselves to take advantage of growing investor demand. As shown below, as many as 168 new sustainable funds came to market in the first half of 2019. The industry is on track to match or even exceed 2018’s record of 305 new offerings.

Several of the equity-fund launches were impact- and theme-oriented with a focus on companies that contribute to the achievement of the United Nations’ Sustainable Development Goals. A host of climate-related funds came to market as well.

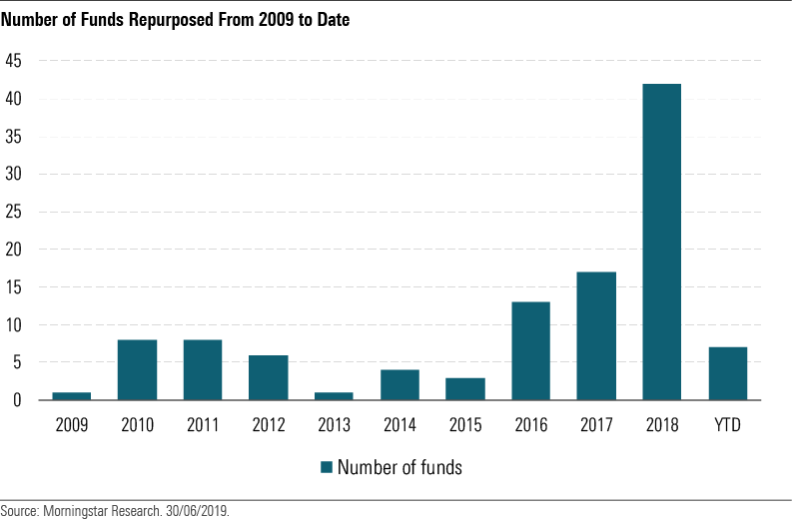

While most of the growth in European ESG funds has come from new launches, asset managers have also repurposed and renamed existing funds.

In other words, managers have changed mandates to make ESG their primary focus and reflected this transformation by rebranding the fund. For instance, Royal London Emerging Markets Equity Tracker rebranded as the Royal London Emerging Markets ESG Leaders Equity Tracker in early 2019, and BL-Equities Horizon B rebranded as BL-Sustainable Horizon B in early 2018.

The chart below shows the number of funds that have turned into full-fledged sustainable investment offerings. The largest surge in this activity happened between 2017 and 2018, with a slowdown into the first half of this year.

Of course, European ESG funds are certainly not all alike. Some employ values-based exclusions to narrow their investment universe, while others use specific ESG criteria to select securities. Some focus on environmental sustainability themes. A growing number of strategies aim to deliver impact alongside financial return by focusing on companies that have a net positive impact on society. And then there are many that use a combination of these approaches.

Whatever their approach may be, there’s no shortage of choices for investors who want to pursue ESG options: Today, there are more than 2,230 sustainable funds available to European investors, covering an ever-expanding range of asset classes and subasset classes.

HORTENSE BIOY is Director of Passive strategies and Sustainability Research, Europe, at Morningstar.

This article first appeared on Morningstar.com and is republished here with Morningstar’s permission.

You can find more on sustainable investing here:

A tipping point in attitudes to climate change?

Does shareholder activism make a positive difference?

Can the UK become a global champion in impact investing?

ShareAction: Why we’re offering free training to shareholder activism

Should sustainable investors own or avoid irresponsible stocks?