By LARRY SWEDROE

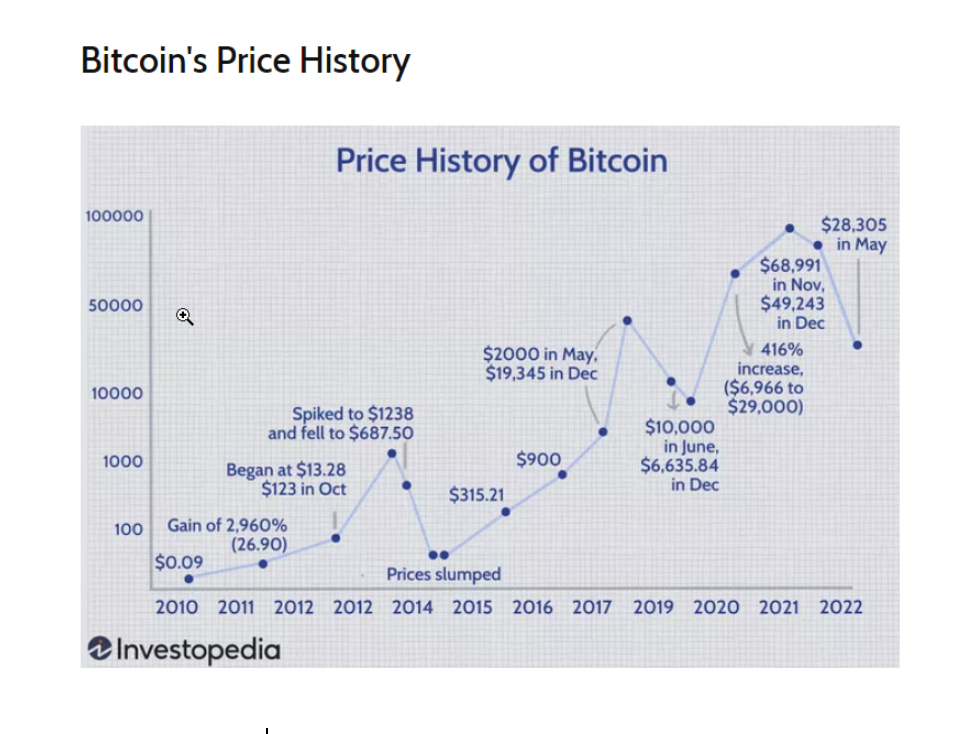

Since their introduction in 2008, cryptocurrency markets have experienced both multiple, massive bull markets and devastating drawdowns, periods of both euphoria and despair, and fear of missing out (FOMO). For example, bitcoin, which traded at just $0.09 in 2010, reached a peak of almost $69,000 in November 2021, and it’s currently trading at around $22,000 — a drawdown of about 68 percent.

Because their value is not guaranteed by a government, their digital nature means the purchase and use of cryptocurrencies carry high levels of risks — not just market risk, but liquidity risk, security risk, regulatory risk and fraud risk. That is why many investor alerts have been issued by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the Consumer Financial Protection Bureau (CFPB) and other agencies.

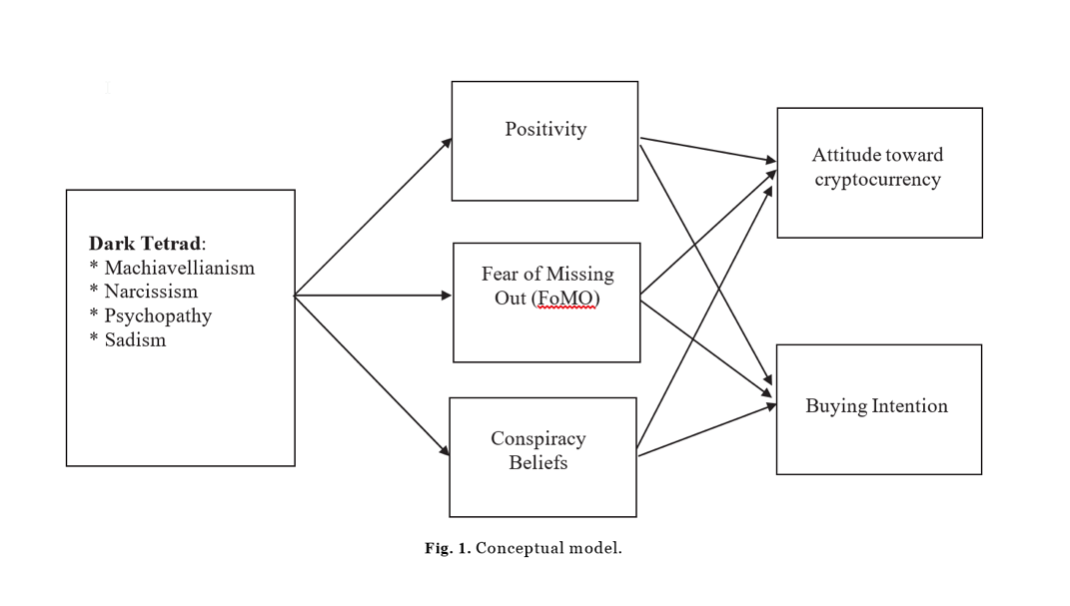

The kind of volatility that is typical of speculations, not investments, and all the warnings from regulatory agencies, raises the question: Who are the buyers of cryptocurrencies? Brett Martin, Polymeros Chrysochou, Carolyn Strong, Di Wang and Jun Yao, authors of the study Dark Personalities and Bitcoin®: The Influence of the Dark Tetrad on Cryptocurrency Attitude and Buying Intention, published in the April 2022 issue of Personality and Individual Differences, sought to answer that question and determine why people want to buy cryptocurrencies. Their hypothesis was that price volatility (i.e., potential gain) and autonomy from government oversight make crypto attractive to that subset of buyers who are prone to gambling and are suspicious of government. That led them to focus their research on examining the effects of the dark tetrad traits (Machiavellianism, subclinical narcissism, subclinical psychopathy and subclinical sadism) on a person’s crypto attitude and buying intention. The following mediators were examined as reasons for people buying crypto: (1) conspiracy beliefs (e.g., distrust of government), (2) positivity and (3) FOMO. Specifically, they examined the effects of:

- Machiavellianism: People who score high on this trait, named after the political philosophy of Niccolò Machiavelli, are cold, lack morality and are excessively motivated by self-interest. Their behavior is characterised by a manipulative approach towards others. The authors hypothesised that the high returns of the crypto market may encourage Machiavellians to buy, as they tend to be money-obsessed and make reward-oriented decisions in gambling. They also predicted the effect of Machiavellianism on crypto judgments will be influenced by conspiracy beliefs, as Machiavellianism has been found to be positively associated with government conspiracy beliefs (including conspiracy theories related to COVID). Machiavellianism has also been found to be associated with FOMO.

- Narcissism: Individuals who score high on narcissism display grandiosity, entitlement, dominance and superiority. Since narcissism has been found to be related to overconfidence and risky stock market investing, crypto investing is appealing. Narcissism has also been found to be associated with conspiracy beliefs.

- Psychopathy: Individuals who score high on psychopathy show low levels of empathy and high levels of impulsivity and thrill-seeking. The reckless nature of psychopaths makes them more resistant to stress and anxiety. As a result, psychopaths like stimulation-seeking and risk-taking. Thus, they are prone to gambling and gambling addiction, making crypto attractive. In addition, the impulsivity of psychopaths may lead them to experience crypto FOMO.

- Sadism: Individuals who score high on sadism obtain pleasure from hurting other people and making them suffer physically or mentally. As sadism involves pleasure from another’s pain and buying crypto is unlikely to directly result in another’s distress, they did not expect an association between sadism and crypto judgments.

Their database of 566 participants (females, 63.3 percent; mean age, 31.1 years) was drawn from Prolific Academy, “the world’s largest crowdsourcing community of people who love science.” They stated: “The final sample size was adequate for testing the proposed model.” Attitude towards cryptocurrency was assessed with three items (bad/good, unfavourable/favorable and negative/positive), and buying intention was assessed with three items (unlikely/likely, unfavourable/favourable and negative/positive). All items were measured on a 7-point scale. They assessed the Short Dark Triad based on the 2014 study Introducing the Short Dark Triad (SD3): A Brief Measure of Dark Personality Traits. The scale consisted of three constructs, each with nine items: Machiavellianism, narcissism and psychopathy. All items were measured on a five-point agreement scale (1 = strongly disagree; 5 = strongly agree). Sadism was measured based on the assessment of the Sadistic Personality Scale (nine items) based on the 2017 study The Assessment of Sadistic Personality: Preliminary Psychometric Evidence for a New Measure. The items were measured on a 5-point agreement scale (1 = strongly disagree; 5 = strongly agree). Following is a summary of their findings:

- Of the 566 participants, 26 percent reported they owned crypto and 64 percent showed interest in crypto investing.

- Machiavellianism was associated with buying intention mediated by conspiracy beliefs — Machiavellianism had a significant positive effect on conspiracy beliefs (0.17) and FOMO (0.13).

- Machiavellians like crypto primarily because they distrust politicians and government agencies — many crypto supporters believe governments are corrupt, and crypto avoids government corruption.

- While narcissism is unrelated to conspiracy theories or FOMO, it has a significant positive effect on positivity (0.45) — narcissists tend to focus on the positive side of life. Thus, narcissists like crypto because of their great faith in the future and because of confidence their own lives will improve.

- Psychopathy has a significant positive effect on FOMO (0.14) and a negative effect on positivity (0.26) — impulsive psychopaths like crypto because they fear missing out on investing rewards others are experiencing.

- Sadism has a significant positive effect on FOMO (0.13) and negative effect on positivity (0.13)—sadists like crypto because they too do not want to miss out on investment rewards. To them, perhaps both the pleasure from seeing another’s pain and FOMO are related to selfishness. However, unlike narcissists, both psychopaths and sadists lack positivity about their prospects, which cancels out their liking crypto.

- Considering the mediators, positivity had a positive significant effect on attitude (0.10); conspiracy beliefs had a positive significant effect on attitude (0.10) and buying intention (0.13); and FOMO had a positive significant effect on attitude (0.14) and buying intention (0.14).

- Controlling for experience and current ownership did not impact the results.

Their findings led the authors to conclude: “The high risks and high potential returns of crypto trading make it attractive to the kind of people who like gambling. They added that the fact that cryptocurrencies are not issued or backed by governments like traditional or ‘fiat’ currencies makes them attractive to people who distrust government.”

The most interesting, and surprising, finding was that while investors were drawn to cryptocurrencies in the hope of lottery-like returns — which I would have guessed was the primary motivator — much of the motivations had little to do with money. Instead, they were related to the personality traits of the Dark Tetrad: Machiavellianism, narcissism, psychopathy and sadism.

Investor takeaways

While noting that they were not suggesting all crypto buyers have Dark Tetrad traits, Martin, Chrysochou, Strong, Wang and Yao found that studying cryptocurrency through the psychological lens of the Dark Tetrad offered insights into why people want to buy crypto. With that in mind, you should consider their findings to determine if they identified the reasons you want to own this highly speculative asset. If you already own Bitcoin or other crypto holder, you should consider if you exhibited any of the traits the authors identified when you made the decision. And in case you are wondering whether you have traits of Machiavellianism, narcissism or psychopathy, you can take an online assessment.

Cryptocurrencies are highly speculative, and investors should weigh their associated risks before including them in their portfolio.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-22-323

ALSO BY LARRY SWEDROE

How does R&D spending affect future returns?

Factor momentum and stock momentum

How wealth, age and gender affect investment decisions

What does a change in ESG rating tell us about future returns?

The risks of highly concentrated equity portfolios

Picture: Kanchanara via Unsplash

© The Evidence-Based Investor MMXXII