By CRAIG LAZZARA from S&P Dow Jones Indices

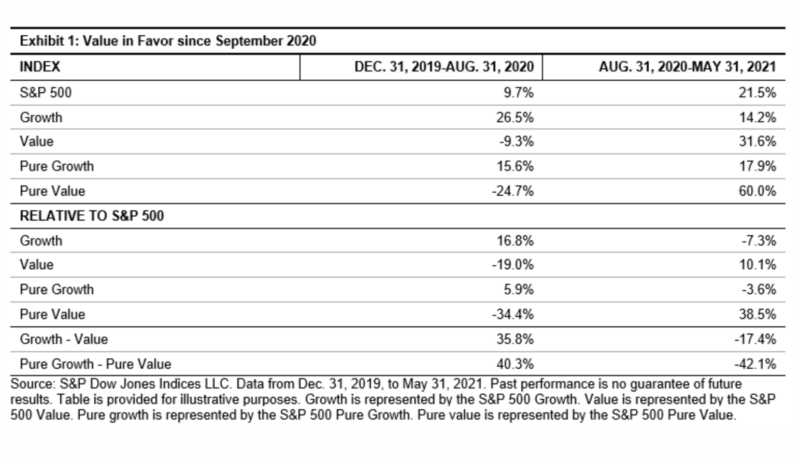

U.S. equity markets seemed to undergo a fundamental change of direction in September of last year. Exhibit 1 illustrates the shift; our growth indices, which had outperformed value handily through the end of August, have lagged ever since. The spreads between growth and value are even greater when we compute them using our Pure Growth and Pure Value indices.

Do the strength and longevity of the value rally suggest that it must be near its peak?

To answer directly — we don’t know. Whether value continues to outperform growth or suffers a reversal is a function of numerous exogenous variables, prominently including the course of inflation, the level of interest rates, and the prospects for growth as the economy recovers from last year’s shutdowns. History does, however, let us make two observations about the nature of past value rallies.

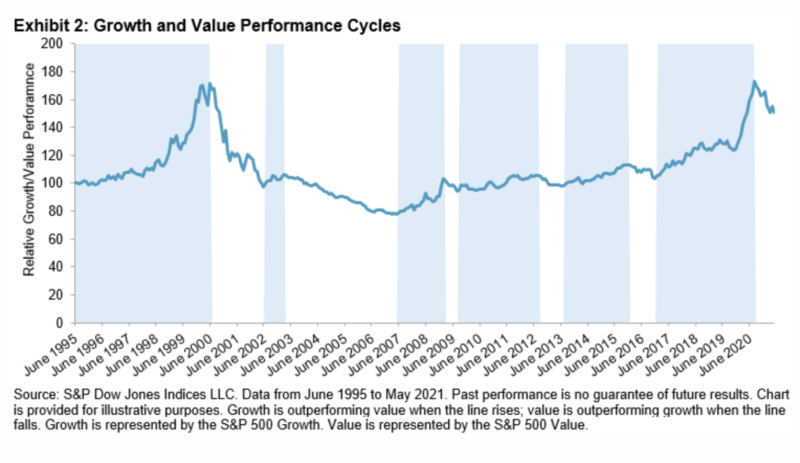

First, as Exhibit 2 illustrates, some historical value rallies have lasted far longer than nine months. Since 1995, there have been six cycles when value outperformed growth. The shortest lasted only six months (between February and August 2009). On the opposite side of the ledger, value outperformed for more than four years between 2003 and 2007. So the nine-month duration of the current rally is meaningless in itself.

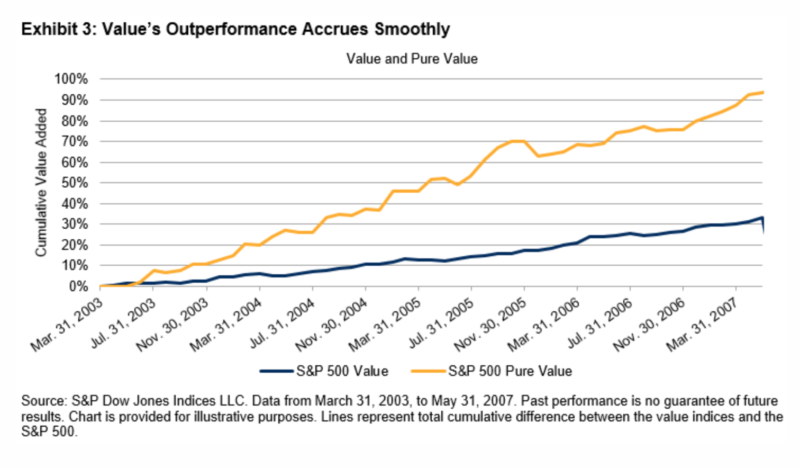

Second, when value has outperformed historically, its outperformance has accrued smoothly. Exhibit 3 illustrates this for the 2003-2007 value rally, although similar graphs could be (and have been…) drawn for the other periods of value dominance. It’s conceptually possible that, although value outperformed for more than four years, most of the outperformance occurred in the early months, with only a small dollop for latecomers. It turns out that this was not the case; early investors did not reap a disproportionate share of value’s gains.

We don’t know for how much longer the value rally will last. We don’t know what the ultimate margin of outperformance will be. But the current nine-month cycle is not remarkably long by historical standards, and if it keeps going, history gives us reason to believe that outperformance in the next period can be as good as it was initially.

CRAIG LAZZARA is Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

MORE FROM S&PDJI

For more valuable insights from our friends at S&P Dow Jones Indices, you might like to read these other recent articles:

The case for tracking the venerable Dow Jones

A diverse portfolio is a strong portfolio

Why even Buffett has been buffeted by the index

The case for looking beyond the S&P 500

The impact of style bias on the latest SPIVA data

Three reasons for active managers to feel positive

PREVIOUSLY ON TEBI

Can you measure your financial wellbeing?

Should investors we worried about US government debt?

Random noise influences advice, study finds

Booth and Fama on rising inflation

Thousands of Woodford investors will never see justice

Return signal momentum: a new strategy worth following?

OUR SISTER BLOGS

If you’re a financial adviser or planner and you enjoy TEBI’s articles, why not try our sister blogs, Adviser 2.0 and Evidence-Based Advisers?

© The Evidence-Based Investor MMXXI