By YARIV HAIM and ALISTAIR MEADOWS

There have been a number of major disruptions in markets of late. Here are a few examples.

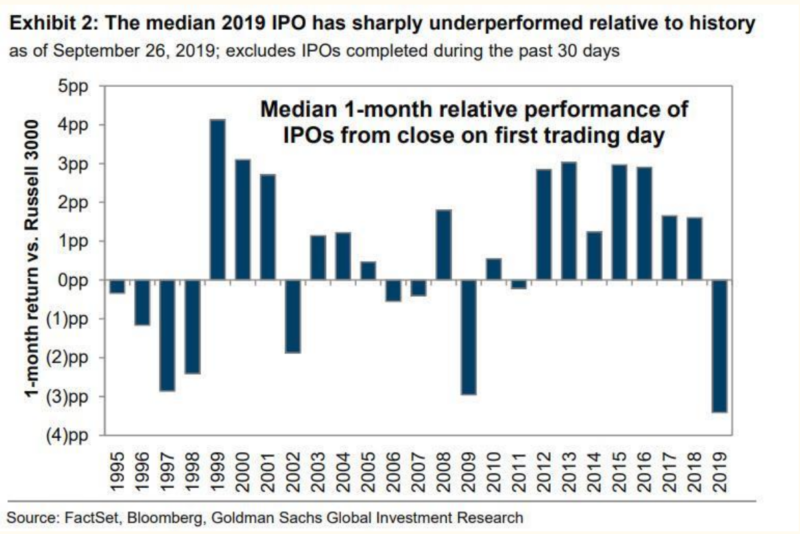

Having been seen as a path to guaranteed riches in recent years, new share issues (IPOs) have seen dismal returns this year, culminating in the shelving of plans to float WeWork and the exit of its CEO. Standard and Poor’s recently downgraded the firms debt to B-, suggesting that the firm may run out of money next year [1]. Uber and Lyft did manage to get their IPOs launched, as did Peloton on the 26th September, but the former are floundering 30-40% below their listing price and Peloton fell from its initial $29 price to just over $21 in early October. The underperformance of newly listed firms has been the sharpest since the market lows of 2009, as the chart below shows:

Erstwhile high flying shares have also faded. Tesla and Netflix have seen 30% falls in their share prices since their highs in early 2019. Cyclical stocks have underperformed, falling by 20% from their September highs whilst defensive shares and sovereign bonds have risen sharply. Long Duration US Treasuries have seen their yields fall by 50% in the last 12 months, a move normally consistent with a sharp recession – even though none has (so far) occurred.

Looking at global markets, the S&P 500 is still within 3-4% of its all-time highs, whilst the MSCI Emerging Markets Index is nearly 20% below its peak, and the Japanese TOPIX Index is down 15% from its highs.

Some analysts believe these events to be harbingers of doom [2] . The failure of the WeWork IPO has echoes of the AOL/Time Warner debacle of 2000, and the sale of Bear Stearns to JP Morgan in 2008, both of which heralded the end of previous bubbles.

The poor performance of IPOs should not be a surprise; the sellers (venture capital firms, private equity or incumbent management) know every detail of the company being sold, while the buyers of an IPO have to take at face value the situation and prospects expressed in the share offer documents. The performance of the Renaissance Technology IPO ETF (Ticker code IPO US) [3] has been in line with what one might expect, given this asymmetry of information: the ETF’s 49.17% return [4] since inception in 2013 is almost exactly half that of the S&P 500 (97.28%) over the same period. Notwithstanding the large jumps in prices in the first few days of trading, the long term performance of IPOs has been poor.

It would be easy to assume that price declines for the likes of Tesla and Netflix are merely an artefact of a “bubble” in markets, but this may not be the whole story. What all of these companies have in common is a lack of a “platform” business model [5] – a scalable portfolio of products and services that can match buyers and sellers in one place to mutual benefit thereby creating a competitive “moat” around the business.

Google, Amazon and Facebook are obvious examples of platform businesses in the US, while Tencent and Alibaba have done much the same thing in China. In contrast, Uber, Lyft, Peloton, etc. cannot protect their profit margins from new, lower cost clones. Tesla has seen BMW, Volvo, Toyota and General Motors all declare their intentions to develop autonomous cars, whilst Disney has announced that they will end their licensing agreement with Netflix to begin their own video streaming service, leaving the latter having to generate its own content. According to newspaper reports [6], Netflix will spend $15 billion on content this year, despite having negative free cash flow and rising debt levels. Investors may be concerned about the effect of this on profit margins.

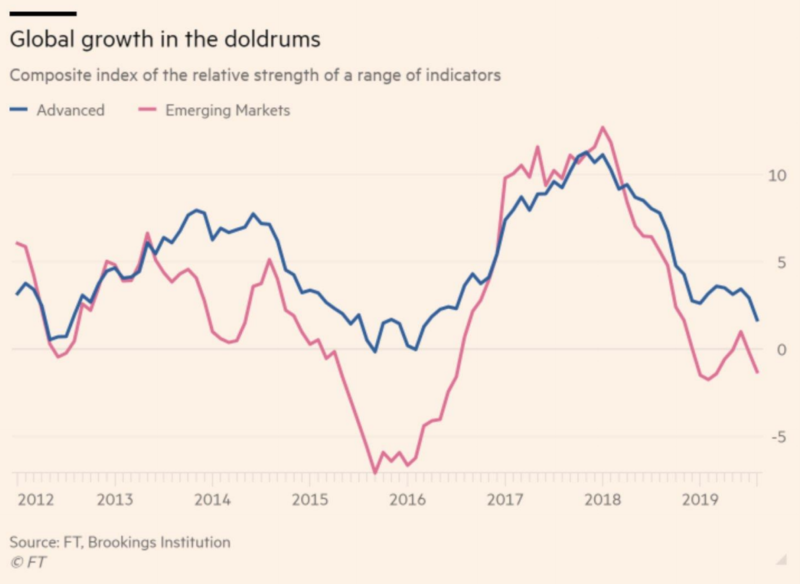

Finally, the divergence between Developed and Emerging Markets, partly a consequence of the strong US Dollar, has been striking. Investors are opting for the perceived safety of US and Developed Markets. As the next chart shows, Developed economies tend to see shallower declines in economic activity when recessions occur and inverted yield curves are certainly implying that a downturn is on the horizon.

All of this underlines the purpose of diversification: to avoid being over-exposed to an asset class, a region, a sector or a company. The stock market is a distillation of the expected future earnings potential of all companies, but the distribution of those earnings between companies will constantly change. It is only by owning a broad spread of assets that an investor can mitigate the effect of trend reversals on portfolio returns.

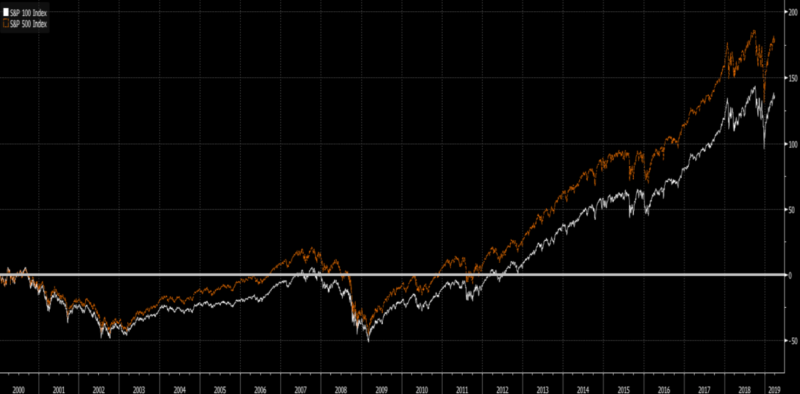

Destruction of portfolio value doesn’t require a catastrophic loss – it merely needs a correlated decline in the value of several components. The fact that all of the company-specific setbacks described above have occurred and yet Indices are largely unchanged over the last year (see the chart below), demonstrates the value of diversified market exposures.

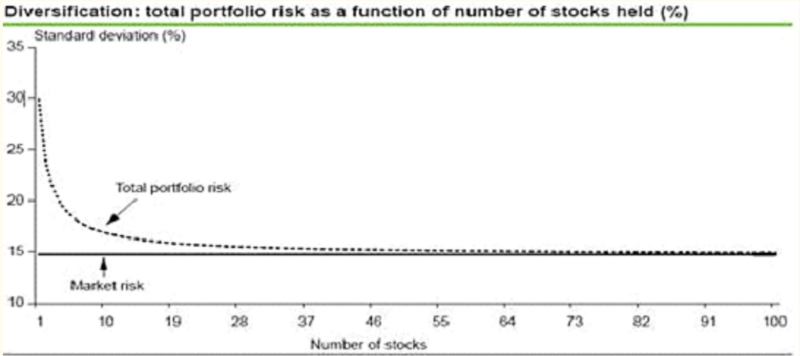

Diversification reduces the impact of idiosyncratic risk that is inherent in individual assets. This does not eliminate the risk of loss, but it makes losses smaller and thus easier to bear, in turn reducing the risk of the investor selling out at what often turns out to be exactly the wrong time. It also reduces overall portfolio volatility, resulting in an improved risk / reward outcome as measured by the Sharpe Ratio.

The graph below is commonly used to depict the value of diversification. It shows the diminishing risk reduction benefit as more stocks are added to an equity portfolio. The chart suggests that by the time you have selected about 25 securities, adding an additional security to the basket produces very little incremental risk reduction.

But today’s financial markets are dominated by investable instruments, such as ETFs and Mutual Funds and Index Funds, which offer mass diversification. They often spread exposure across hundreds, if not thousands, of securities. The S&P 500 ETF, for example, holds the 500 largest listed firms in the U.S. Is it too diversified, and is there any benefit to holding such an instrument compared to the S&P 100 ETF?

There is another, overlooked benefit to diversification. The chart below compares the performance of the S&P 100 (OEX, in white) to the S&P 500 (GSPC, in orange) since January 1 2000. $100 invested in the S&P 100 would have grown to $236 by the end of the first quarter of 2019, while the same amount invested in the S&P 500 would have grown to $280, a whopping 32% better performance than the less diversified option.

The reason for this significant outperformance? The exclusion of outperformers by the more restricted index. An example in point is Netflix which, notwithstanding its recent woes, rose by 33,178% between its initial listing and the end of Q1 this year. A single dollar invested in this stock at issuance would have grown to $333, a better outcome than either of the $100 index investments.

Of course it is effectively impossible to identify the Netflix of the future. Many interesting business models do outperform, but many others fail. Mass diversification not only reduces idiosyncratic risk of loss, but also ensures that the portfolio is exposed to all sources of risk premium. It is a guaranteed means of ensuring that you are not missing out on a great investment.

Footnotes

[1] https://247wallst.com/investing/2019/09/27/rating-agency-worries-wework-could-run-out-of-money/

[2] https://davidstockmanscontracorner.com/wework-rang-the-bell-unicorns-down-bulls-next/

[3] https://www.renaissancecapital.com/IPO-Investing/US-IPO-ETF

[4] To 10th October 2019

[5] https://www.innovationtactics.com/platform-business-model-complete-guide/

[6] https://variety.com/2019/digital/news/netflix-content-spending-2019-15-billion-1203112090/

YARIV HAIM is the founder of Sparrows Capital. Sparrows is an evidence-based wealth management firm, based in London, which manages assets for family offices and selected institutions. It is one of two strategic partners that TEBI works with in the UK. ALISTAIR MEADOWS works for Sparrows as an investment consultant.

Related articles:

Simple portfolios are best for billionaires too

How to pick all of tomorrow’s winning stocks

Positive skew and the near impossibility of consistent alpha

The case for global diversification is as strong as ever

Back to basics (4/5): choosing a strategy

Picture: Thibault Penin via Unsplash