By ANDY PETTIT

Investors in LF Woodford Equity Income Fund (“Woodford Fund”) are in an unfamiliar and uncomfortable situation of being temporarily locked into the fund and unable to liquidate their holdings. It will be of little consolation to them that regulators have been looking for some time at the factors that led the fund to suspend dealings.

On Feb. 5, the European Securities and Markets Authority issued a paper to provide recommendations on how investment funds can manage liquidity risk. The paper cited two reasons for the increased regulatory focus on liquidity:

— The sharp growth of the asset-management industry (measured by total net assets) since the mid-2000s. This has increased the potential impact of asset-management activities on the broader market.

— An increased focus on the potential “liquidity mismatch” in many investment funds, whereby units in funds are sometimes dealt and settled in a shorter time frame than the fund’s assets can be reasonably liquidated.

The second bullet listed here prophetically sums up the predicament of the Woodford fund, which is further detailed in the paper “Woodford Facing Dramatic Portfolio Liquidity Challenge” by Tom Whitelaw, director of equity ratings for Morningstar Research Services LLC.

Below, we take a closer look at what the Woodford fund reveals about regulatory efforts across the board.

Liquidity regulations in Europe and the U.S.

The Woodford fund, like the majority of retail funds that European retail investors buy, is a UCITS fund, meaning that it operates under a set of rules established by the European Union more than 30 years ago. The UCITS Directive includes several requirements related to liquidity, stipulating that funds must:

—Invest in transferable securities or other liquid financial assets. This may include money-market instruments, bonds, shares, and financial derivative instruments. A maximum of 10% of the fund can be invested in unlisted securities.

— Be diversified. This is principally enforced by what is known as the 5/10/40 rule, which stipulates that a maximum of 10% of a fund’s net assets may be invested in securities from a single issuer, and that investments of more than 5% with a single issuer may not make up more than 40% of the whole portfolio. These limits can be revised upwards in the case of funds tracking a market index, and other limits apply on the amounts that can be invested into other UCITS and non-UCITS funds.

— Allow investors to buy or sell shares at least twice a month. In actuality, most UCITS funds offer daily liquidity if they are able to sell enough of the fund’s holdings to pay back those investors who are redeeming on any given day.

In the U.K., there is already a pending response from the Financial Conduct Authority on issues of liquidity like that of the Woodford fund. The FCA held a consultation earlier this year on proposals that could reduce the potential harm to retail investors in non-UCITS funds that hold illiquid assets.

At an international level, the International Organization of Securities Commissions has published a Good Practices report on fund liquidity.

Like UCITS funds, U.S. mutual funds also can be bought and sold daily. On June 1, the portion of a new SEC rule that provided liquidity categories for large asset managers took effect. It requires funds to classify each of their holdings into one of four liquidity categories: highly liquid, moderately liquid, less liquid, or illiquid (illiquid assets are limited to 15% of a fund’s net assets). A fund’s categorization is based on the number of days it reasonably needs to raise cash to meet investor redemptions without significantly changing the market value of the remaining fund holdings.

A closer look at liquidity in the Woodford fund

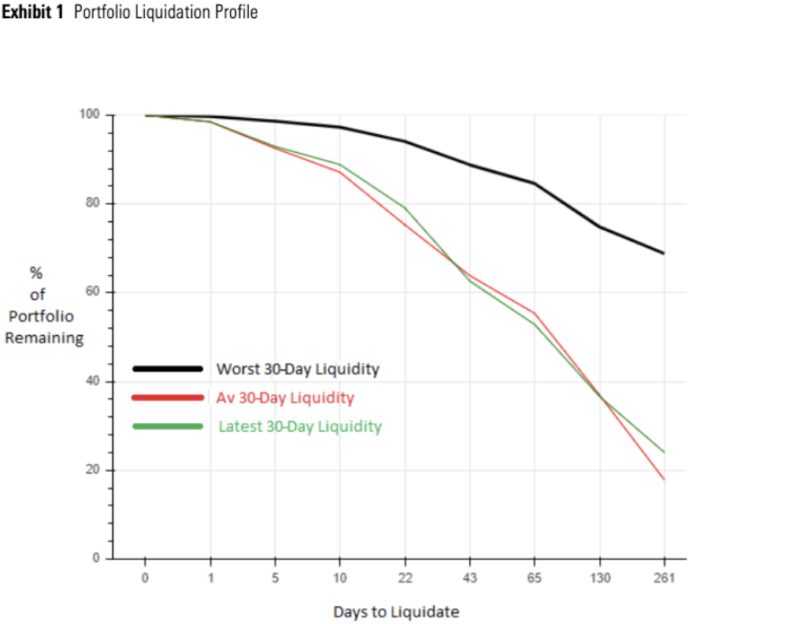

The chart below shows three potential liquidation scenarios for the Woodford fund based on past trading volumes of each holding. Under the most conservative approach, potentially only 30% of the portfolio could be redeemed within one year. For assets that assume more generous liquidity, closer to 80% could be redeemed in that time frame.

Source: Morningstar Direct. Data as of June 2019. For illustrative purposes only.

Expediting the sale of securities to meet investor redemptions will almost certainly result in fire-sale prices for some securities. This situation would highlight the fund’s duty to act in the best interest of all investors—departing, incoming, and ongoing—since the sale of the fund’s assets below current values to meet the redemption demand of departing investors would depress the value of ongoing investors’ holdings.

Next steps for the Woodford fund

The rules allowing the temporary suspension of the Woodford fund seek to protect the interests of all investors, as they enable the fund to build sufficient liquidity to again meet redemption requirements by selling the assets in an orderly manner. While there is no maximum duration for the suspension, it has to be reviewed at least every 28 days, and investors are to be kept informed about developments.

The size and profile of this fund is likely to be considered in the regulatory reviews in progress.

ANDY PETTIT is the Director of International Data & Research Strategy for Morningstar.

This article first appeared on Morningstar.com and is republished here with Morningstar’s kind permission.

You can find more on Woodford Equity Income on TEBI right here:

What Woodford teaches us about illiquid assets

Woodford shows we need more journalism like this

What Neil Woodford and Arsenal FC have in common

Neil Woodford, a lesson in humility