By JASON BUTLER

At age 18, Abigail Sweeney was passionate about computer science and the potential for more women to have a role in the male-dominated technology sector. A teacher questioning why she would want to do a “boy’s subject” only strengthened her resolve and she managed to secure an offer from Royal Holloway University in London to study computer science.

In the UK, the controversy about A-Level grades and the impact on students’ ability to get into their chosen university has brought back into focus the question of whether it makes sense to go to university.

A university education offers several benefits:

— Independence: for most young people this will be their first experience of living away from home and learning to live with non-family members.

— Self-discipline: an undergraduate has to develop the motivation, routines, and habits to be a self-directed learner.

— Friendships: many people develop lifelong friendships and useful connections from a very diverse range of people, including those from overseas.

— Interests and skills: most universities offer a plethora of clubs and associations which allow students to indulge in hobbies, interests and develop life skills.

— Resilience: obstacles, setbacks and disappointments are all part of life and learning how to navigate these in the absence of parents is a vital part of undergraduate life.

— Financial: on average graduates tend to earn more over their lifetime than non-graduates, known as the graduate premium.

But is it really worth it?

The cost of tuition and living expenses can easily top £53,000 for UK students studying in England, with the average in 2018 being £36,000 [i]. Much of these costs are funded by repayable student finance from the UK government.

In countries like the United States or India, student financing is like any other borrowing, with a fixed repayment schedule and full personal liability for the debt.

But in the UK student finance is more like a hypothetical graduate tax. That’s because repayments are earnings-linked, not a fixed repayment schedule, based on 9% of earnings above a starting amount (currently £26,575 pa). And any amount outstanding after 30 years is written off. Plus, the UK government expects only 30% of graduates to repay their student financing in full [ii].

Some graduates will be WORSE off

An analysis by the IFS shows that, after accounting for tax and student loans, there is an average net earnings premium from obtaining a university degree of £130,000 for men and £100,000 for women. However, as this is an average, it masks the fact that that about 10% of graduates do exceptionally well, while a significant number of graduates will see no earnings premium. In fact about 20% of graduates will be worse off than had they not gone to university [iii].

Another recent study found that the graduate earnings premium at age 26 has reduced from 19% to 11%. However, this is before earnings see the most substantial growth from age 30 [iv]. A 2016 study found that “[…] apart from Oxbridge, medical and dentistry graduates, there is no guaranteed graduate earnings premium for the many young people entering higher education.” [v]

A gender gap

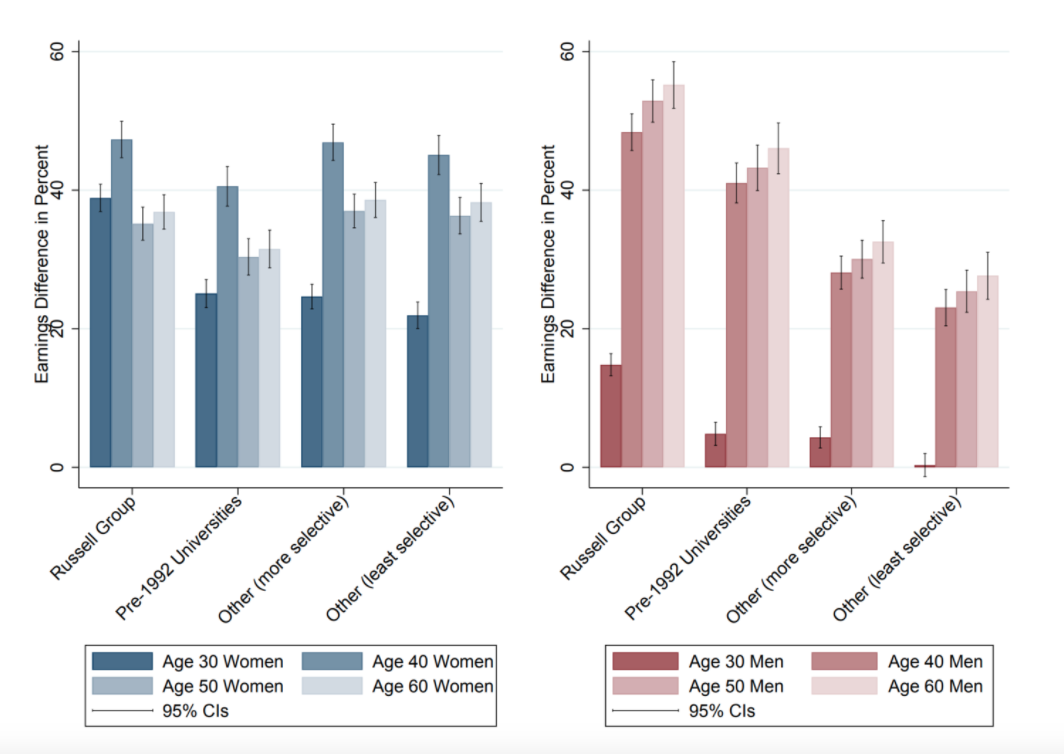

The choice of university seems to have a significant impact on the graduate premium for men in the long-term, but not women, as shown in the chart below.

Source: The impact of undergraduate degrees on lifetime earnings. Institute for Fiscal Studies (2019)

Although medical, law, economics and Oxbridge degrees seem to deliver a significant premium in lifetime earnings, degree subject appears to be less critical on future career outcomes. In 2008, Vivek Wadhwa and his research team at Duke and Harvard universities surveyed 652 US-born chief executive officers and heads of product engineering at 502 technology companies [vi].

They found that they tended to be highly educated; 92% held bachelor’s degrees, and 47% held higher degrees. But only 37% held degrees in engineering or computer technology, and just 2% held them in mathematics. The rest have degrees in fields as diverse as business, accounting, finance, healthcare, arts and the humanities.

The apprenticeship alternative

You don’t need to go to university to develop a financially rewarding career, and in the process can avoid incurring student financing costs. PwC, the large accounting and business services group, has run a professional apprenticeship programme for many years, as they explain on their website:

“You don’t need a degree to launch a successful career in the business world. Many of our senior leaders joined us without a university degree and have accelerated their career at PwC and beyond. Things are changing, and we’re giving you more opportunities than ever before to progress your career in business and technology – whether you want to jump straight into the working world, go to university, or both.”

Microsoft launched an apprenticeship programme nationally in 2010, to provide promising, motivated young people with a vital first step in their ICT careers. To date, it has placed over 7,000 apprentices.

What Abigail did

Abigail Sweeney, who we met earlier, applied to Microsoft for a computer science apprenticeship as a possible alternative to taking up her degree place at university, despite a teacher at her school telling her at the time, “You’ll never get a technology job in the USA without a degree.”

Out of 500 people who applied for an apprenticeship, Abigail was one of the 13 successful applicants and the only woman. She decided to pass up her university place offer and take the apprenticeship.

Six years later, now aged 24, Abigail is based at Microsoft’s Software Engineering Centre in San Francisco as a software engineer responsible for the NFL (National Football League). Her role takes her all over the US and even back to the UK on occasion when Wembley Stadium hosts NFL games.

Abigail earns a six-figure remuneration package which includes generous pension contributions, housing allowance and share options. She is also being sponsored by Microsoft to take additional qualifications and take on more responsibility.

Abigail is proof that, unless you want to be a doctor or pursue other such jobs which require a degree, university isn’t the only answer. There are lots of jobs that don’t involve a degree, yet they pay well, can be personally rewarding, and offer plenty of opportunities for advancement, as shown here.*

Caring, construction & computing

The three Cs (caring, construction, and computing) are crying out for staff. You can start out doing basic work and then take courses and qualifications to progress to roles which have more responsibility and financial rewards.

For many young people, going to university is a great experience that lays solid foundations for their future life. But unless you use the degree to get into one of the higher paying professions or vocations, don’t assume that you’ll have significant excess earnings over the costs of going.

And seriously consider whether a modern apprenticeship might offer you a much more rewarding route to a career in the real world of work. Employers are looking for people with aptitude, resilience, motivation and enthusiasm, and you don’t need a degree to prove that.

JASON BUTLER is a former financial planner, based in Suffolk. He is a personal finance columnist for the Financial Times, and is Head of Financial Education at Salary Finance. You can find out more about him on his website.

If you’re interested in reading more from Jason, here are some other articles he’s contributed to TEBI:

Should you buy or rent in the current housing market?

Seven positive changes you can make post-lockdown

Your retirement could be longer than you think

How to stop money spoiling your relationship

No emergency fund? Start one now

Learn from your money mistakes

What does your financial wellbeing look like?

Picture: Nathan Dumlao via Unsplash