By LARRY SWEDROE

The ability to interpret financial statements has been complicated by the dramatic shift from tangible investments (such as plant and equipment) to intangibles such as research and development, advertising and expenses related to human capital. The increasing role of intangibles is highlighted by the fact that research and development (R&D) expenditures increased from 1 percent of company expenditures in 1975 to 7.5 percent in 2018 and that in 2015, services’ share of GDP stood at 74 percent in high-income countries and just under 69 percent globally.

Given the shift in expenditures, it should not be a surprise that researchers have focused attention on the impact on equity valuations and returns resulting from the change in the relative importance of intangible assets compared to physical assets. These include the authors of the 2020 studies Explaining the Recent Failure of Value Investing, Intangible Capital and the Value Factor: Has Your Value Definition Just Expired? and Equity Investing in the Age of Intangibles, and the 2021 study Value of Internally Generated Intangible Capital,

These researchers found that the increasing importance of intangibles, at least for industries with high concentrations of them, is playing an important role in the cross-section of returns. Thus, the role of intangibles should be addressed in portfolio construction for the reason that not accounting for them affects not just value metrics but other measures (e.g. profitability) that often scale by book value or total assets, both of which are affected by intangibles. One solution recommended and used by some investment management firms is to capitalise the investments that appear on the income statement and amortise them over their useful lives. This means treating an intangible investment the same as a tangible investment. However, that raises questions such as: Which income statement items are appropriately considered investments? And what is a proper useful life for those assets?

Illustrating the problem, the authors of the 2018 study Should Intangible Investments Be Reported Separately or Commingled with Operating Expenses? New Evidence found that the 0 and 80 percent of “MainSG&A” (selling, general and administrative expenses other than R&D and advertising) is an investment across the range of industries, with an average of 54 percent. They estimated that a range of 7 to 98 percent of R&D expense is an investment, with a mean of 76 percent. And they found that the useful life of MainSG&A investments is 0.25 to 5 years, with an average of 3.3 years; and the useful lives for R&D investments range from 0.5 to 7 years, with a mean of 4.4 years.

To attempt to answer address these issues, Aneel Iqbal, Shivaram Rajgopal, Anup Srivastava and Rong Zhao, authors of the September 2021 study Value of Internally Generated Intangible Capital, proposed a new method to estimate the industry-specific capitalisation and amortisation rates for R&D and SG&A outlays. The authors explained: “We estimate two regressions, one with R&D as the dependent variable and the other with MainSG&A, on current revenues and a series of future revenues, with all variables scaled by average total assets. The focus on future revenues implicitly leads to the inclusion of R&D and MainSG&A expenditures that produce future benefits and exclusion of those that turn out to be unproductive, ex post. Ideally, from a financial statement user perspective, the former should be capitalised and included in the assets, and the latter should not be. A better identification of either category of expenses should lead to better estimates of book value than a method based on mechanical rules of thumb.”

They added: “We use expenditures as the dependent variable (and not as an independent variable, as in prior studies). Second, we use future revenues as the outcome variables (and not the operating income, used in prior studies). These modifications enable us to identify the optimal lag structure by industry, that is, the model that shows the best association of current expenditures with future revenues. Our method simultaneously identifies the investment portions and the useful lives of intangible expenditures. The investment portion is the part of intangible expenditures associated with future revenues, and useful life is the optimal number of future revenues that maximises the adjusted R-squared of the equation estimated.”

For each industry, they selected the model that gave the highest adjusted R-squared. Once they estimated the investment portions of R&D and MainSG&A and their amortisation schedules, they computed the capitalised values of intangibles using a perpetual inventory method and then added the capitalised values to reported values to recalculate what they called the “modified book values” of equity. The modified book value exhibited greater association with future risk-adjusted returns, future investments and bankruptcy probability per the Altman Z-score model relative to both as-reported book values and the mechanically adjusted book values, and their results were stronger for intangible intensive industries, such as high tech and health tech, than other industries.

Their findings led Iqbal, Rajgopal, Srivastava and Zhao to conclude that their “capitalised values are more useful for predicting future outcomes such as risk-adjusted returns and investments relative to extant methods used by the literature.” With that said, while their methodology may help explain the useful portions of intangibles, a good part (or all) of the reason for why it predicts future returns is that their methodology uses future revenues. Thus, one should be wary about using it for forecasts.

Improving the usefulness of financial statements

Agreeing with Iqbal, Rajgopal, Srivastava and Zhao, in its April 2022 paper Intangibles and Earnings: Improving the Usefulness of Financial Statements, Morgan Stanley found that a “one size does not fit all” approach to intangibles is ineffective because adjustments significantly recast profitability for some companies while being inconsequential for others.

Perhaps its most important finding was that the dramatic shift toward intangible investments has had a significant impact on reported profitability. It found that putting intangibles back on the balance sheet and depreciating them would result in earnings for the S&P 500 that would be about 12 percent higher. That would make the S&P 500 look considerably less expensive, lowering its P/E ratio from about 20 to about 17.5.

Morgan Stanley noted that earnings that are reclassified as an investment also increase book value. The adjustment increases assets, liabilities remain the same, and shareholders’ equity has to be revised up to maintain the balance on the balance sheet. Citing Iqbal et al: “The change in book value by industry ranges from 4 to 95 percent, with an average increase of 49 percent.”

To make the point about how accounting rules impact valuation metrics, Morgan Stanley used Amazon as an example: “The company’s enterprise value at the end of 2021 was approximately $1.725 trillion, and its EBITDA [earnings before interest, taxes, depreciation and amortisation] was $59.2 billion ($24.9 billion in EBIT and $34.3 billion in DA). Reclassifying $60.1 billion in expenses as investments increases net income from $33.4 billion to $61.5 billion, effectively doubles EBITDA, and lifts investments by almost 90 percent. Provided these adjustments present a more accurate portrait of the company’s financial situation, the P/E and EV/EBITDA multiples are substantially lower than the traditional calculations suggest.”

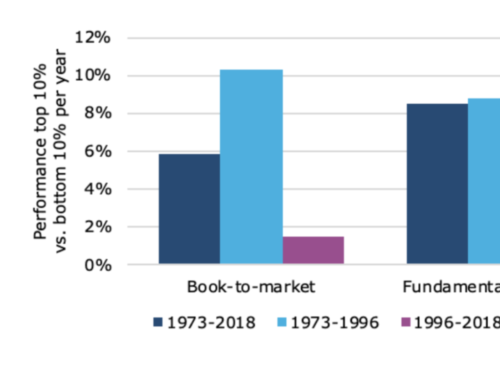

Morgan Stanley also noted: “If the shift from tangible to intangible investment is meaningful, we would expect a weakening of the signal from the value factor. This is what we have seen.” They added: “The signal from the value factor improves when intangibles are reflected as investments.”

This is consistent with the findings of Fei-Fei Li, author of the 2022 study Intangibles: The Missing Ingredient in Book Value, who examined the impact of adding intangibles to traditional book equity to determine if it is a more meaningful value measure. Although she did not adjust by industry, but rather uniformly across companies, she found that mis-measurement by the traditional book-to-market metric (HML, high minus low) led to misclassification of value and growth companies and a reduced value premium (correcting for this improved the value premium by about 1.3 percent per year). She also found that capitalised R&D expenditures (knowledge capital) played a more important role in improving the value metric than capitalised SG&A expenditures (organisation capital) — the addition of organisation capital to the book value of equity did not appear to offer much performance improvement over the addition of R&D capital stock alone.

A recent study from members of the research team at Dimensional came to a different conclusion.

Conflicting findings

Savina Rizova and Namiko Saito, authors of the 2021 study Internally Developed Intangibles and Expected Stock Returns, estimated the value of internally developed intangibles systematically across global markets over time by accumulating the historical spending on R&D (to capture the development of knowledge capital) and SG&A (to capture the development of organisation capital) and amortising them at fixed rates. While they too found that adding estimated internally developed intangibles would have had a slightly positive impact on the value premium over the long term and would have mitigated (but not eliminated) its underperformance in recent years, they also found that this impact was primarily driven by differences in sector weights—adjusting for sector differences largely eliminated premium differences.

The researchers’ findings led them to conclude: “Our research does not find compelling evidence that we should include estimates of internally developed intangibles in company fundamentals such as book equity. The estimation of internally developed intangibles contains a lot of noise. Perhaps due to this high level of noise, we find that estimated internally developed intangibles provide little additional information about future firm cash flows beyond what is contained in current cash flows.” The result was that adjusting for internally generated intangibles did not improve upon the use of a combination of traditional value metrics plus sorting for profitability. I spoke with the AQR research team and learned that their conclusions are broadly consistent with those of Dimensional — industry-adjusting book-to-market equity captures much of what intangibles are providing in terms of excess returns.

Interestingly, Rizova and Saito also found that “while the ratios of estimated internally developed intangibles to assets vary across sectors, they have been stable over time for each sector.” Their findings are why Dimensional’s value strategies do not attempt to adjust for internally generated intangibles; instead, they use the traditional HML metric but also sort for profitability.

Investor takeaways

In terms of the intensity of intangible assets, there is significant variance across industries. This is important for investors who rely predominantly on multiples for valuation and for portfolio construction. Adjusting for intangibles can result in a large operating profit margin expansion for companies that are intangible intensive and insignificant changes for ones that are tangible intensive. This suggests caution in comparing earnings or multiples across industries and over time.

Academics and fund managers have been trying to address the issues related to intangibles not being on the balance sheet through various methods. One method is to use alternatives to price-to-book (P/B) as the value metric, such as price-to-earnings (P/E), price-to-cash flow (P/CF) and enterprise value-to-earnings before interest, taxes, depreciation and amortisation (EV/EBITDA). Many fund families (such as Alpha Architect, AQR, BlackRock, Bridgeway and Research Affiliates) use multiple value metrics (such as P/E, P/CF, P/S and EBITDA/EV), some of which indirectly provide exposure to the profitability factor. Another alternative is to add other factors into the definition of the eligible universe. For example, since 2013 Dimensional has included a sort for profitability in their value funds. A third alternative, as suggested by Li and others, is to add back to book value an estimate of the value of intangible R&D and organisational expenses. A fourth way to address the issue is to apply what some call “contextual” stock selection, using different metrics or different weightings of those metrics depending on the intangible intensity. For example, if book value is not well specified for industries with high intangibles, it may be less effective in those industries than in industries with low intangibles.

At any rate, at least for most practitioners, the exclusive use of the traditional HML factor to build a value portfolio is no longer standard practice. In fact, none of the fund families Buckingham Strategic Wealth uses in its portfolios exclusively use HML to construct its value funds. Stay tuned, as we are likely to see more research on this important subject.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, however its accuracy and completeness cannot be guaranteed. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the accuracy of this article. LSR-22-286

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

Is social media making markets more efficient?

Active versus passive all boils down to cost

Do dividend-paying stocks hedge against inflation?

ESG strategies: do risk factors explain returns?

Is there an opportunity cost of responsible investing?

CONTENT FOR ADVICE FIRMS

Through our partners at Regis Media, TEBI provides a wide range of high-quality content for financial advice and planning firms. The material is designed to help educate clients and to engage with prospects.

As well as exclusive content, we also offer pre-produced videos, eGuides and articles which explain how investing works and the valuable role that a good financial adviser can play.

If you would like to find out more, why not visit the Regis Media website and YouTube channel? If you have any specific enquiries, email Robin Powell, who will be happy to help you.

© The Evidence-Based Investor MMXXII