By JASON BUTLER

It’s no surprise that the current global coronavirus pandemic has caused many people to focus on their short-term financial needs and challenges.

But as our economy gradually starts to emerge from the lockdown, and we all start to learn to live with necessary health restrictions, the danger is we resume old spending patterns and fail to get to grips with the biggest and most expensive financial life goal we all have — funding the time when paid work is either not possible or desirable in later life.

Longevity has been rising

Knowing how long you are going to live after you stop work (known as longevity) makes planning for the time after work so much easier, because it helps you understand how much money you need to have accumulated. The Office for National Statistics has an easy to use longevity calculator to help answer this question.

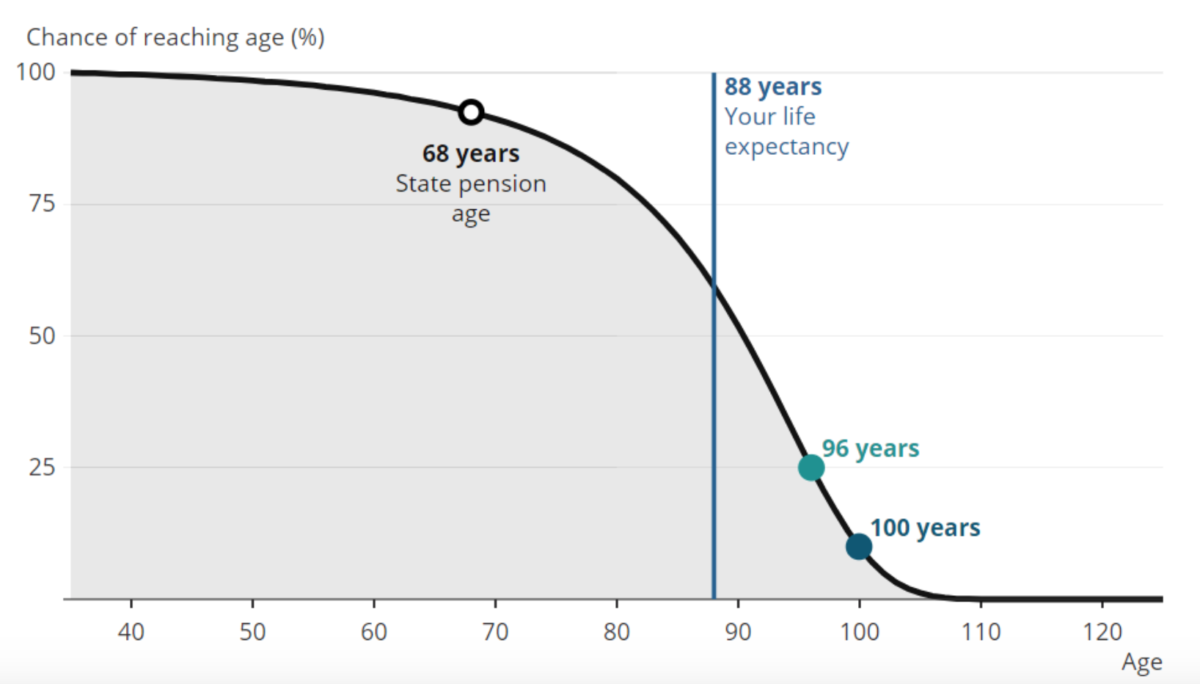

The chart below shows the results for a 35-year old female. She can expect to live on average to age 88. While there is a chance that she will die at an earlier age than 88, this will merely reduce the cost of funding her life after work.

She needs to be more concerned with the chance that she lives much longer than the average, due to the extra cost this will place on her financial assets.

The chart shows that she has a 25% chance of living to 96 and a 10% chance of living to age 100. It seems sensible, therefore, to assume she will live to 95. If she stops work at 65 then this suggests she needs to fund a 30-year period after work.

Source: Office for National Statistics

How much money should you aim to have accumulated?

Every person has different circumstances and lifestyle expectations which will affect how much they need to accumulate, but to get an idea of whether you are on track to have enough financial assets to fund life after work, there are a few broad brush checks you can carry out.

There are two simple rules of thumb to determine how much you need to have saved for financial independence.

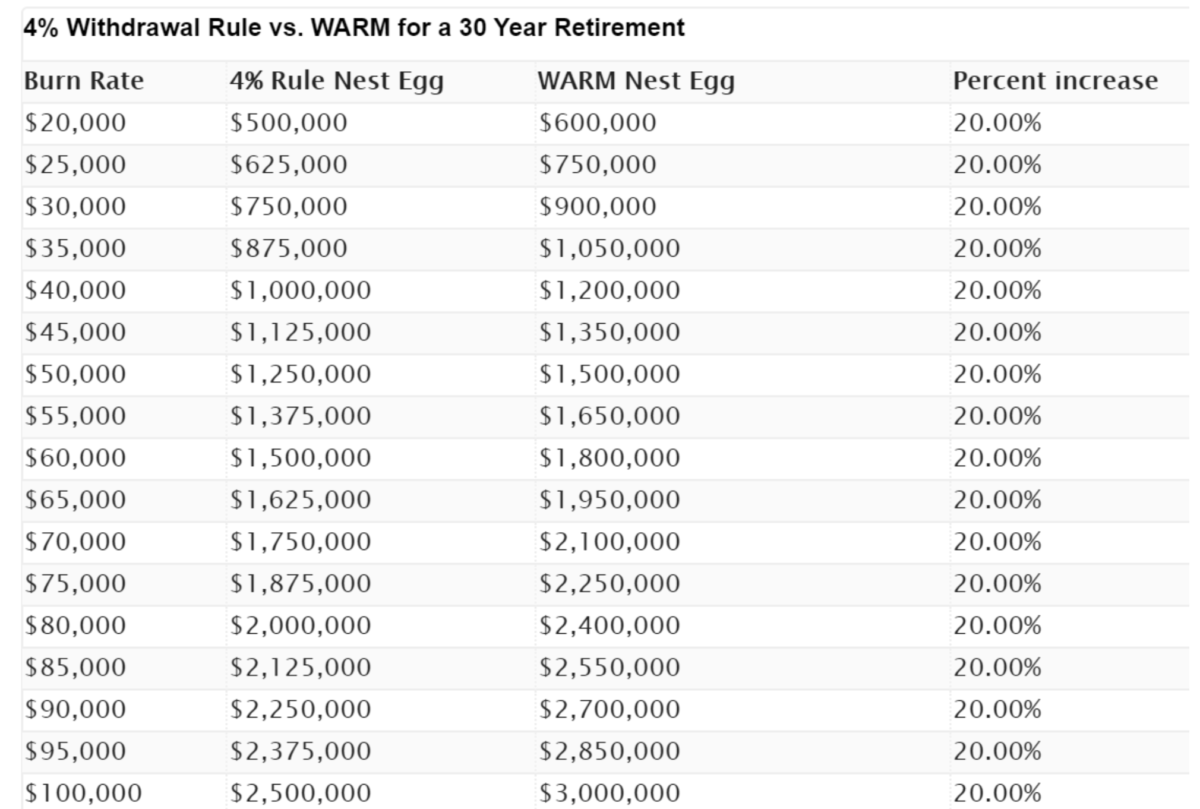

The 4% rule suggests that a portfolio allocated 50% to bonds and 50% to equities has a very high probability of being able to sustain an inflation adjusted annual income that starts out at 4% of the portfolio for a 30-year period.

The Wasting Asset Retirement Model (WARM). This approach assumes a much more conservative investment approach, with less than 10% in equities, and the bulk in high quality bonds. The required fund is determined by multiplying the expected period of retirement by the annual desired lifestyle expenditure.

For example, 30 years of £20,000 per annum suggests a starting fund of £600,000 (30 x £20,000). Different retirement periods and expenditures lead to different starting fund values.

The WARM method leads to a 20% higher required fund than the 4% rule approach, mainly because of the lower expected (but less volatile) return from the underlying investments held. For example, £25,000 per annum required for 30 years would require a starting fund of £750,000 for the 4% rule and £900,000 for the WARM approach.

Source: frugalfringe.com

Regular savings reality check

Few people have a clear idea of when they want to make paid work optional (what our parents would have called retirement), how long they are going to live and exactly how much their post-work lifestyle will cost.

Ideally we’d all use a financial planning calculator or hire a financial adviser to do the calculations for us, but in the absence of that here is a simple, if rather crude, way to check if your saving rate is high enough.

Target net wealth = (current age minus 27) x (pre-tax current income/5)

Example for 35-year-old earning £38,000 per annum would look like thus:

(35-27) x (£38,000/5) = £60,800

Note: The original version of this net worth checker methodology was first set out in the 1996 book The Millionaire Next Door. The version set out here is an adaptation that seeks to address some weaknesses of the original model and was created by Trent Hamm for The Simple Dollar in 2007.

Track your net worth not your income

Another way to check whether you are on track with your regular savings rate and accumulation of financial assets is to divide your current net worth by your current pre-tax income (from all sources, not just working).

If your income is, say, £30,000 per annum and your net worth is £100,000, your income to wealth ratio is 30%. The lower you can get that ratio (anything under 10% is pretty good), the more financial flexibility you’ll have and the easier it will be to achieve and sustain financial independence.

Just because your income to net worth ratio is high, doesn’t mean you are a loser or will end up eating cat food in your later years. But it might suggest that you need to reign in your current lifestyle spending, so you can get a bit more serious about saving and investing more of what you earn.

Building wealth takes hard work, discipline, and some sacrifice. So, if you are serious about becoming financially independent, don’t let your income define your spending budget. Let your values and priorities define where you put your income, focus on growing your net worth and forget everything else.

Your future self will thank you for it.

JASON BUTLER is a former financial planner, based in Suffolk. He is a personal finance columnist for the Financial Times, and is Head of Financial Education at Salary Finance. You can find out more about him on his website.

If you’re interested in reading more from Jason, here are a few of the other articles he’s contributed to TEBI:

How to stop money spoiling your relationship

No emergency fund? Start one now

Learn from your money mistakes

What does your financial wellbeing look like?