On Tuesday we showed how European fund managers underperformed the index the first three months of 2020. Your chances of identifying, in advance, one of the funds that did outperform were worse than a coin flip. Active managers in some countries fared better than those in others. UK-domiciled funds performed particularly poorly — falling, on average, 2.1% further than the relevant market index. So how did Australian active managers do? STUART McGRATH from S&P Dow Jones Indices has been running the numbers.

In early March 2020, S&P Dow Jones Indices released the SPIVA Australia Year-End 2019 Scorecard. With the market gyrations in late February and March due to the COVID-19 pandemic spreading across the globe, we decided to provide a “mid-term” SPIVA update to include data up to March 31, 2020.

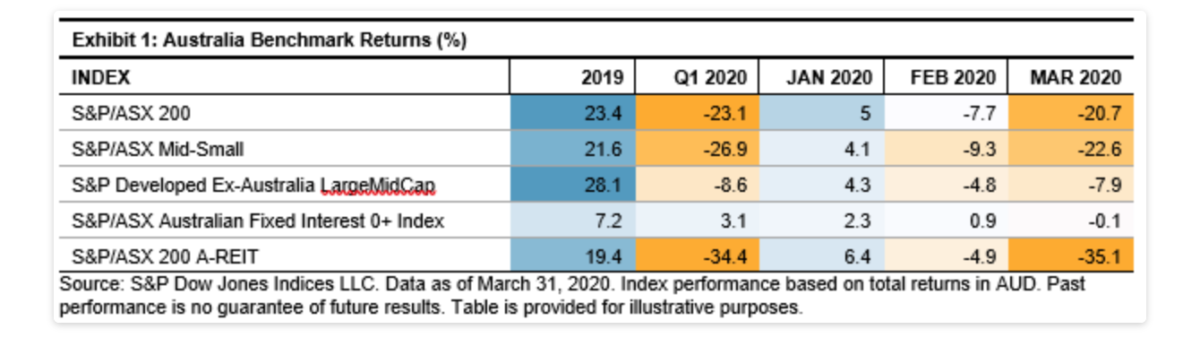

Q1 2020 market performance

With the exception of Australian bonds, all asset classes suffered drawdowns, with the S&P/ASX 200 seeing a drawdown of 23%. The S&P/ASX 200 A-REIT experienced a drawdown of 34.4%.

Q1 2020 fund performance

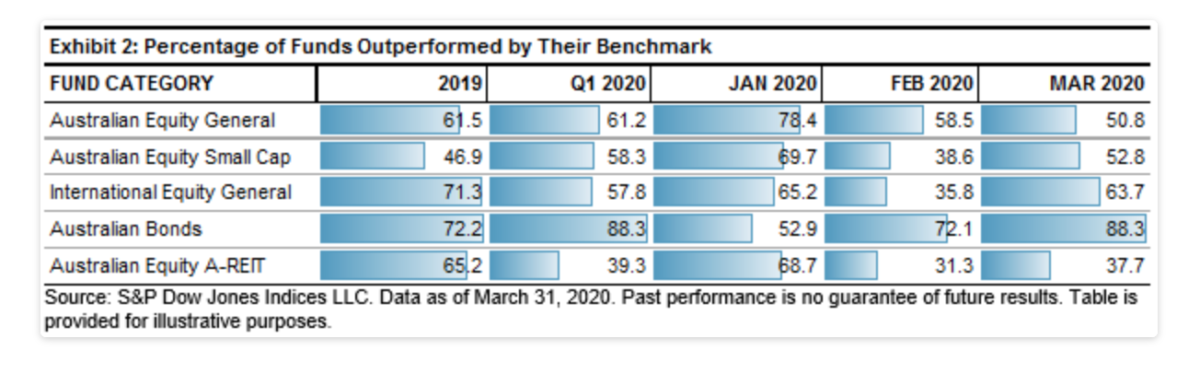

As Exhibit 2 shows, for the three-month period ending March 31, 2020, 61.2% of funds in the Australian Equity General category were outperformed by the S&P/ASX 200. This was more or less in line with the results as of Dec. 31, 2019.

What becomes more interesting is when we look at the results on a month-by-month basis, we saw a steady improvement in the performance of funds in that category across the three-month period, with the number of funds outperformed by the benchmark decreasing from 78.4% to 50.8%.

To put this another way, in January 2020, 21.6% of funds outperformed the benchmark, in February 2020, this increased to 41.5%, and in March 2020, it increased to 49.2%. The volatile market appears to have provided active fund managers opportunities to outperform the benchmark, although the benchmark still outperformed greater than 50% of funds.

Other fund categories were also not able to beat the benchmark in Q1 2020, with the exception of A-REITs. For the three-month period, 39.3% of A-REIT funds were outperformed by the benchmark.

While opportunities for outperformance by active fund managers may have increased in Q1 2020, most continued to underperform their relevant benchmarks. The challenge remains. How can investors, or financial advisers, select outperforming funds in advance? 2020 hindsight continues to prevail in 2020.

STUART McGRATH’s role at S&P Dow Jones Indices is Senior Director, Channel Management, Australia and New Zealand. This article was first published on the Indexology blog.

Robin writes:

You may be wondering, what about New Zealand’s active managers? Did they perform any better than their counterparts across the Tasman Sea? In fact they appear to have done worse, as this article on interest.co.nz explains.

According to Dean Anderson, founder and CEO of the index investing platform Kernel, a whopping 93% of New Zealand-domiciled active equity funds underperformed the Kernel NZ 20 tracker in the first quarter of 2020. The average active fund fell 13.6% — 30% more than the NZ 20 tracker, which was down 10.5%.

Picture: Catarina Sousa via Pexels