One of the biggest obstacles to better investment outcomes is that financial professionals are not very good at speaking in plain language. As a regular attendee at presentations by alternative investment firms, PRESTON McSWAIN comes across examples all the time.

“Son, I wouldn’t do that. It don’t make good sense.”

“Yes, Sir.”

“I told you once, and ain’t going to say it again, don’t do that.”

“Yes, Sir.”

The next thing I knew, I was literally knocked off my feet.

My grandfather ran a one-man HVAC service business in Alabama (yes, I called him Granddaddy). To keep me out of trouble in the summer during my teenage years, he had me work with him to repair outside air conditioning units. One day, I was working to reconnect a large central AC unit to the main power coming from the street. I rushed the final connections wanting it to look great, but I didn’t listen. Boom – I got “hit” as we would say, by 220 volts.

What was my Granddaddy’s simple response?

“You won’t do that again, will you?”

“No, Sir.”What’s the relevance of this story right now?

First, I’ve been thinking about old childhood friends, experiences and extended family lately, so I wanted to work in a little story from Bama.

Next, my Granddaddy’s simple warning comes back to me sometimes when I receive alternative investment fund pitches.

It don’t make good sense.

I wasn’t so subtle in my first piece related to this. I titled it Fake News?.

That story pointed out how private fund return presentations of IRRs can be inflated as compared to the returns investors in some funds actually receive.

I put the question mark in the title as a hint, but I continued to receive more, so I was a little more blunt in my next post on the subject – Stop It!.

Based on letters and pitches that I continue to get from private investment funds, and other so-called alternative investment funds that own large amounts of private investments, the pattern isn’t changing, so here goes again.

When I get these presentations, more of Granddaddy’s words often come to mind:

“I know that’s what it says on the paper, but somethin’ don’t seem right.”

What doesn’t seem right in some of these alternative fund presentations?

Here’s an example of what I recently received from an alternatives fund manager:

“For the quarter, our fund was down mid-teens as compared to broader equity markets that were down 20-30%.”

This sounds good on a relative basis, but looking closer, maybe not.

A problem is that, according to the fund’s latest update, it holds approximately 40% in private equity limited partnerships, which are classified as Level III assets that have definitions similar to the following:

Level III – Unobservable inputs are used in valuations where markets don’t exist or are illiquid. Due to this, fair market valuation becomes highly subjective.

By comparison, the public markets the fund is comparing itself to are Level I assets, which reflect quoted prices that can be realized in liquid, daily, publicly traded markets.

My Granddaddy never went to college. In fact, I’m not sure he even graduated high school (he never would talk about it). However, he was one of the smartest people I’ve ever known — smart by experiences. A hard-working WWII veteran and guy who knew how to spot trouble.

I can hear him saying something like this about using unobservable and highly subjective private Level III assets to compute and share performance relative to public markets only a few weeks after the end of a quarter:

“They say something looks a certain way, but then say they can’t observe it.”

“If it can’t be observed, how do you know what it really looks like?”

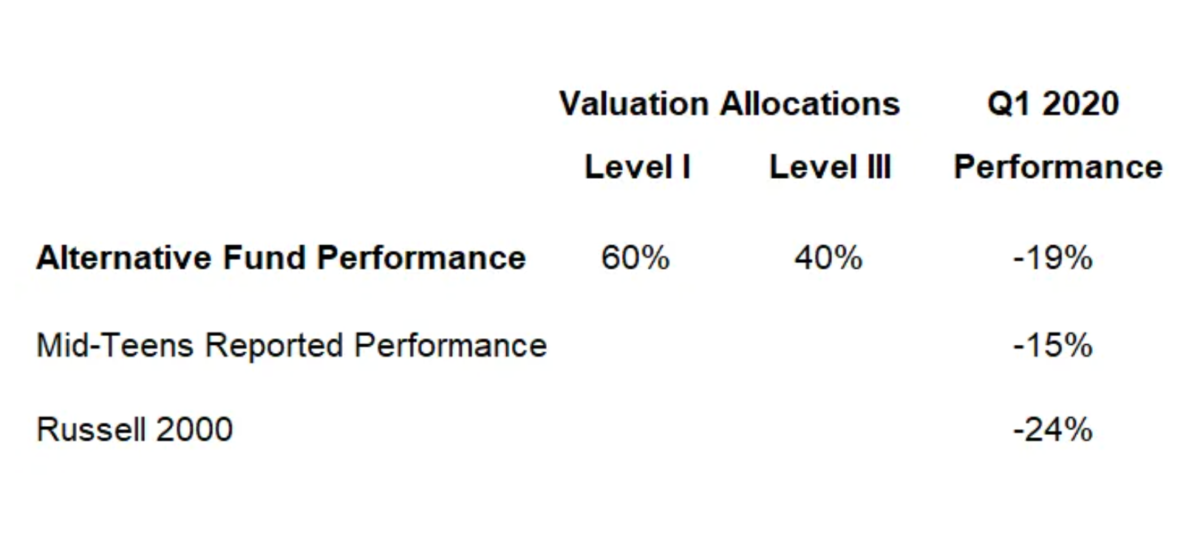

To highlight how this might impact the way an investment does indeed look, consider the chart below.

It illustrates how a hypothetical fund portfolio might have performed assuming that 60% of its assets were down 15% and 40% of its assets produced returns equal to U.S. small-cap stocks (academic studies suggest that private equity holdings tend to be small cap in nature).

The hypothetical alternative fund performance is now not down mid-teens, which would represent solid relative outperformance as compared to the S&P 500. It is down almost 20% — basically even with S&P 500.

My issue is not that alternative funds are trying to communicate how they are doing. They should — on a timely basis.

I also acknowledge that, based on the types of assets they can hold, it can be hard.

My beef is with how they are communicating their performance relative to other types of investments that investors may or could hold.

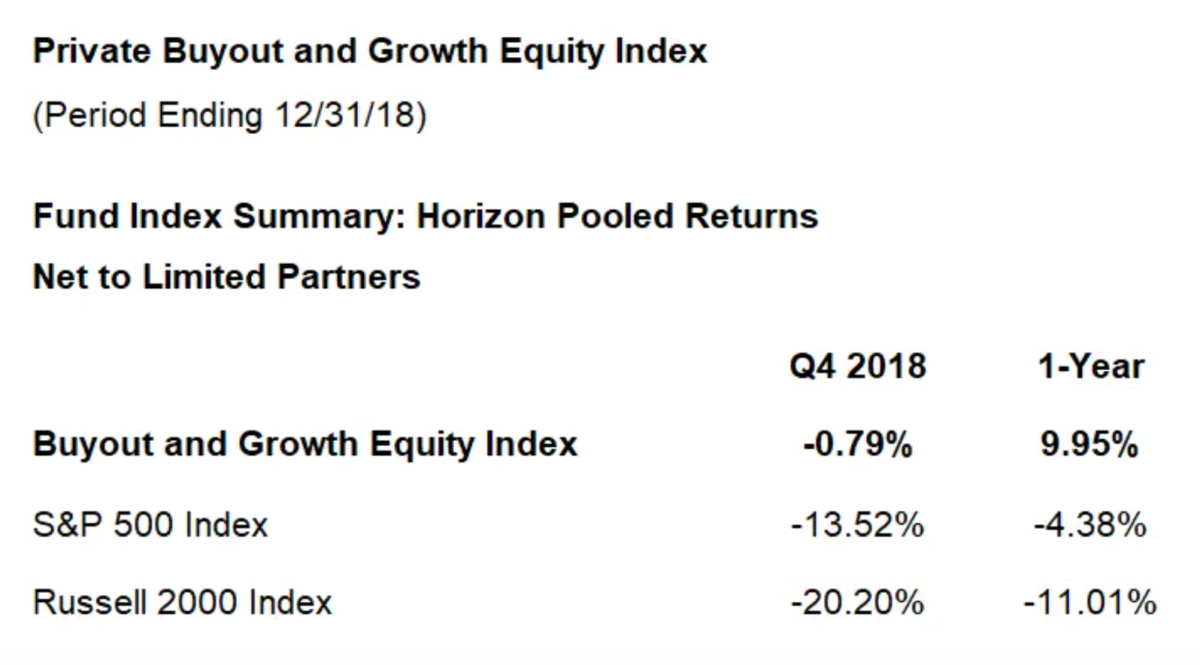

At my firm, we spoke about these practices in pieces titled Bungled Benchmarking and Baking Portfolios With Bad Ingredients. They highlight charts like the following that was produced at the end of Q4 2018. It compares so-called “Net to Limited Partner” returns of private equity funds to public benchmarks:

Presentations like this bring three questions to mind:

1. How is it that a pooled index of private funds, which predominately hold levered up U.S. small-cap or micro-cap equity positions, was down by less than 1% at the end of 2018, when U.S. public small-cap stocks were down over 20%?

2. How was the same private fund pooled index up almost 10% in 2018 on a trailing 1-year basis, when public U.S. small-cap stocks were down 11%?

3. In a few months, will we see similar relative comparisons of Q1 2020 “Net to Investor Returns” with fine print again stating that “due to fundamental differences between [how private equity and public market returns are calculated], direct comparison… is not recommended?”

In writing all of this, I’m not suggesting that alternative investment funds are not appropriate. Many good alternative managers exist, and when appropriate, investors should invest with them.

As my friend Dan Rasmussen, Founder and CIO of Verdad Capital, said when helping me with this piece:

“[We are not] criticising fund managers for being optimistic about assets they have a choice to be optimistic or pessimistic about.

“They are allowed to present assets in a flattering light — nothing is technically wrong with this.

“The problem is that many people don’t understand that the element of discretion in the valuations used in their communications, performance calculations, and risk presentations, is so much greater than mutual funds, ETFs or most any other type of investment.”

How about just using plain language? If we don’t know what performance really is yet, maybe we should just admit it along the lines of this hypothetical presentation:

“The portion of our portfolio that is in public investments is down mid-teens. This is encouraging as global equity markets were down more than 20% over the same time period. We do not have clarity yet related to the private equity positions in our portfolio, but in a timely manner, we will provide updates on these investments, and how they have impacted total fund performance, based on independent valuations.”

As I once wrote for the CFA Institute:

“[If we did this more often,] I believe it [would] be a positive for investors and for Wall Street, which many studies show has a big image and confidence problem, especially among younger generations who are the industry’s future.”

Bringing this back to Granddaddy one more time, here’s something he might mention to the industry. It’s what he would calmly and quietly ask when I had done something he didn’t think was right.

“Can you do better?”

PRESTON McSWAIN is a Managing Partner and Founder of Fiduciary Wealth Partners, an-SEC registered investment adviser and multi-family office in Boston, Massachusetts. This article first appeared on his blog and is republished here with his kind permission.