By CRAIG LAZZARA

“You all did see that on the Lupercal

I thrice presented him a kingly crown,

Which he did thrice refuse.”

— Julius Caesar, Act 3

The Wall Street Journal recently declared that “Index Funds are the New Kings of Wall Street“. The coronation, and similar notes of the “end of an era,” were prompted by Morningstar data showing that, for the first time, the assets invested in index-tracking mutual funds and ETFs exceed the AUM of actively-managed funds which aim to outperform. As index providers, we’re gratified to see the extent of investor acceptance of our services, but, like Caesar, we renounce the crown.

In any event, it’s important to understand the extent of our putative domain. The Morningstar data are based on mutual fund and ETF assets under management. This is a popular data set because it’s easy to access — funds are legally required to report their AUM. Pensions, endowments, individuals, etc. have no such requirement, at least not on a continuous basis. As the WSJ article notes, indexed mutual funds, though 50% of mutual fund and ETF assets, account for only 14% of the value of the entire US equity market.

This estimate is consistent with our own research, which suggests that indexing amounts to between 20% and 25% of the US equity market. Even this lower figure is remarkable given that index funds did not exist 50 years ago; the growth of indexing surely counts as one of the most significant developments of contemporary financial history.

Indexing started because active management overpromised and underdelivered, as our SPIVA reports have consistently demonstrated. The challenges to active management in the last 50 years are arguably a product of its success in the decades prior. Active investing is intrinsically a zero-sum game; the only source of outperformance for one investor is the underperformance of another. As they came to dominate global markets, it became impossible for professional investors as a group to deliver above-index performance.

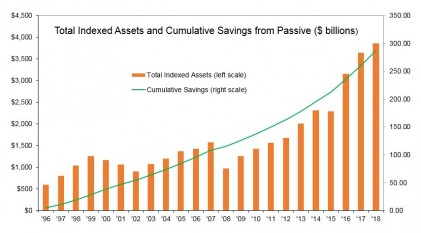

As indexing has grown, the benefits to investors — in terms of underperformance avoided and fees saved — have been substantial. The bars in the chart above show the growth of assets tracking the S&P 500, S&P MidCap 400, and S&P SmallCap 600. As of December 2018, those assets totalled nearly $3.9 trillion. The green line represents our estimate of the cumulative savings in management fees over the past 23 years; the savings cumulate to $287 billion.

CRAIG LAZZARA is Managing Director and Global Head of Index Investment Strategy for S&P Dow Jones Indices.

This article was first posted on the Indexology Blog and is republished here with the kind permission of S&P Dow Jones Indices.

You may also be interested in other research by S&P Dow Jones that we have previously covered on TEBI:

Does active trading of passive funds pose liquidity risks?

The impact of size on large-cap fund performance

The performance of low volatility