When JASON BUTLER bought his first home, 31 years ago, his property owning dream soon turned into a financial nightmare. Mortgage rates doubled and the housing market crashed, as the economy fell into the doldrums and unemployment rose sharply.

UK house prices rose in June and July, despite all the economic uncertainty. Mortgage approvals have also beaten expectations. But with still no end in sight to the COVID pandemic, is now a good time for young people to buy a property? Or should they exercise caution and rent instead?

Over the past few weeks, I’ve been reading and hearing a lot about the same question: “Is now a good time to buy a home?” In this slightly longer than normal blog, I set out some thoughts to help you form your own answer to that question.

The long-term view

It makes a lot of sense to buy your home rather than rent over the long term. That’s because you need somewhere to live and the money not spent on rent can be used to repay the mortgage. At the end of the typical 25-year mortgage period, you’ll have no rental or mortgage payments to make, and you’ll own the property outright.

But sometimes buying isn’t a good idea or you should proceed with much more caution to avoid a very costly mistake that might hold you back for years.

Supply and demand basics

Property values are affected by supply and demand. More demand than supply pushes up prices. More supply than demand pushes down prices.

There are several factors which influence supply and demand:

the availability of mortgage finance (including how much deposit the lender requires the borrower to put down);

the cost of borrowing as a proportion of wages;

tax incentives or liabilities;

employment conditions, including unemployment rate and level of average wages;

divorce rates and relationship breakdowns;

population growth or contraction;

the availability of high-quality, affordable social housing;

the amount of housebuilding, including conversions;

the availability of suitable land for development;

level of household wealth and transfers to younger generations.

A change in just one area can have a positive or negative impact on supply and demand. Sometimes changes happen in several areas at the same time that accentuates those changes.

Affordability

Affordability is a crucial factor which influences property values.

That means either having the cash available to fund the purchase outright or the income to enable the buyer to borrow enough money to do so. Even then, the buyer has to find a deposit of at least 5%, but more typically 10%, of the purchase price.

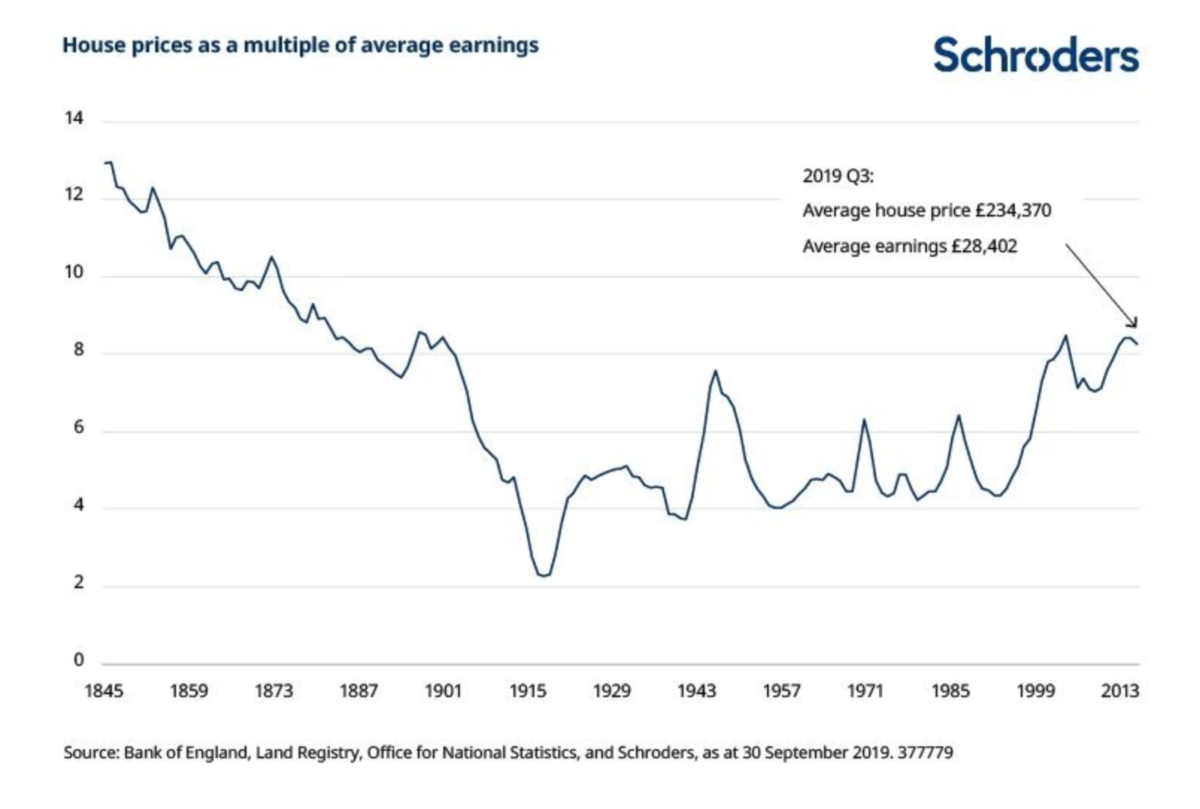

The average income to house price ratio in the UK towards the end of 2019 was just above 8. This is almost at the highest it’s been for the last 100 years, but about half the level it was 150 years ago.

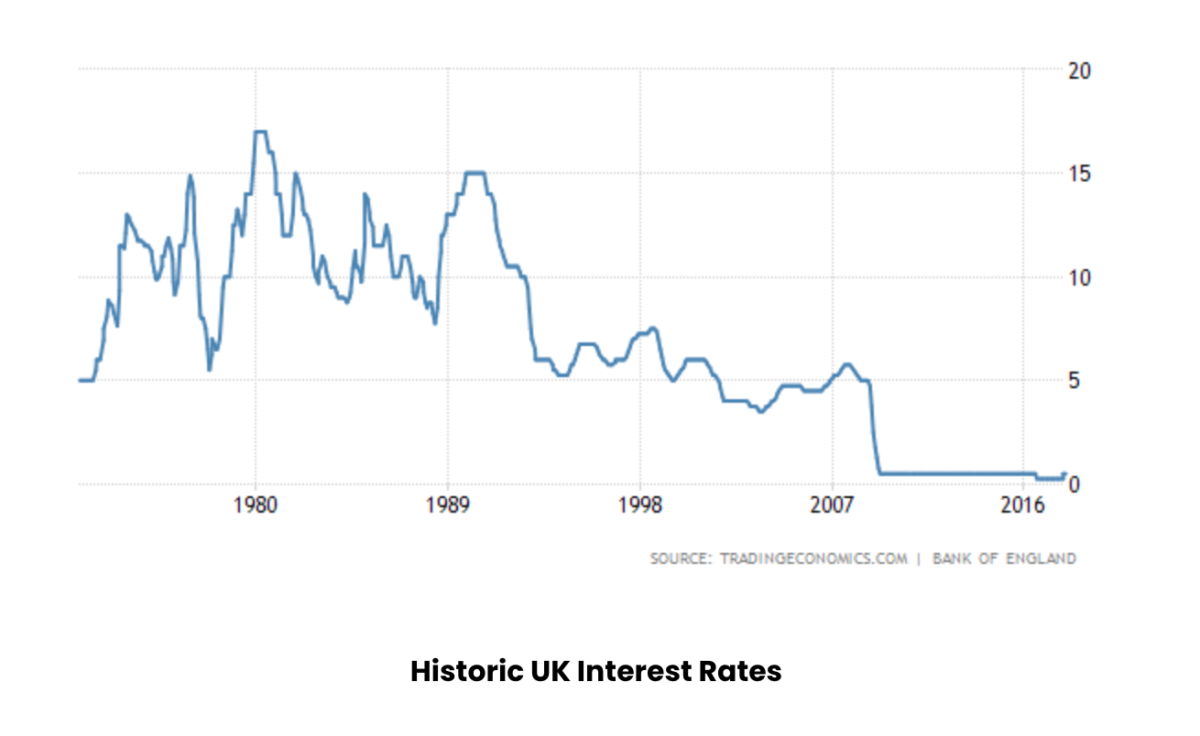

The cost of borrowing also has a significant impact on affordability, because if interest rates fall, then people can borrow more on the same income. Interest rates have fallen substantially over the past 20 years to current historically low levels, as shown in the chart below. While interest rates are unlikely to fall much further, they could eventually rise, putting a brake on affordability.

Coronavirus pandemic

We entered 2020 with the ratio of residential property prices to earnings at an all-time high and interest rates at an all-time low. Then along came the coronavirus.

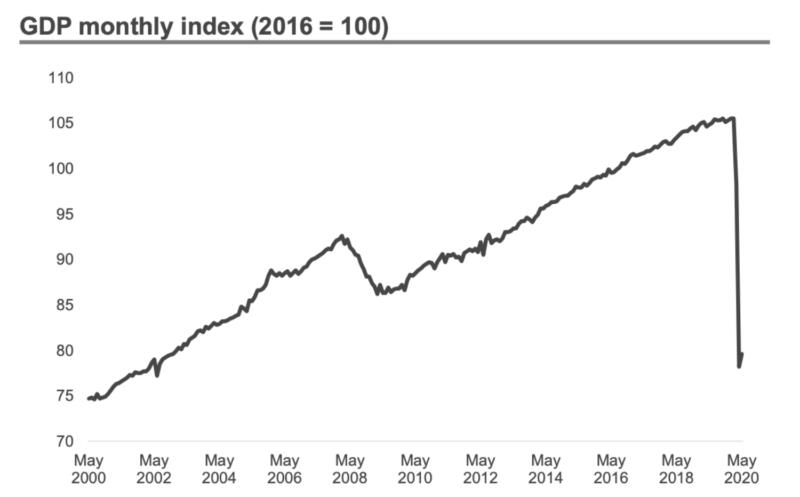

The UK economy has fallen substantially since the lockdown in March, as shown in the chart below.

Source: ONS

We don’t know the full economic consequences of the pandemic. It seems reasonable to assume that unemployment will rise substantially, due to the massive disruption in the travel, leisure and hospitality sectors. Rising employment means less consumption, less money circulating in the economy and, crucially, less confidence among consumers.

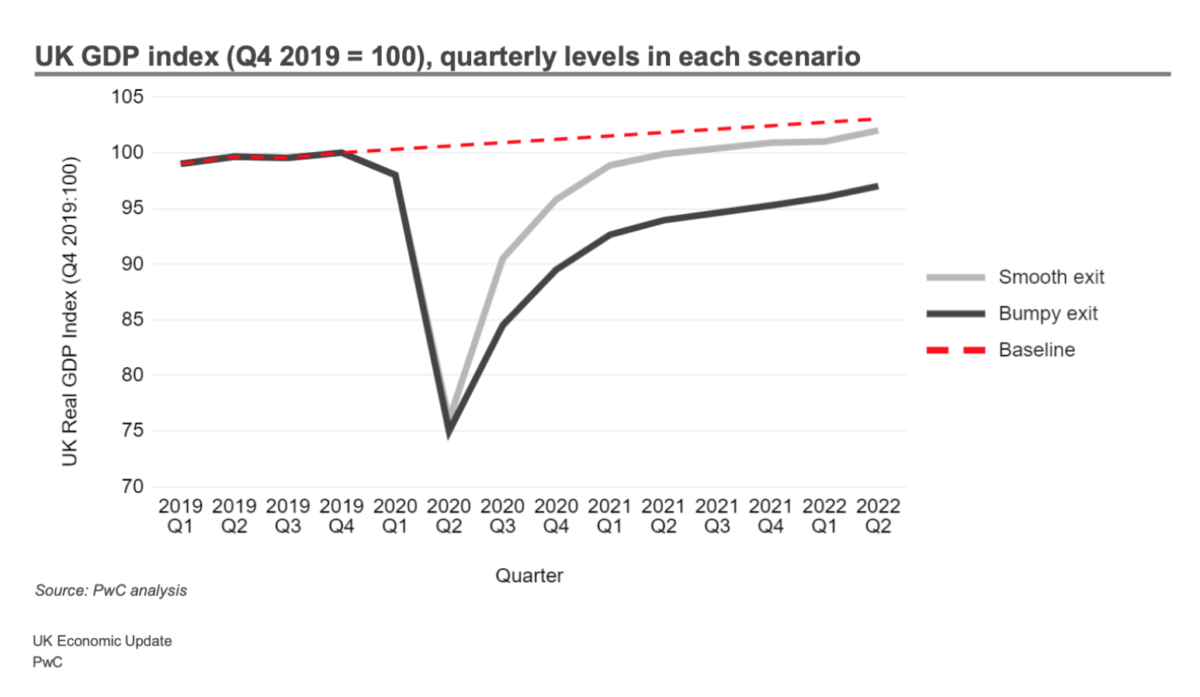

The UK also has to navigate its exit from the EU at the end of 2020. The big accountancy firm PWC thinks that, whatever sort of trade deal is agreed, this will still hold back future economic growth, as the following chart shows.

My property nightmare

I bought my first property in the summer of 1989 when I was 20. Little did I know that my property owning dream was to turn into a financial nightmare. The property cost me £62,000 and I borrowed £58,000 at 7% pa. Within 3 years, the mortgage rate and my monthly repayments had doubled. Unemployment was high and the economy was in the doldrums.

I could have possibly rented out the property, but that wasn’t a common thing back then and I really didn’t want the hassle. I eventually sold it for £46,000 in 1994 after paying £10,000 off the mortgage, due to the negative equity (owing more on the mortgage than the property was worth).

But my experience was nothing compared to the couple in this BBC News feature — Mortgage prisoners: Key workers in ‘financial nightmare’. They still owe too much today to either move home or move to a cheaper mortgage lender, 13 years after they bought their property.

Property prices fell 20% in the period 1989 to 1993 and 18.7% over 16 months between 2008-09. Official data shows that UK property prices in February 2020 (before Coronavirus) had already fallen 0.60% in one month. Are you confident that that small fall hasn’t (official house price data has been suspended since March) or won’t turn into a much larger one?

The government is clearly anxious about house prices as they have given a purchase tax (known as Stamp Duty Land Tax) amnesty until 31 March 2021 for all purchases up to £500,000 (although the 3% second home surcharge still applies). They suggest that the average purchaser will save about £4,500, but someone buying a £500,000 will save £15,000. Which? has a useful summary of the tax changes.

Whether the Stamp Duty saving will outweigh any fall in property values is anyone’s guess. But if, for example, a £300,000 home falls by just 10%, the £30,000 loss would dwarf the tax reduction.

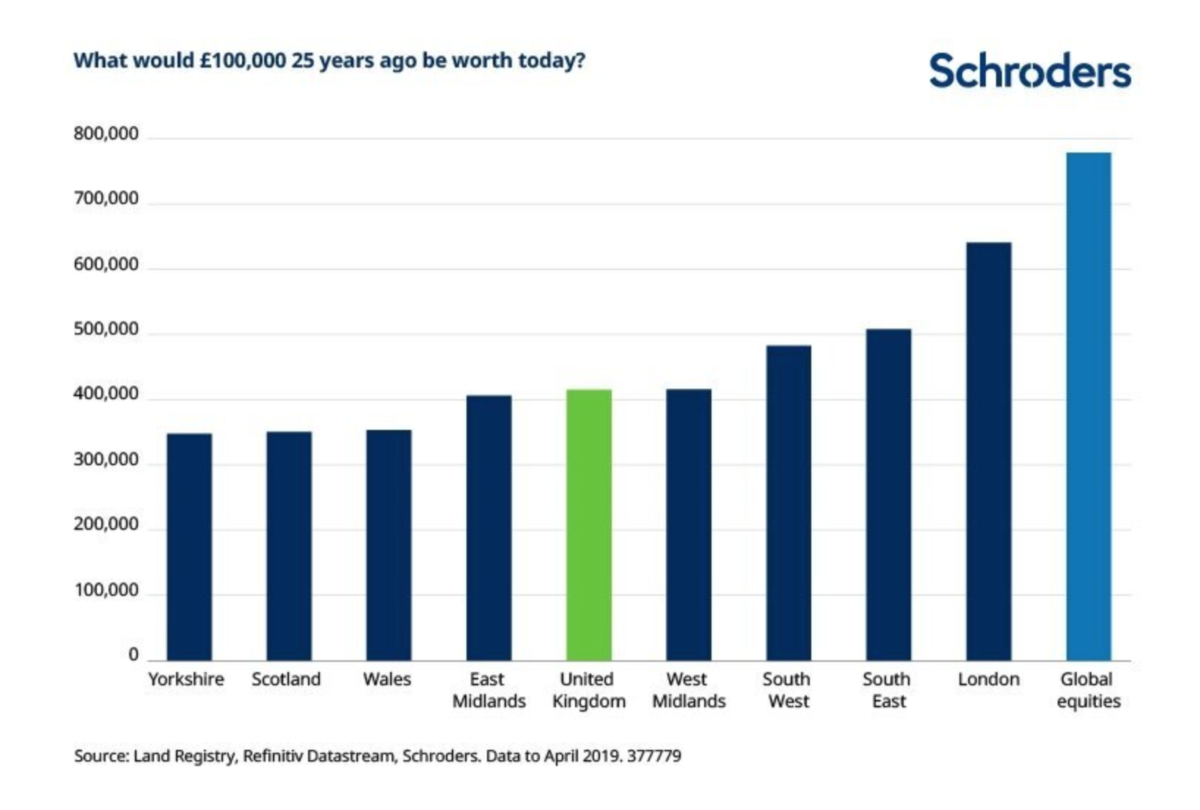

And if you are thinking of property as your get out of retirement underfunding jail card, you might want to think again. While residential property has historically done well, it’s still not done as good as a simple global equity index fund, especially when compared to property outside of London as the chart below shows.

If I was betting man

A combination of trade friction with the EU, rising and high unemployment, an all-time high price to earnings ratio, historically low-interest rates, together with more conservative lending criteria from nervous lenders doesn’t sound like the recipe for runaway property prices.

So here is what I would do if I was considering buying a home now:

Consider the worst-case scenario

Think through how you’d cope with a fall of, say, 25% in what you pay. Could you still move home in future? Would you be prepared to stay put long enough for prices the recover? Would you be willing and able to let the property if you couldn’t sell it?

Calculate the investment yield

What price would you need to pay for the property you are considering, to generate a 6% gross yield, assuming that rental rates fall 10% from the current market rate.

For example, say you are looking at a property for sale at £300,000. The current market rent is £1,200 PCM. A 10% fall in rent would result in a revised rental of £1,080 PCM, equivalent to £12,960 per annum. A gross yield of 6% would, therefore, suggest a purchase price of £216,000 or 28% reduction in the asking price.

This is just the formula I would use, but you can choose a yield that you think represents a fair returns given the illiquid nature of property, the significant running costs and the very uncertain economic outlook. Just make sure you have a formula to assess the purchase price on an investment basis.

Look for motivated sellers

The property expert Henry Pryor says a house is not worth what the seller is asking, what they need, what someone told them it was worth last year, or what someone they know sold theirs for recently. Rather, he says that: “A property is only worth what a willing and able buyer is prepared to pay.”

While many owners will not want to sell in a down market, there will always be plenty of sellers who want or need to sell to realise capital due to divorce, death or to repay debts. These are what the property industry call the 3 Ds. A motivated seller is a dream for you the careful buyer, because they need or want the money more than you want or need to buy!

Make lots of offers

Treat buying your property in a businesslike manner. Get yourself as ready as possible (ideally chain free) with the money and any mortgage agreed, and then submit offers in line with your rental yield explained earlier. An estate agent is legally obliged to submit your offer to the vendor, so don’t let them fob you off with excuses why they can’t.

And take with a pinch of salt any suggestion of ‘strong’ interest from other buyers. There might be or there might not. It’s of no concern to you if other people want to overpay. You are looking for a bargain, not to be the seller’s fairy godmother or white knight!

I have no idea what will happen to property values in the short to medium term, but everything tells me it won’t be pretty and prices are very vulnerable. But what we do know is that everyone needs to live somewhere and in the very long run, property is likely to be a good investment. As Mark Twain said “Buy land, they’re not making it anymore.”

JASON BUTLER is a former financial planner, based in Suffolk. He is a personal finance columnist for the Financial Times, and is Head of Financial Education at Salary Finance. You can find out more about him on his website.

If you’re interested in reading more from Jason, here are some other articles he’s contributed to TEBI:

Seven positive changes you can make post-lockdown

Your retirement could be longer than you think

How to stop money spoiling your relationship

No emergency fund? Start one now

Learn from your money mistakes

What does your financial wellbeing look like?