As we’ve been reporting here on TEBI, active fund managers haven’t had a good crisis. For example, UK-domiciled funds fell, on average, 2.1% further than the relevant market index in the first quarter of 2020. So how did European active funds fare across the continent generally? The answer is, a little bit better, but they still, on average, underperformed the index. Your chances of identifying, in advance, one of the funds that did outperform, were worse than a coin flip.

This article by ANDREW CAIRNS at S&P Dow Jones Indices was first published on the Indexology blog.

Despite the early warning signs of a global pandemic and its devastating potential to obliterate economic growth, it appears that fund managers in Europe generally failed to position themselves appropriately for the storm that was to come.

Taking a sneak peek into our upcoming SPIVA® Europe Scorecard, we can see the majority of Europe Equity active fund managers were unable to beat the S&P Europe 350® in Q1 2020.

Month by month

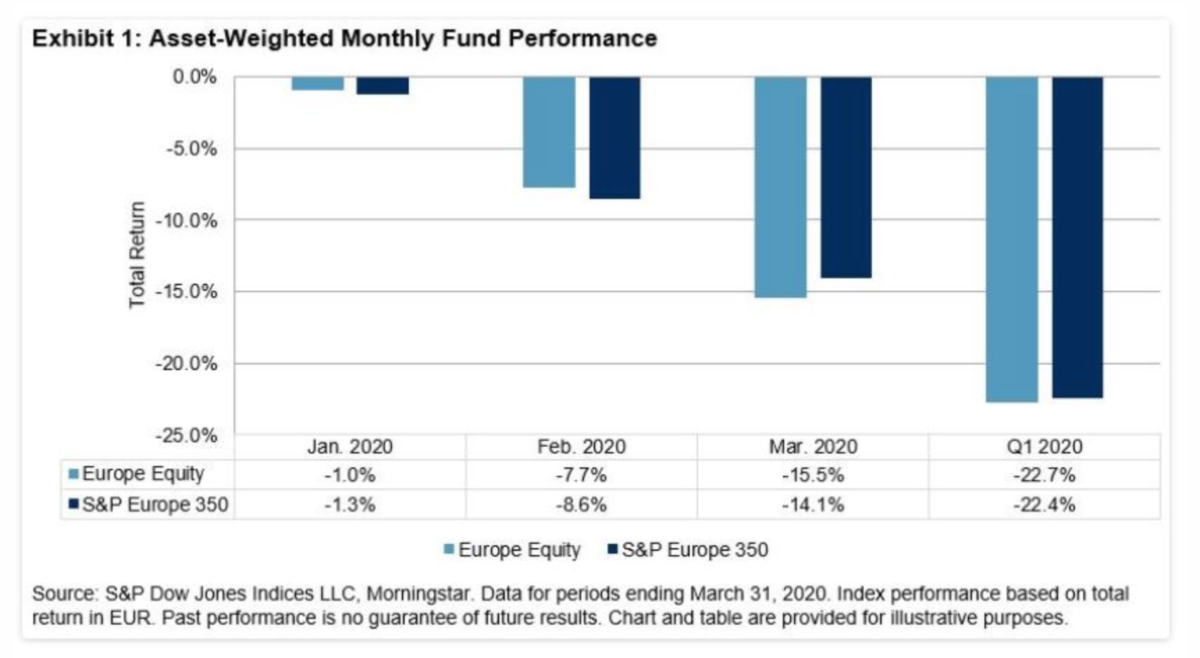

The invisible threat of COVID-19 began to shut down production in many parts of mainland China by mid-January 2020, but the market repercussions took some time to be felt in Europe. By the end of January, Europe Equity funds had only lost 1% of their value on an asset-weighted basis, compared with a 1.3% drop in the S&P Europe 350 benchmark.

Come the end of February 2020, many European-focused investors would have welcomed such returns. European fund returns were down 7.7% for the month, slightly better than the benchmark, which fell 8.6%. At this point, it may have looked like active fund managers had the upper hand and were well placed to continue this outperformance into March.

March 2020 will go down in European stock market history as one of the most volatile months ever (surpassed only by October 2008). European funds lost 15.5% for the month compared with a 14.1% drop in the benchmark.

Tallying it all up, the first quarter of 2020 saw fund returns down 22.7%, while benchmark returns were down 22.4%.

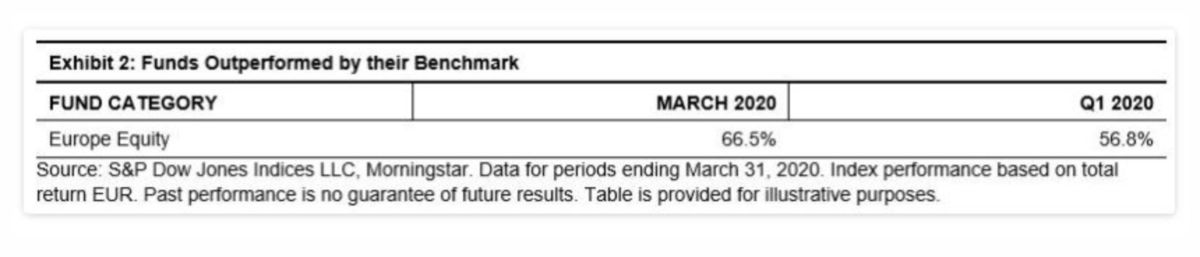

While active managers’ performance in the quarter may appear broadly level with the benchmark, the chances of choosing an active fund that outperformed were not. The majority of Europe Equity fund managers were unable to beat the benchmark in either March or Q1 2020 as a whole, with 66% and 57% underperforming the benchmark, respectively.

The large proportion of underperforming active funds in March 2020 would suggest that despite their ability to time the market and extract value, fund managers broadly failed to utilise their skills and navigate the market in one of the most turbulent months. This is contrary to the widely held belief that market volatility provides a better opportunity for active managers to outperform.

With the COVID-19 crisis not yet over and volatility remaining high, will fund managers’ skill begin to show or will passive benchmarks continue to outperform the majority? Stay tuned for SPIVA Europe Mid-Year 2020 Scorecard to find out more.

ANDREW CAIRNS is Senior Analyst, Global Research & Design, at S&P Dow Jones Indices.

Here are some other articles about the impact of the coronavirus crisis on the markets that we’ve published here on TEBI in recent weeks:

What’s the worst that could happen?

What if the doom mongers are right?

What previous market crashes teach us about this one

How did UK active managers fare in the market rout?

How worried should investors be about a recession?

The economy and the stock market are not the same

Are markets still rational, even in a crash?

Will the optimists triumph again?

Remember, you’ve trained for this

Stay the Course: our crisis survival kit for advisers