Our study also offers valuable context in evaluating many other variables for their potential usefulness to fixed income investors. It tells us that many of the metrics that have been cited by others as predictive of expected bond returns aren’t telling us much new. Many variables are not reliably linked to expected bond returns, or they provide information about expected bond returns only through their correlation with forward rates. Our research indicates that forward rates tell you—almost—everything you may want to know about corporate bond returns.

This is a guest post from DIMENSIONAL FUND ADVISORS

At Dimensional, we have used a systematic approach to pursue higher expected returns in fixed income since 1983. Just like in equities, we use information in current market prices to identify differences in expected bond returns.

There is abundant academic scholarship that supports this systematic approach to fixed income. A new study as part of continuing research from Dimensional supports it, too, and identifies an additional metric—a bond issuer’s stock returns—that holds merit in evaluating fixed income investments.

Separating the wheat from the chaff

Our latest research comes amid a proliferation of variables that other researchers and investors have highlighted as having the potential to become “factors” driving a systematic investment approach in fixed income. Dimensional, on the other hand, has long focused on forward rates. We use these rates, which are calculated from current market prices, to identify differences in bonds’ expected returns.

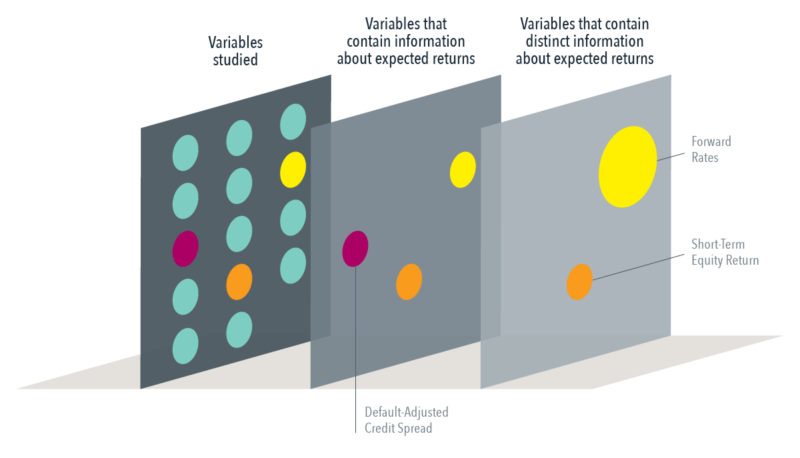

Information in forward rates has been studied for decades, with pioneering work conducted by Professor Eugene Fama in the 1970s and 1980s, and it has been incorporated into Dimensional’s strategies for more than 35 years. The new study that is part of our ongoing research further validates this approach. The study looks at the performance of more than 7,000 US dollar-denominated corporate bonds over nearly 20 years. Our sample includes both investment grade and high yield bonds with credit ratings ranging from AAA to B. We test 14 variables to see whether they contain information about future bond returns.

Forward rates stand out in this research as the most reliable and the most useful metric for targeting bonds with higher expected returns. Using forward rates to identify bonds with lower prices (higher yields) and greater expected capital appreciation is the cornerstone of Dimensional’s approach to value investing in fixed income, and our research confirms this. Interestingly, our recent study finds that another measure of value, default-adjusted credit spreads—which look at a bond’s credit spread relative to the issuer’s chances of default—does not add information over what is already contained in forward rates.

Exhibit 1: Rising to the top

Two bond metrics stood out among 14 examined.

Finding insight in stock returns

The one metric among the many we examined that has information complementing what forward rates tell us about expected returns is the recent performance of a bond issuer’s stock. If a company’s stock underperforms the market in a given month, our findings show that its bonds tend to underperform in the next month. Short-term equity returns show little correlation to forward rates.

Short-term equity returns aren’t a new area of interest at Dimensional. We have for many years evaluated a bond issuer’s recent stock performance as part of our trading and credit monitoring approach in fixed income, which uses up-to-date information from many sources, including credit rating agencies, trade prices and quotes, credit default swaps, and reviews of any related news. Our new study contributes to our understanding of the relationship between short-term equity returns and expected bond returns.

While short-term equity returns provide insight into expected bond returns, our research shows this insight to be somewhat ephemeral—its short-term nature means using it in isolation to drive trading decisions could lead to high, and potentially costly, turnover for investors. This is why we use short-term equity returns to complement our trading decisions, helping to inform the overall merits of a potential “buy” or “sell” order alongside a host of other considerations that are evaluated as part of our process of executing a trade. Consistent with existing research and our fresh examination of credit variables’ potential relation to bond returns, forward rates are the key metric Dimensional uses to pursue higher expected returns in fixed income.

This article first appeared on the Dimensional Fund Advisors blog, Dimensional Perspectives.

Interested in more insights from Dimensional? Here are some more articles from this series:

The outsize rewards for owning the top-performing stocks

You can’t predict market movements: 2019 is a case in point

DFA’s new investment factor explained

Has value really lost its vigour?

Booth & Fama: a friendship that changed investing