By PATRICK CAIRNS

The big question over the last few weeks has been what the recovery from the Covid-19 crisis will look like. Many letters of the alphabet have been put forward: will it be V-shaped, U-shaped, W-shaped or L-shaped?

Every pundit has their opinion. Initially, the V-shaped recovery was the most likely choice. As the economic impact has worsened, however, the others have been more widely talked about.

This can be rather confusing for investors, as the experts can’t seem to make up their minds. How is anyone supposed to make sensible decisions when there are so many conflicting opinions about how things are going to play out?

Heading into the unknown

We feel this uncertainty keenly in times like these, when it is obvious that so much is unknown. However, the reality is that it is not unique to moments of massive disruption.

The future is never certain. Just a few months ago, markets were rising steadily in the belief that 2020 would be a year of positive economic growth. The US and China also seemed to have come to some sort of agreement on the trade war, and Brexit was finally going to be dealt with.

It seemed then that the future was relatively certain. Everyone had a pretty good idea of what the outlook was.

Only, a global pandemic came along and turned everything on its head.

It was a particular harsh way to reinforce the truth that even when things seem clear, they never are. The risk of an unknown event is constant.

So too is the risk of failing to predict the real impacts of things even we know are coming. The city of Wuhan was placed in total lockdown due to the coronavirus on 23 January. Markets kept going up for almost a full month after that before they peaked on 19 February.

Be prepared

On one level, this shows that investors can never really be prepared for anything in particular. If nobody ever really knows what is will happen next or what the impacts of events will be, nobody can plot a successful course of action all the time.

This doesn’t, however, mean that planning is fruitless. On the contrary, if investors can’t plan for anything, that means that what they should do is plan for everything.

That means, firstly, building portfolios that are not dependent on single, specific outcomes. Many investors, for instance, set up their portfolios in expectation that the UK would vote to stay within the European Union in 2016. When the Brexit referendum went the other way, they were caught out.

Secondly, it means not concentrating your risks. If all of your money is in a single stock, for instance, that is a highly risky strategy. If that company goes bankrupt, you would lose everything.

The free lunch

The only way to achieve both of these objectives is through diversification. That is why Nobel Prize winner Harry Markowitz called diversification “the only free lunch in finance”. It costs you nothing to diversify, but it reduces your risk and therefore improves your likely outcomes.

Consider the example above. If you had invested equally in 100 stocks, rather than just one, a bankruptcy would only cost you 1% of your portfolio.

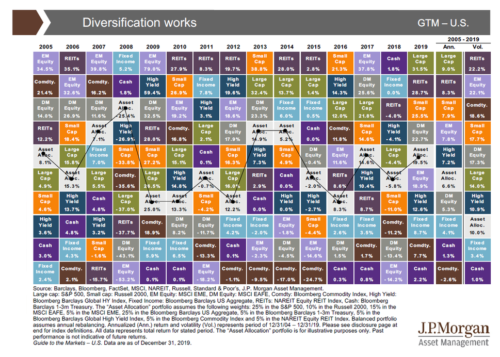

The chart below from J.P. Morgan Asset Management illustrates how diversification across asset classes has benefited investors over the last 15 years. It compares the returns of different asset classes year by year against the performance of an asset allocation strategy.

(Click to enlarge)

Although the asset allocation strategy was never the top-performer, it was also never amongst the three worst performers. It delivered a relatively consistent return across this entire period. Only bonds and cash were less volatile.

Seeing clearly

The real beauty of diversification is that it removes the need to try to predict the future. With a suitably well diversified strategy, where you have spread your portfolio between different risks and potential sources of return, you don’t have to know what is going to happen next.

If an event causes some part of your portfolio to fall, there should be another part of your portfolio that goes up, or at least holds it value. And over the long term, you should have far more ups than downs.

All you have to do then is stay patient, and let the markets work for you.

One of South Africa’s most respected financial journalists, PATRICK CAIRNS is a trusted commentator on the world of investments and the quirks of behavioural finance. Over more than a decade he has built a reputation for keeping the industry honest, and putting the interests of investors first.

If you are interested in reading more of his work, here are his most recent articles for TEBI:

There’s no such thing as a perfect investment

Are markets still rational, even in a crash?

A market lesson in a time of crisis

As investors have grown more astute, passive investing has grown

How much should the economy matter to stock market investors?

A lesson still worth learning three centuries later

© The Evidence-Based Investor MMXX