By CAROLYN GOWEN

“Putting yourself first is not selfish. Quite the opposite. You must put your happiness and health first before you can be of help to anyone else.”

– Simon Sinek

Towards the end of last year, I met with a couple, John and Erica (names changed to protect their identity), who were interested in becoming clients.

Our initial meeting with potential new clients focuses primarily on them rather than their money. The principal aim of the meeting – from our perspective – is to find out who they are. What makes them tick? What gets them out of bed in the morning? What are the goals they want to achieve and how important is each one of them (from ‘must do’ to ‘nice to do’)? What does ‘a good life’ look like to them?

For this couple, who had recently sold their business and were now looking forward to doing all the things they’d put off doing for years, the one message which came through loud and clear was how important family was to them. They had one married daughter, Sally, and had celebrated the birth of their first grandchild just a few months earlier. Like many of our clients, they were totally besotted grandparents.

- Because of this emphasis on family, many of their goals centred around helping Sally and her young family. The specific goals which they set out at that first meeting included the following:

- A gift of £100,000 to Sally and her husband to help them to move out of their small flat and buy a house;

- Set up a trust for their new grandson (and any further grandchildren) to pay for education costs from age 5 to 21, with an initial transfer to the trust of £250,000;

- Invest in Junior ISAs each year and contribute the maximum (£2,880 net) to a personal pension plan for each grandchild to age 18 (they were of the firm belief that, by the time their grandson got to their age, the state pension would be a thing of the past). The assumption was that they would need to provide funding for two grandchildren;

- In seven years, gift their holiday home in France to Sally so that her children could enjoy the wonderful summer holidays there which she had experienced.

In addition to the above, there were also personal goals around their spending needs, the travel they wanted to do while they are still fit and healthy, and making a difference through allocating time to voluntary and charity work.

John and Erica are in the fortunate position of having received a sizeable lump sum from the sale of their business as well as having built up pensions and savings during their working lives. That said, they were stopping paid work at a relatively young age (mid-50s) and were, therefore, looking at funding a period of financial independence which could well be as long as their working lives had been.

While the various goals relating to gifts required advice in respect of the potential tax implications, a more important question which we needed to answer first was “Can they afford the cost of their goals?”. John had tried to do some basic calculations with the aid of an Excel spreadsheet, but they didn’t have any clear idea as to whether what they want to do is achievable.

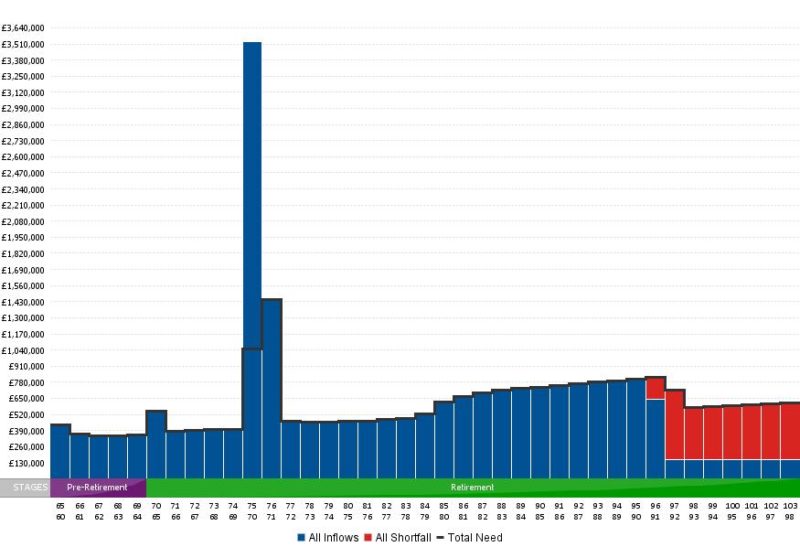

After the initial meeting, and if both sides feel there may be value in us working together, we offer a second meeting at which we present a basic lifetime cashflow forecast based on high-level data provided to us. John and Erica were keen to progress to that stage, so a meeting was arranged for last week when I was in London.

The cashflow forecast which we present at this meeting is highly visual, and I have never met with anyone who has seen anything like it previously (including when they have an existing adviser and/or when they see several other firms besides us).

It’s part of our process that I love because, without fail, it blows people away. In no time at all, they are asking questions, considering alternative ‘what if’ scenarios, looking at the effects of changes to the assumptions, which we can make in real-time. Seeing what their financial future might look like.

And above all, seeing whether, based on cautious forward-looking assumptions, they can afford the life they want to live and if not, what they might need to change to do so. It’s hard to explain the power of that process.

In John and Erica’s case, things weren’t completely straightforward. Incorporating into the cash flow everything they had told us they wanted to achieve, including the level of personal expenditure they desired, the cash flow forecast indicated that they would run out of money at around age 85 (we run the cashflow until the younger of a couple’s age 99).

There’s a phrase which Ben Carlson uses from time to time in his and Michael Batnick’s podcast: “Put your own oxygen mask on first”. What he means by that is, as much as we might want to help those around us, we need to ensure our own financial future is secure first.

And this was a classic case. If John and Erica were to do all the things they wanted to for their family, there was a reasonable chance there would be insufficient resources to fund their own needs.

As is often the case, the results surprised John and Erica. With several million pounds behind them, they had assumed – like many people do in their situation – that they had ample to fund the lifestyle they wanted, which wasn’t an extravagant lifestyle by any means. They’re very typical of their generation – they come from a modest background and have worked hard to get where they are today.

The thing is, having to fund maybe forty years of financial independence is expensive. Especially when you build inflation into the calculations.

When faced with a shortfall like this, everyone has options of what to change to increase the chances of not running out of money. The important thing is always to concentrate solely on the things you can control:

How much you spend

This is probably the most powerful lever in your arsenal. In our cash flow forecasts, we assume that lifestyle expenses will increase at a rate 1.5% pa higher than inflation. This is partly due to the evidence that in financial independence, we tend to buy more services than goods, and the cost of those tends to rise at a faster rate than the price of goods. Over several decades this can have a huge impact. Often a modest reduction in assumed lifestyle expenditure can eliminate the shortfall.

How much you earn

While you may not be able to move from a job paying £50,000 pa to one paying £100,000 pa you have a pretty good level of control over how long you work. Putting financial independence back, or working part-time, for a couple of years can get rid of the shortfall;

How you consume your assets

For many people, a large proportion of their wealth is tied up in their home. Downsizing at some point can release capital which you can invest to meet lifestyle costs. The timing and format of drawing benefits from pensions can also affect your cash flow;

How you own your assets

Transferring assets from a higher paying spouse to a lower-paying one can mean paying less tax and therefore increase the amount available to meet outflows.

The one thing you must NEVER do to try and get rid of a shortfall is to increase the level of risk in your investment portfolio, in the hope of generating higher returns, above that which you can tolerate emotionally. It is extremely hard to control our emotions surrounding risk and loss, and we certainly have no control over markets and the returns they give us.

In John and Erica’s case, when we removed the gift of the holiday home from their cashflow and instead showed that being liquidated when they were in their early ’70s, the shortfall disappeared. It was agreed after some discussion and modelling a range of various options that, of all their goals, this was the one that fell into the “nice to do” camp. If things worked out better than expected, they might yet be able to make the gift to Sally and in the meantime, there was nothing to stop her holidaying there.

If they become clients their plan will be reviewed and updated each year meaning they will have a roadmap to guide them and will be able to make informed financial decisions such as that throughout the rest of their lives.

Being able to do this for clients is – in my opinion – one of the most important parts of the financial planning process. There is never only one solution to a problem and being able to see the effects of pulling the various levers undoubtedly helps people make better-informed decisions. That’s the power of a plan.

“You can’t make decisions based on fear and the possibility of what might happen.”

– Michelle Obama

CAROLYN GOWEN is a director and co-owner of Bloomsbury Wealth, an evidence-based financial planning firm based in London. You can follow her on Twitter @CarolynGowen. This post originally appeared on Carolyn’s blog, The Financial Bodyguard, and is republished here with her kind permission.

Here are four of her previous articles on TEBI:

Eight investment traps to avoid

A financial plan is about much more than investing