By LARRY SWEDROE

Two strong trends have had a dramatic impact on the investment world over the past few decades — the rise of indexing (and passive/systematic investing in general) and an increase in the level of skill of active managers.

While passive investing’s market share has been rising rapidly, recent decades have also seen an increasing number of highly talented young investment professionals enter the profession, with more advanced training than their predecessors, better analytical tools and faster access to more information. And legendary hedge funds, such as Renaissance Technologies, S.A.C. Capital Advisors and D.E. Shaw, hire Ph.D. scientists, mathematicians and computer scientists. The result is a rise in the skill level of active managers.

As Andrew Berkin and I pointed out in our book The Incredible Shrinking Alpha, these two trends, along with academics converting what were once sources of alpha into common factors (such as momentum, profitability and quality) that can be accessed with low-cost, systematic strategies, have made it increasingly difficult for active managers to generate alpha. Let’s see why that is the case.

The paradox of skill

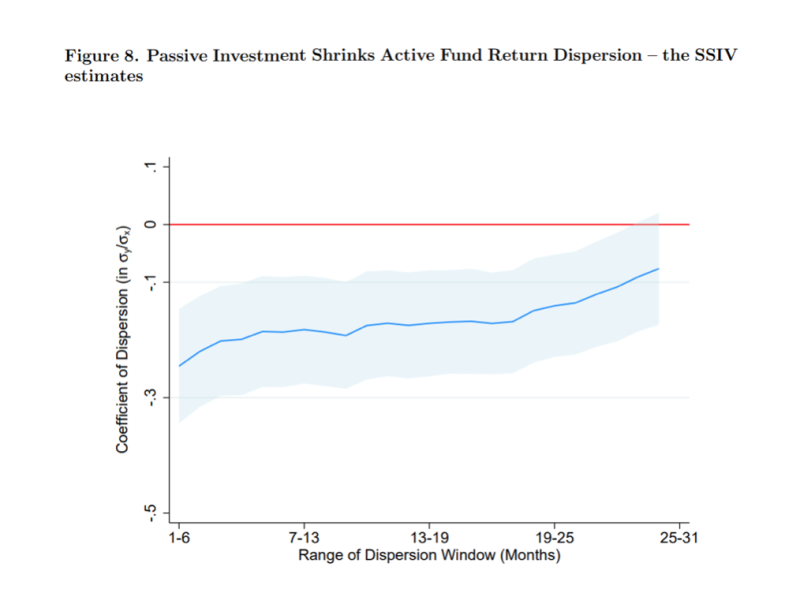

What so many people fail to comprehend is that in many forms of competition, such as chess, poker or investing, it is the relative, not absolute, level of skill that plays the more important role in determining outcomes. What is referred to as the “paradox of skill” means that as skill level rises, luck becomes more important in determining outcomes if the level of competition is also rising, which has been the case for active managers. Compounding the problem for active management is that the dramatic rise in passive investment has accelerated investors’ learning about managers’ skill—underperforming a fund’s benchmark index becomes a more credible signal that the fund manager has low skill. That has led to acceleration of the exit of unskilled managers, which in turn has led to the shrinking performance dispersion of the active management industry as the industry becomes more skilled. The result could be that greater passive investment improves market efficiency.

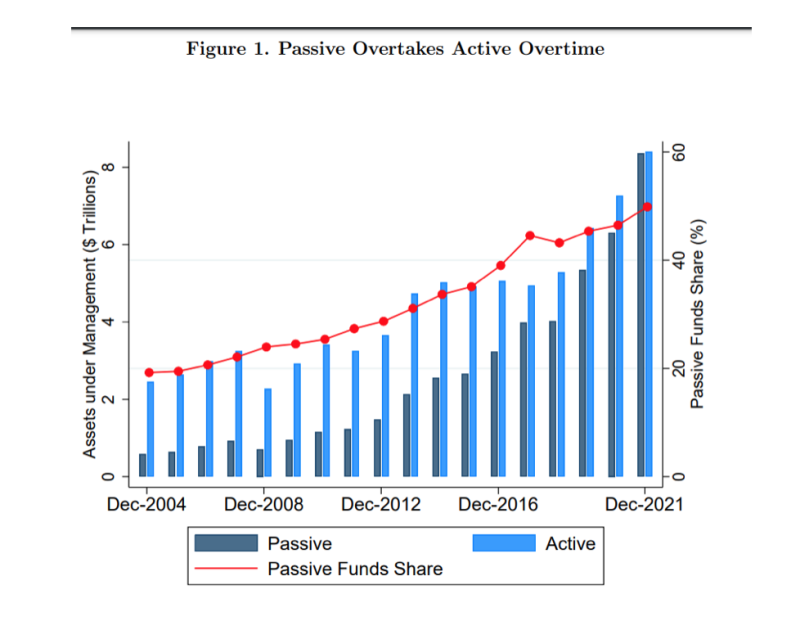

Da Huang, author of the August 2022 study Passive Investing, Mutual Fund Skill, and Market Efficiency, examined the impact of the rise of indexing on the skill level of the active management industry, the risk-taking of active managers (measured by the forward volatility of excess return in the next six months and the portfolio turnover ratio in the following year), the dispersion of returns of active managers, and the price efficiency of individual stocks. His data sample was the Center for Research in Security Prices Survival-Bias-Free U.S. Mutual Fund Database. It included mutual funds and ETFs and covered the period 2004-2020. Following is a summary of his findings:

- Consistent with the idea that higher passive investment accelerates the revelation of low-skilled managers and makes their funds go out of business faster, a one-standard-deviation increase in passive size exacerbated exit risk by 21.1 percent on average. As a result, the active management industry becomes more skilled over time due to the rise of passive investment.

- A one-standard-deviation increase in passive size led to a 0.17-standard-deviation decrease in risk-taking — a 0.23-standard-deviation decrease in forward volatility, and a 0.14-standard-deviation decrease in future portfolio turnover. The results are consistent with a more skilled active management industry as more-skilled surviving managers take less risk in order to reveal their high skill faster by generating consistent outperformance — active share falls, and along with it, the odds of outperformance.

- A one-standard-deviation increase in passive size shrunk the performance dispersion in the next three to 12 months by 0.25 standard deviation on average — active fund returns become more homogenised due to the rise of passive investing.

- A one-standard-deviation increase in passive size improved price efficiency of stocks in corresponding styles by about 0.2 standard deviation. The result suggests that low-skilled managers harm market efficiency by adding noise to stock prices, and high-skilled managers do not completely offset this noise.

His findings led Huang to conclude: “Higher levels of passive investment improve stock market efficiency, consistent with a more skilled mutual fund industry.” He added that the evidence suggests that the “current level of passive investment may be lower than optimal from a market efficiency perspective.”

Investor takeaway

While many claim that the rise of indexing has made the markets less efficient, the evidence suggests the opposite may be true. For example, the rise of indexing has led to a dramatic reduction in the ownership of individual stocks by naive retail investors and the impact of their “noise trading” that creates the potential for price inefficiencies, particularly in stocks where limits to arbitrage prevent sophisticated investors from exploiting mispricings. Similarly, the rise of indexing has led to an acceleration of the exiting of low-skilled active managers, resulting in the surviving active management industry becoming more skilled, leading to greater price efficiency of stocks.

Finally, it is hard to make the case that the price discovery function has been impaired by the rise of indexing — implying that securities are mispriced — when not only has trading volume been rising, but the percentage of active managers that outperform has been on a steep decline for the past 20 years. As evidence of the declining ability of active management to deliver alpha, the study Conviction in Equity Investing by Mike Sebastian and Sudhakar Attaluri found that while the percentage of skilled managers was about 20 percent in 1993, it had fallen to just 1.6 percent by 2011. This closely matched the result of the 2010 paper Luck versus Skill in the Cross-Section of Mutual Fund Returns. The authors, Eugene Fama and Kenneth French, found that only managers in the 98th and 99th percentiles showed evidence of statistically significant skill. On an after-tax basis, that 2 percent would be even lower.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively known as Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined, or confirmed the adequacy of this article. LSR-22-372

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

If you found this post interesting, you might also want to read these other articles that Larry has written about sustainable investing:

Is there a link between GDP growth and emerging market returns?

How do interest rates impact on REIT returns?

Do recency bias and loss aversion lead to mispricings?

How a 52-week high hurts returns

Identifying winning funds ex ante: Is it possible?

FIND AN ADVISER

Investors are far more likely to achieve their goals if they use a financial adviser. But really good advisers with an evidence-based investment philosophy are sadly in the minority.

If you would like us to put you in touch with one in your area, just click here and send us your email address, and we’ll see if we can help.

© The Evidence-Based Investor MMXXII