Readers of this blog very likely have multiple bank and savings accounts, as well as pension products. JONATHAN HOLLOW recommends that you gather this information in one place, to make it less stressful for others when you die, as well as helping your money management while you are alive.

I recently turned 55, so my chances of dying in the next year are, statistically, 1 in 112. (For women, it’s a faintly less alarming 1 in 178.)

This probability roughly doubles every 10 years:

- Back when I was 45, it would have been 1 in 279.

- By the time I am 65, it will be a 1 in 42 chance of dying over the next year.

Of course, none of us likes to think about how to prepare for our own death. For example, in the UK fewer than four in 10 people have made a will, according to a 2020 survey, and the covid pandemic seems to have given this figure only a tiny uplift.

When you die, you won’t be around to see the after-effects of mess or untidiness you’ve left behind in your affairs. So, at least to some people, taking trouble about what will happen seems counterintuitive.

However, I’m going to make the case that creating a “death box” will have benefits to you before you die, as well as to others after you are gone.

First, make a will

Before I get to my “death box” however … if you haven’t made a will, that’s the first thing to fix on your checklist. No matter how modest the affairs you will leave behind. If you die without a will, your family, friends and the authorities will all suffer extra complications and expense. Some of these can cause families enormous stress.

Yet you can eliminate this stress simply and cheaply. You can even make a will for free. Major charities offer reputable free will-writing services. For readers in the UK, MoneySavingExpert has a great guide to point you in the right direction. Many local solicitors also participate in Free Wills Month (which confusingly happens twice a year, in March and October), and is open to anyone over the age of 55. In the United States, August is the month.

Or, if you want to get it done right now, and your affairs are simple, there are fairly low-cost online services. The best of these generate a will using an online tool, then check it using regulated solicitors before feeding a definitive version back to you. I used beyond.life (£90 for one person, £135 for a couple at the time of writing). I found it very easy to use, and just as easy to keep updated as my affairs changed. MoneySavingExpert lists some others, as does Investopedia for the United States.

Whatever service you use, you should check whether a qualified lawyer will look over your will. If your affairs are very simple, the will’s legality may be trivial, but the more complicated your life is, the more vital a legal review. And of course, it’s not enough just to have written a will – you must sign it and get it witnessed.

What is a “death box”?

There’s value in putting together a spreadsheet and document set that summarises your financial world. If you suddenly died, how would your executors know exactly which financial products you owned?

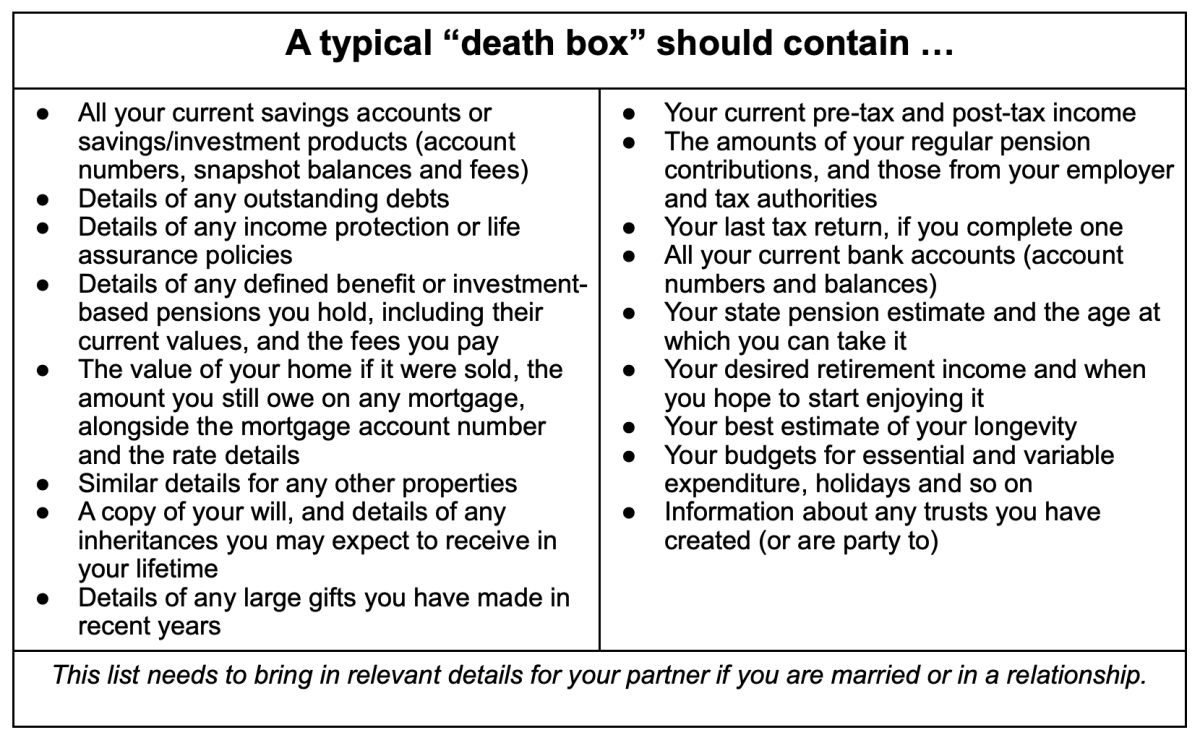

What should this document (or rather, library of documents) contain? Ideally you should collate all of the following.

My list does contain some items that won’t be relevant after you are dead (for example, your expected longevity, or inheritances you expect to receive). This is because your “death box” has a dual purpose: to help others when you die, and to help you in life.

How could the total list be useful while you are still alive? The answer is it can not only help your family, but it can greatly assist your relationship with a financial adviser.

You may or may not have a financial adviser. Not everyone needs one, and only a minority chooses a permanent professional relationship. In our forthcoming book, Robin Powell and I devote our final chapter to the question of how to choose an adviser in the UK. We also look at the circumstances when it’s most valuable to pay for an adviser’s help. We argue that, although the case for a permanent professional relationship is not universally strong, very few people will be able to get through their whole life without needing to ask for help from a financial adviser at some stage and on some issue.

If you supply your “death box” information to a potential adviser, they will know that they don’t have to spend hours drawing this information out of you. This can help shape the bargain you drive with them about what they charge for onboarding you. Many advisers will assume a worst-case onboarding (that is, a very time-consuming process) because some people come to them with very chaotic financial lives.

And an adviser may prove their worth in an initial consultation by coming up with an opportunity or a saving that you didn’t know about. They are unlikely to do this before they have seen your “big picture”. Your “death box” contains all the essentials an adviser will need to see your financial world in the round. This is why I suggest you include snapshot figures from accounts, alongside account details.

Finally, many people have accounts they don’t use. The “death box” will help you consolidate and close accounts, if that is what you need to do, by prompting you to do a round-up.

Keep it safe

Obviously, such a list will be a gold mine to thieves and fraudsters as well as financial advisers. So:

- Do not write your passwords on the list. You might want to write them down, but do this elsewhere!

- If you create the list digitally, lock it behind a secure digital vault such as 1password.

- If it’s printed out, you might want to give it in a sealed envelope to a trusted friend, but without your name anywhere on the documents, so that a stranger who got hold of it would find it useless.

- Or, if you have a financial adviser, they may well be willing to securely hold and administer your list. Much of their work for you will revolve around the details in it.

That’s one less thing to worry about

If you’ve made a will, you will probably remember that there was a certain feeling of relief when it was signed and done. In my case, that feeling was increased by how long it had taken me to get from a draft will to something actually legally valid and complete: about three years! Now it’s done, it’s trivially easy to keep it up to date.

I predict that although putting together a “death box” will be a bit tedious and arduous, you’ll get some of the same emotional relief when it’s complete. Start today!

JONATHAN HOLLOW worked for the UK Government’s Money and Pensions Service and is a writer and commentator on consumer education and protection.

ALSO BY JONATHAN HOLLOW

Get Britain budgeting! A modest proposal for the Chancellor

Should our banks help us to budget?

Bitcoin is not an investment — I’m glad I sold it

Money shouldn’t be “dark matter” for today’s children

Have you discovered MoneyHelper yet?

FIND AN ADVISER

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we offer a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Need help? Click here.

© The Evidence-Based Investor MMXXII