By MURRAY COLEMAN

Active fund managers tout how much “alpha” they can deliver for investors. Besides representing a Greek letter, this terminology in finance represents how much “excess” return a fund makes relative to a comparative index.

But a host of academic and professional research serves as a giant red flag for such claims. Now comes new research by S&P Dow Jones Indices providing even more evidence that alpha is elusive at best. In “Fleeting Alpha: The Challenge of Consistent Outperformance,” analysts Berlinda Liu, Hamish Preston and Aye Soe build on research methodologies developed for the SPIVA Scorecard as well as S&P’s Persistence Scorecard.

The fresh study is based on Lipper classification data and spans more than 15 years (Q2 in 2003 through Q3 of 2018). Performance is broken down by three-year periods, then a rolling average for all of these incremental timeframes are calculated for each major fund category.

For example, the S&P report’s results showed that even for equity fund managers who beat their benchmarks over a three-year period ending in late 2015, performance “persistence” beyond one-year was “negligible.” This was typical of longer time periods studied, the S&P analysts point out, adding that past performance didn’t prove to “help identify superior performing managers in advance.”

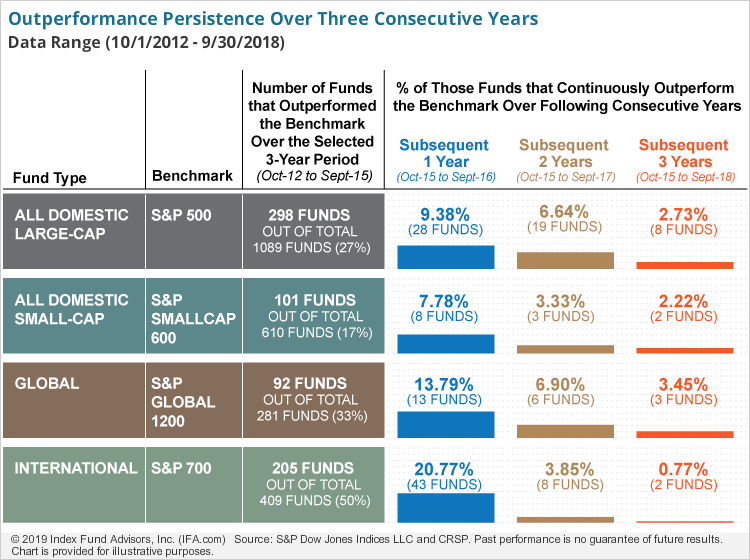

So much for chasing fund performance by seemingly winning stock pickers. But there’s much more. We’ve already related these researchers’ results for the three-year period ending in Q3 of 2015. Below we’ve graphically depicted this report’s findings for the subsequent three years (Oct. 2015 through Sept. 2018), which is framed by the previous three-year period’s results.

Active equity managers are compared to their respective S&P benchmarks in four key areas of focus — domestic large caps, U.S. small caps, international large caps and global large caps. Percentages are presented as rounded numbers.

Out of the 1,089 active U.S. large-cap funds that existed at the end of Q3 in 2015, just 27.38% (298) had outperformed the S&P 500 index in the previous three years. In the following 12 months, 9.38% of those winners were able to keep beating the blue chip benchmark. And by the end of September 2018, only 2.73% of the 298 winners were able to maintain that streak for a third consecutive year.

Similar declining patterns of alpha as measured by S&P’s researchers prevailed for active managers in domestic small caps (S&P SmallCap 600), global equities (S&P Global 1200) and international (S&P International 700).

“We observe little to no evidence of performance persistence (i.e., alpha) among active managers,” the authors summarize. They additionally note that “the data suggests the persistence of fund performance was worse than would be expected from luck.”

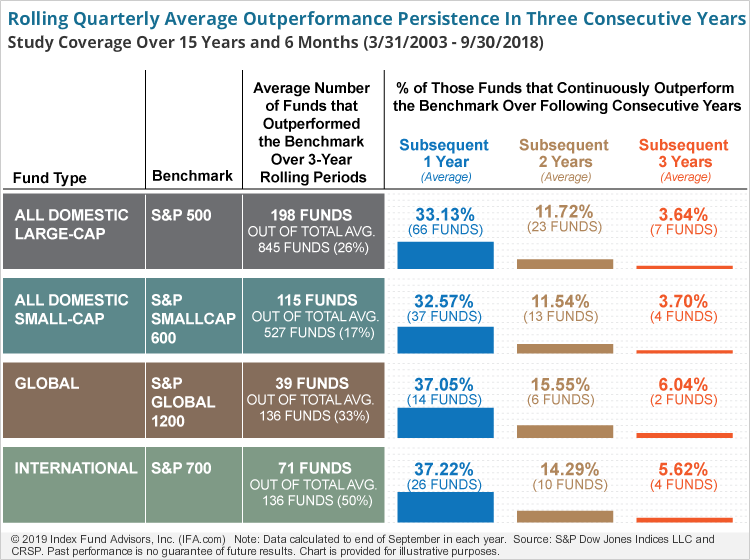

In their latest study, the S&P analysts acknowledge an inverse relationship exists between persistence rates and time horizons. To support their overall results, S&P’s researchers also break down data by rolling three-month periods between Q2 of 2003 and Q3 of 2018. The idea is to study inverse relationships between how consistent — or, more to the point inconsistent — active management performance turns out to be over longer periods.

Along those lines, the graph below shows rolling averages for active fund managers’ persistence in beating their closest S&P benchmarks in the past 15-and-a-half years (through September 2018). Calculations came by comparing each quarter’s figures, then using simple averages to measure persistence levels in different fund categories.

At first glance, this longer-term and quarterly picture makes active managers appear to fare “slightly” better at the beginning, according to S&P’s analysis. “However, we can observe an inverse relationship between the level of persistence and time horizon; persistence declined in each subsequent year,” the researchers observe.

The level of decline is so overwhelming from a statistical standpoint, the report concludes, that it should stand as a stark warning to fund investors who think they can use alpha to distill future winners. To quote the researchers, “market participants may want to reconsider chasing ‘hot hands’ or picking managers based on past performance.”

Murray Coleman is an investment writer at IFA.com. He has also worked as a funds reporter for The Wall Street Journal, The Financial Times, Barron’s, and MarketWatch.

You can find more of the latest research here:

Does active trading of passive funds pose liquidity risks?

The impact of size on large-cap fund performance