By JOACHIM KLEMENT

It is well-known that value investors are going through a really hard time. Even Eugene Fama and Kenneth French admit that the size of the value factor has declined since the publication of their publication in 1991. I have written before about value and its dependence on the market environment, but a new study from the University of North Carolina presents another, more fundamental explanation.

They look at the original value metric, the book-to-market ratio, used by Fama and French (i.e. the inverse of the Price/Book-ratio commonly used by practitioners). They claim that since the 1970s accounting rules and corporate finance practices have changed significantly. Most notably, companies now have an increasing amount of capitalised goodwill and other intangibles on their books.

These intangibles increase book value but are not a form of productive capital in the sense that they produce cash flows that are converted into dividends, share buybacks and other revenues for shareholders.

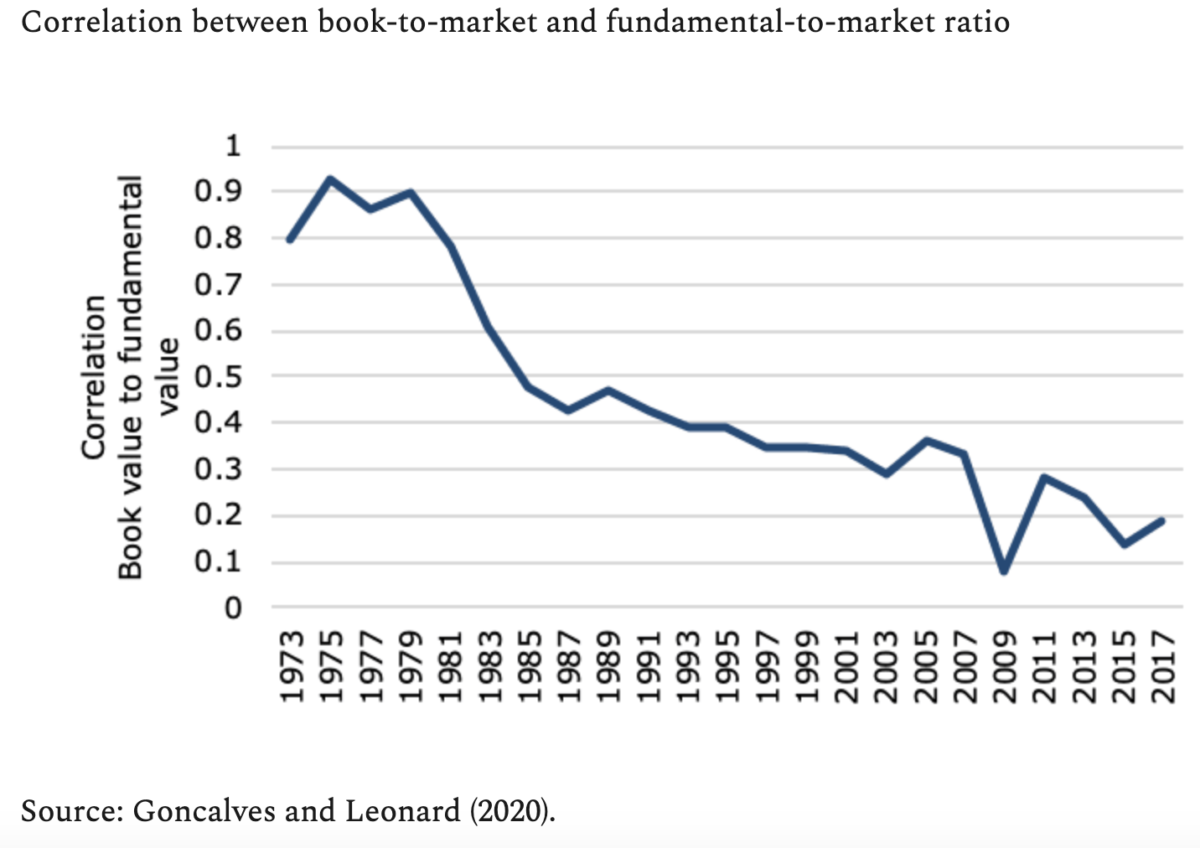

They then calculate a fundamental value that excludes such unproductive forms of capital. The resulting fundamental-to-market ratio is very similar to the book-to-market ratio in the 1970s but starts to diverge more and more in the 1980s and afterward.

The correlation of changes in book-to-market ratio with changes in fundamental-to-market ratio was about 0.8 in the 1970s but has since declined to 0.19 in the most recent two-year period.

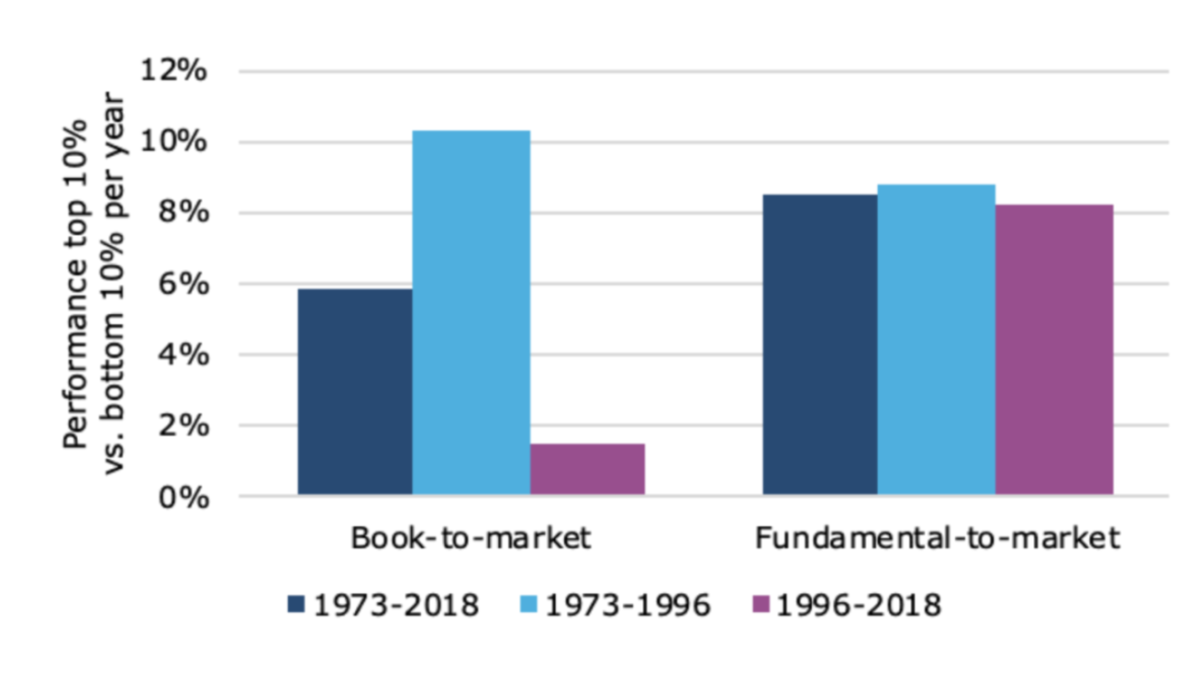

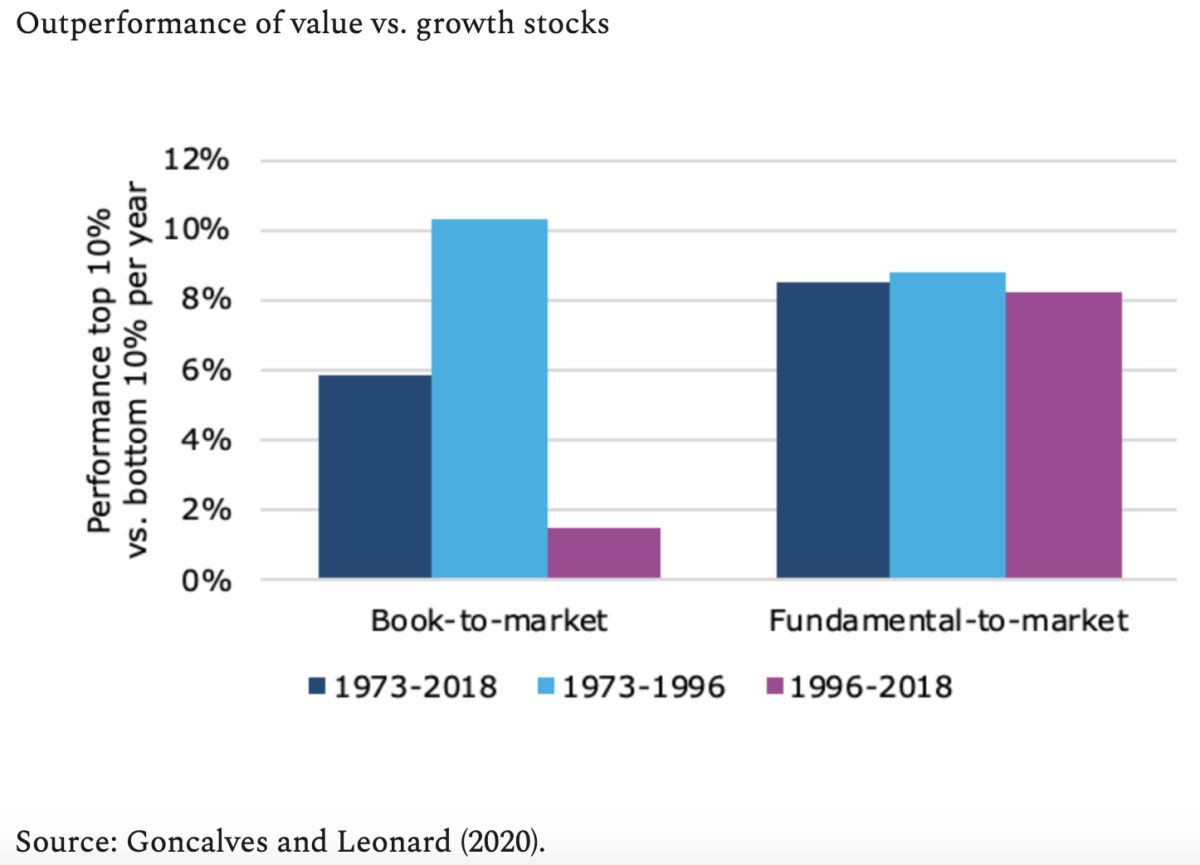

When one then sorts stocks not on book-to-market ratio but instead on this fundamental-to-market ratio, the value premium does not disappear but remains constant over time. Ét voilà, value investing is alive and kicking again.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

Joachim is a regular contributor to TEBI. Here are some of his most recent articles:

Are we heading for another financial crisis?

Knowledge can be dangerous for stock pickers

Finding the right level of patience

Are investors happier to trust an algorithm than a human?

Are we really heading for a zombie apocalypse?

Investors who smoke earn lower returns, study shows