We’ve made these changes in order to both improve the ratings’ ability to predict and build on the assessment framework’s strengths. The enhancements also should make the ratings more relevant to decisions investors make and be easier for them to use in practice. During the interim period when we’re updating the rest of our coverage universe to the enhanced methodology, users can be confident in Analyst Ratings not yet updated under the new approach.

By JEFFREY PTAK

The Morningstar Analyst Rating for Funds is a forward-looking, qualitative rating that Morningstar’s manager-research analysts assign based on their assessment of a fund’s investment merits. We recently enhanced the methodology that underpins the Analyst Rating to make the ratings even more effective and useful to investors. Today marks the first day we’ve rated funds under the enhanced methodology.

In this piece, we’ll briefly review the Analyst Rating, walk through what’s changed under the updated methodology, and present an example that highlights those changes. We’ll also examine ratings trends we’re seeing in the initial batch of funds assessed under the updated methodology. We’ll close by explaining why we’re making the changes and how to use the Analyst Ratings in the months ahead.

Key takeaways

We’ve established the methodology that underpins the Analyst Rating and rated 123 funds under this updated approach; we’ll update the rest of our coverage universe over the next 11 months or so.

As part of the enhancement, we’ve streamlined the framework analysts use to analyse fund, moving from five pillars to three — People, Process, and Parents — and given more weight to fees.

We’ve also set a higher bar for active funds, refined the pillar ratings scale, and changed how we assign ratings to fund share classes to account for the specific fees each share class levies.

Among the initial batch of rated funds, downgrades outnumbered upgrades 2 to 1, with costly funds downgraded 4 times as often as inexpensive funds.

We’ve made these changes in order to both improve the ratings’ ability to predict and build on the assessment framework’s strengths.

The enhancements also should make the ratings more relevant to decisions investors make and be easier for them to use in practice.

During the interim period when we’re updating the rest of our coverage universe to the enhanced methodology, users can be confident in Analyst Ratings not yet updated under the new approach.

Review: The Morningstar Analyst Rating for funds

The Analyst Rating is a forward-looking, qualitative rating that sets forth Morningstar’s fundamental assessment of a fund’s merits. It takes the form of Gold, Silver, Bronze, Neutral, and Negative, with the highest ratings going to funds the analysts’ research leads them to conclude will outperform over a market cycle, and Neutral and Negative ratings to those they lack conviction in.

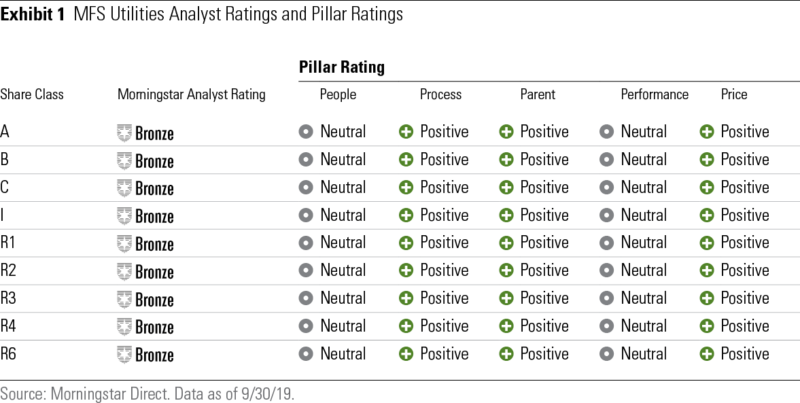

To this point, our analysts have organised their fund research around five pillars-People, Process, Parent, Performance, and Price. The analysts conduct fundamental research into each of these areas, assigning a rating to each pillar on a three-point scale–Positive, Neutral, and Negative. Those pillar ratings, in turn, drive the overall Analyst Rating the analysts assign to funds.

Although Morningstar has been conducting qualitative fund research for nearly three decades, we introduced the Analyst Rating more recently, in November 2011. This is the first enhancement we’ve made to the Analyst Rating methodology since launching it eight years ago.

What’s changing

The Analyst Rating will remain a forward-looking measure that turns on the analysts’ qualitative assessments. It will also continue to follow a Gold, Silver, Bronze, Neutral, and Negative scale. That said, we’ve made several changes to the underlying methodology–that is, the process the analysts follow in assessing a fund and arriving at a conclusion about its investment merits.

Fewer pillars: We’ve moved from a five-pillar framework to three-pillars–People, Process, and Parent. We’ve absorbed the Performance Pillar into the People and Process pillars to ensure performance analysis takes place as part of a broader assessment of a fund’s strategy and the people behind it. We’ve removed the Price Pillar as part of a rethink of how we evaluate fund costs. Previously, we ranked a fund’s price tag against those of others in its peer group. Now, we’ll compare a fund’s costs to our estimate of what value it can deliver before fees.

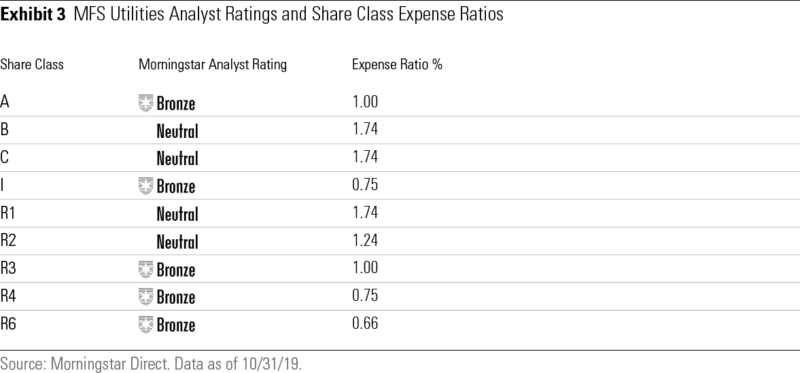

More weight on fees: Formerly, we’d assign a fund’s Price Pillar rating by ranking its fees against peers. That was useful but didn’t convey whether the price was reasonable compared with the value the fund delivered. To address this, we’ve moved to simply subtracting a fund’s expenses from our estimate of how much value it can add before fees. If there’s nothing left for investors, then we won’t recommend the fund. This approach amplifies our fee assessment, making it as important as People, Process, and Parent combined. We’ve also changed how we assign ratings to better account for fees. Previously, we assigned the same rating to all a fund’s share classes, fee differences aside. Now we’re tailoring ratings to each share class by taking its specific fees into account. Thus, costlier share classes see lower ratings in some situations.

Higher bar for active funds: To earn a Gold, Silver, or Bronze rating, our research must lead us to conclude that an active fund can beat its benchmark index after fees, adjusted for risk. Formerly, we might have recommended an active fund that could beat its average peer but not a costless index, net of fees and after adjusting for risk. Now we won’t recommend an active fund if it can’t clear both a relevant benchmark index and peer group average.

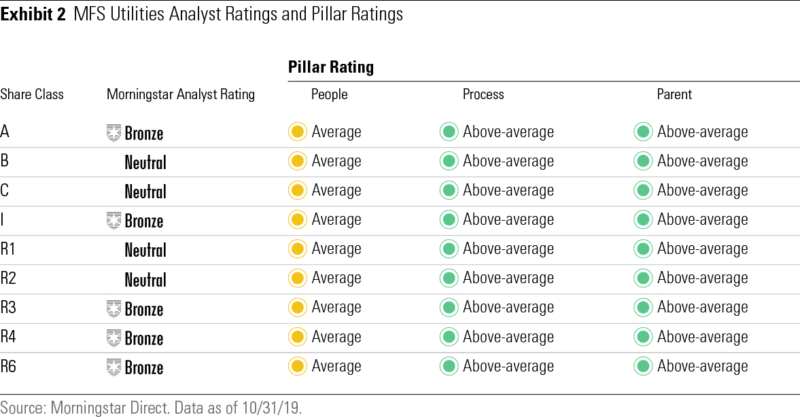

Greater detail and structure: We’ve moved from a three-point pillar ratings scale–Positive, Neutral, and Negative–to a five-point scale (High, Above Average, Average, Below Average, Low). This greater granularity should make it easier to determine how we arrived at a fund’s overall Analyst Rating and compare ratings between funds. We’ve also taken steps to better quantify the expectations we form for how much value a fund can add (or subtract) before and after fees, and to further systematise how we translate those estimates into an Analyst Rating.

Example of applying the new methodology

Today, we released the first batch of Analyst Ratings assigned under the enhanced methodology. All told, we assigned ratings to 123 different funds spanning 556 different share classes under the new approach.

While users of our research and ratings won’t detect many changes in the way we write about funds–the reports we publish will still address People, Process, Parent, Performance, and Price, and the ratings spectrum remains the same–there will be some noticeable differences. There will be two fewer pillar ratings, a more refined pillar ratings spectrum, and potential variations among the Analyst Ratings assigned to the fund’s share classes.

To illustrate, below we present a before-and-after comparison of one fund, MFS Utilities, that was among the initial batch we rated under the new methodology. Here’s what that fund’s Analyst Ratings and pillar ratings looked like under our former methodology:

And here’s what it looks like now under our new approach:

Notice there are two fewer pillar ratings than before, there is a different pillar ratings scale, and the Analyst Ratings aren’t the same across the fund’s nine share classes. Why do the Analyst Ratings vary by share class? Because the fees those share classes levy differ. When we accounted for each share class’ specific fees as part of our analysis, we concluded that these more expensive share classes wouldn’t add value for investors after adjusting for risk. That explains why they received Neutral ratings while the fund’s less costly share classes got Bronze ratings.

Trends in the initial batch of Analyst Ratings

We’ve looked at one example, but what trends emerge when we examine the full batch of funds that have been rated under the enhanced methodology thus far? In this section, we present those findings based on our analysis of all 556 fund share classes that have been rated under the new methodology.

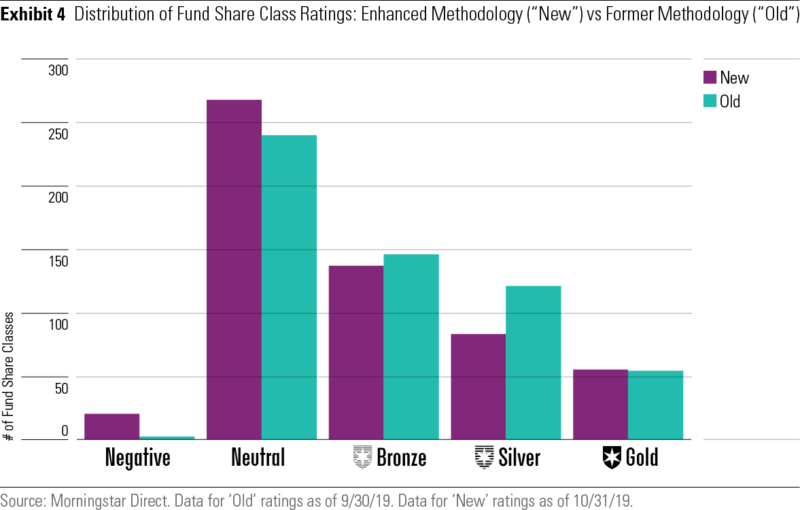

For starters, below is the distribution of fund share classes by Analyst Rating under the enhanced methodology (“New”) and the former methodology (“Old”). In summary, the distribution shifted away from Silver and Bronze and toward Neutral and Negative.

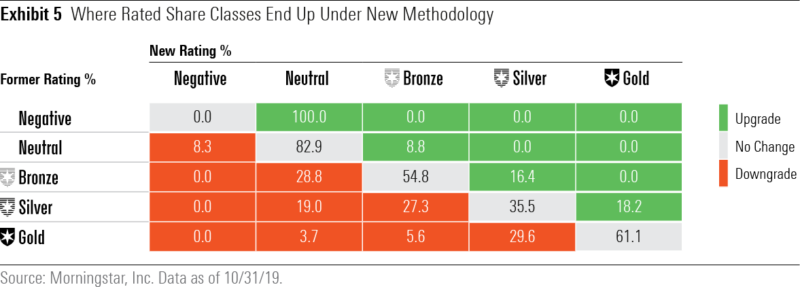

Here’s another look that examines the percentage breakdown of the share classes’ ratings under the enhanced methodology (the vertical columns) by their former ratings (the rows). For example, among share classes formerly rated Bronze, around 55% retained their rating, 29% saw a downgrade to Neutral, and 16% an upgrade to Silver. In total, around 63% of share classes rated under the updated methodology kept the same rating while 37% saw a change.

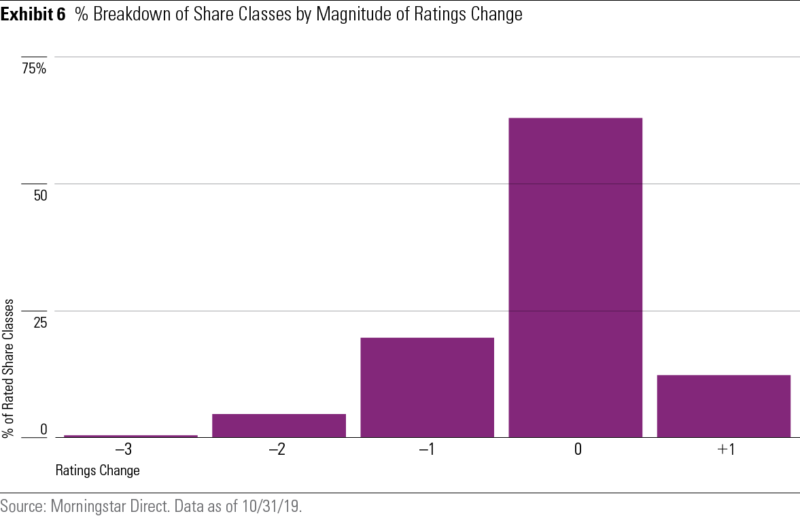

Among share classes that saw a rating change, downgrades outnumbered upgrades 2 to 1. Around 85% of the ratings changes were one-rung, with Bronze-to-Neutral and Silver-to-Bronze being the most common moves.

Nearly every ratings change stemmed from assigning ratings to individual fund share classes by accounting for their specific fees. Of the 208 share classes that saw a rating change, 196 had the same pillar ratings (albeit expressed on the new five-point scale). In these cases, the analysts’ assessment of People, Process, and Parent didn’t change, but the share classes’ ratings changed anyway because we were now more precisely accounting for the fees those share classes were levying.

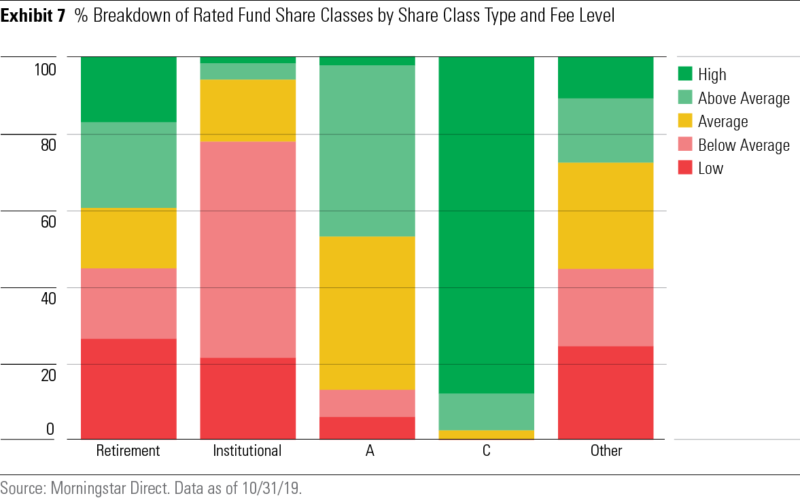

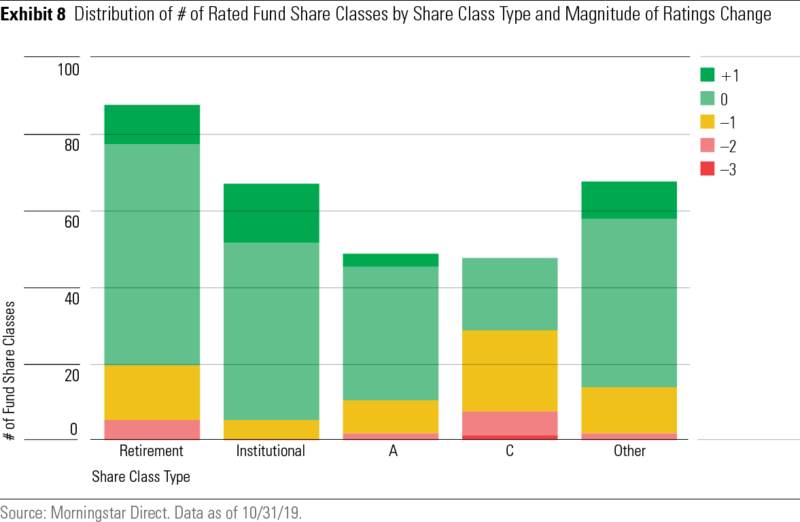

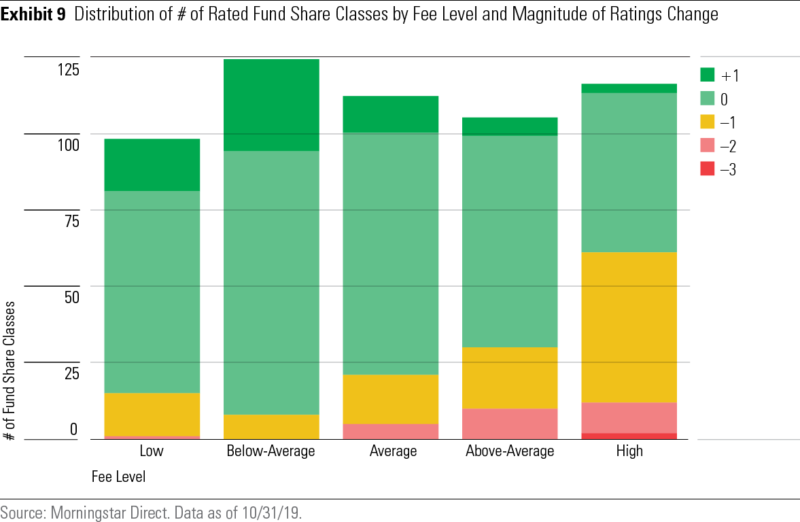

Fees can vary considerably by share class given the practice of bundling in distribution, marketing, and service fees to certain share-class types. To illustrate, here is a cross-section of rated fund share classes by share-class type and fee level. While it’s true that some share-class types are home to cheap and expensive funds alike, A and C share classes are clearly pricier.

This explains why, among the initial batch of rated funds, A and C share classes saw downgrades much more often than other share-class types, as these funds tend to be expensive and the updated methodology accounts for those price differences. On the flip side, less expensive share-class types, like institutional shares, saw relatively few downgrades.

All told, costly fund share classes (that is, Above Average and High fee levels) saw downgrades about 4 times more often than inexpensive share classes (Below Average and Low fee levels) among the initial batch of funds rated under the enhanced methodology.

These trends are consistent with an analysis we’d previously published in which we applied the updated methodology to rated funds and compared the pro forma new ratings to the existing ratings.

Why we’re making the changes

We’re enhancing the Analyst Ratings to make them more effective and useful to investors. More specifically, we’re updating the methodology in order to advance the following four goals:

To make the ratings more predictive: We saw opportunities to make the Analyst Ratings an even better predictor of future performance. This explains why we’re further emphasising fees in the ratings framework, as our research has found that cost does the best job of predicting difference in funds’ future performance.

To build on the framework’s strengths: We’ve found that our assessments of People, Process, and Parent do the best job of predicting funds’ performance before fees, while price is a strong predictor after fees. Given that, the enhanced methodology redoubles its focus on those elements of the framework.

To ensure the ratings are relevant: Investors are asking questions like “Where should I invest in active funds versus index?” We can better answer questions like these by more precisely quantifying the potential value active funds can add before and after fees. Those estimates can drive how many Gold, Silver, and Bronze ratings analysts will assign to active funds in various Morningstar Categories. In categories where active funds have less potential, analysts might assign fewer Morningstar Medalist ratings and the opposite in categories that are more target rich. Thus, the Analyst Ratings can serve as a road map of sorts for investors seeking to choose between active and index funds.

To make the ratings easier to understand and use: We’ve streamlined the assessment so there are fewer components, which should make it easier to understand what’s driving the rating. We’ve also switched the pillar ratings to a more refined five-point scale, simplifying attribution and comparison between funds. Finally, because we’re establishing clearer guidelines for when funds can receive the highest ratings–for instance, an active fund can’t get a medalist rating unless it’s expected to deliver positive net alpha–it should more clearly delineate ratings. That, in turn, can help investors form more-specific expectations about a fund’s potential future performance based on its rating.

How to use the ratings

As mentioned previously, we’ll gradually run all rated funds through the updated methodology in the months ahead. We expect that process to take around one year to complete.

During that one-year transition period, we’ll have ratings in force that were assigned under the former methodology as well as the enhanced methodology. Users of our ratings might have a few questions:

How do I know if the Analyst Rating I’m seeing was assigned under the enhanced methodology or the former methodology?

Can I have the same confidence in Analyst Ratings assigned under the former methodology and not yet updated under the enhanced approach?

Distinguishing between old and new ratings

The best indication of whether an Analyst Rating was assigned under the enhanced methodology is the rating date–that is, the date of the analysis that sets forth the rating. If the report date is prior to Oct. 31, 2019, then the Analyst Rating was assigned under the former methodology. If the date is Oct. 31, 2019 or after, the rating was assigned under the enhanced methodology.

If you don’t have the rating date handy, you can look for other telltales: The enhanced methodology turns on three pillars and features a refined five-point pillar ratings scale. If you’re seeing five pillars–People, Process, Parent, Performance, and Price–on a three-point pillar ratings scale–Positive, Neutral, Negative–then that means the Analyst Rating was assigned under the former methodology.

We strongly encourage users of our research to read our global fund report or one-page short-form reports. These reports provide the context behind our recommendations, from which it should be apparent whether a fund has been rated under our enhanced methodology or not.

Using “old” Analyst Ratings

Users of our research should feel confident using Analyst Ratings that have not yet been run through the enhanced methodology. If we had reason to believe these Analyst Ratings weren’t reliable, we’d expedite the process of updating them under the enhanced methodology.

That said, one key difference to keep in mind is that until we update funds under the new methodology, they’ll continue to have the same rating across every share class. This means, irrespective of whether the analyst eventually revisits her fundamental assessments or not (that is, her evaluation of People, Process, and Parent), some costlier share classes could see downgrades once we eventually run the fund through the enhanced methodology.

It should be possible to infer whether a fund not yet run through the updated methodology will eventually see a potential ratings impact by examining the updated ratings of funds that share similar attributes. For instance, if we run a fund through the updated methodology and that fund sits in the same peer group; has similar People, Process, and Parent Pillar ratings; and sports a similar expense ratio to a fund that hasn’t gone through yet, then the peer fund’s Analyst Rating can offer clues into how that fund will eventually be rated under the new methodology.

Putting this issue aside, during this interim period you can feel confident in using Analyst Ratings assigned under the enhanced and former methodologies. We stand by any Analyst Rating we assign to a fund.

Conclusion

We’ve enhanced the methodology that underpins the Analyst Rating and rated 123 funds under this updated approach; we’ll update the rest of our coverage universe over the next 11 months or so.

As part of the enhancement, we’ve streamlined the framework analysts use to analyse funds, moving from five pillars to three–People, Process, and Parent–and given more weight to fees. We’ve also set a higher bar for active funds, refined the pillar ratings scale, and changed how we assign ratings to fund share classes to account for the specific fees each share class levies. Among the initial batch of rated funds, downgrades outnumbered upgrades 2 to 1, with costly funds downgraded 4 times as often as inexpensive funds.

JEFFREY PTAK is the Global Head of Manager Research at Morningstar.

For more about new investing research, here are few more recent articles:

What are the world’s highest fund fees?

Are passive managers really kings of Wall Street?

Active versus passive in Europe is no contest

Does active trading of passive funds pose liquidity risks?