By LARRY SWEDROE

The stock market serves as a relocation centre at which money is moved from the active to the patient.

— Warren Buffett

Over the long term, small value stocks have rewarded investors with higher returns for their incremental risks. Over the period July 1926-August 2022, as measured by the Fama-French research index of U.S. small value stocks, they returned 14.4 percent per annum, outperforming the total U.S. market, as measured by the CRSP 1-10 Index, which returned 10.0 percent per annum, by 4.4 percentage points per year. Those higher returns, as one would expect, were accompanied by greater risks—the annualized standard deviation of the U.S. Small Value Research Index was 28.1 percent versus 18.4 percent for the CRSP 1-10 Index. The higher return of small value stocks reflects the returns over the full period and across economic cycles — the return available to a buy and, importantly, hold investor.

Performance during recessions

Because of their greater exposure to economic cycle risk, it would be logical to assume the risks of small value stocks would tend to show up the most during recessions. Given that the U.S. real GDP decreased at an annual rate of 0.6 percent in the second quarter after declining 1.6 percent in the first, and the Fed has tightened monetary policy considerably — not only raising rates sharply but beginning a program of quantitative tightening (reducing the size of its balance sheet by either selling bonds or allowing maturing bonds to roll off)—increasing the risk of a recession, it seems like a good time to review the historical evidence on how small value stocks have performed during recessionary periods. Thanks to the research team at Avantis, we know the answer.

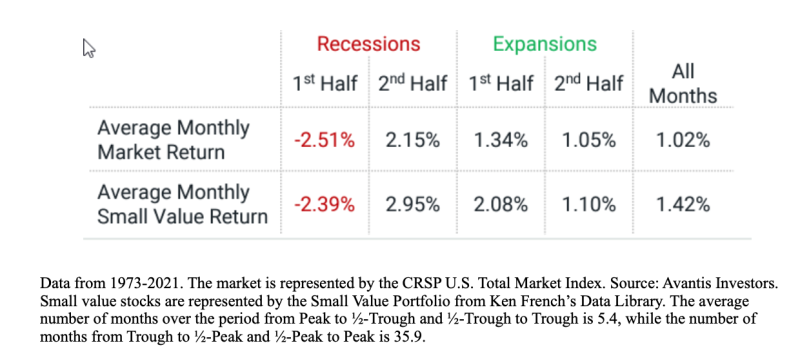

As you can see in the table below, covering the period 1973-2021 and showing average monthly returns, while small value stocks did earn negative returns during the first half of recessions, their losses were actually slightly less than those of the overall market. Note that while the National Bureau of Economic Research has not formally declared a recession, while small value stocks produced losses over the first nine months, they did outperform the market. For example, through October 5, 2022, the iShares Russell 2000 Value ETF (IWN) lost 16.9 percent, while the iShares Russell 3000 ETF (IWV) lost 20.3 percent.

The fact that small value stocks experienced their strongest outperformance (by 0.80 percent per month) during the second half of recessions should not really be a surprise because the market is forward looking, and the second half of recessions followed historically very poor returns. They also outperformed in both halves of expansions—by 0.74 percentage point per month in the first half and a slim 0.05 percentage point a month in the second half. Across all months they outperformed by 0.40 percentage point per month.

Investor takeaways

As I noted in my third quarter 2022 economic and market review for Advisor Perspectives, investors are having to face significant geopolitical and economic headwinds, which have led to increased volatility and a bear market. Unfortunately, my crystal ball remains cloudy—preventing me (and everyone else) from knowing which part of the economic cycle we are actually in. With that said, the historical evidence we reviewed demonstrates both that valuations matter whether the economy expands or contracts, and in the periods following the first half of historical recessions, valuations have mattered even more. With that in mind, it is worth noting that as of October 3, 2022, Morningstar’s P/E for the market, as represented by IWV, was 14.4, more than 60 percent higher than the P/E of 8.9 for small value stocks, as represented by IWN.

In his 2013 letter to Berkshire shareholders, Warren Buffett advised: “Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important.” And in his 2004 letter, he advised against trying to time the market, but if investors “insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.” Buffett’s warnings refer to the fact that if we stay out of the market to avoid downturns, we may not reach our financial goals—as you have to be right twice, selling at the right time and getting back in before markets have recovered. Thus, it’s important to practice patience and learn to manage in times of uncertainty. Keeping a focus on the long-term destination and avoiding actions based on the emotions caused by bear markets can help you stay the course.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded at any time without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, confirmed the adequacy of this article. LSR-22-395

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

PREVIOUSLY ON TEBI

Indexing has saved investors $403 BILLION since 1996

Mutual fund alpha as a predictor of stock returns

How good are analysts at forecasting earnings growth?

Valuations and earnings growth rates

Start planning the life you want to lead

FIND AN ADVISER

Investors are far more likely to achieve their goals if they use a financial adviser. But really good advisers with an evidence-based investment philosophy are sadly in the minority.

If you would like us to put you in touch with one in your area, just click here and send us your email address, and we’ll see if we can help.

© The Evidence-Based Investor MMXXII