If it ain’t broke, the old adage goes, don’t fix it. And for MARK NORTHWAY, that certainly applies to the classic 60/40 portfolio. With near-zero yields, the logic for holding fixed income is coming under increasing scrutiny. But, says Northway, giving up on bonds entirely is not a good idea.

Wherever you look, the bond doomsayers are there. Their message is that the fixed income bull market, fuelled by decades of falling rates, simply cannot go on any longer with yields across trillions of dollars of securities at zero, or even negative.

Add in the prospect of rising inflation, which erodes the capital returns portion of a bond, and investors in the likes of the classic 60/40 portfolio need to take urgent action, so the narrative goes.

It’s hard to deny that the question ‘why hold fixed income?’ is becoming increasingly valid and that its answer is becoming increasingly challenging.

But investors should be wary about being tempted into ‘the next best thing’ given the detractors of bonds have failed to accurately predict something that will work as well.

Dates back to the 1950s

Billions are invested in 60/40 strategies or similar. The thinking behind this form of portfolio construction emerged in 1950s America when economist Harry Markowitz coined the term ‘modern portfolio theory’.

The theory exploits the fact that certain asset classes traditionally move in alternative directions through the market cycle and through short term market turmoil, and can help reduce portfolio volatility along the way.

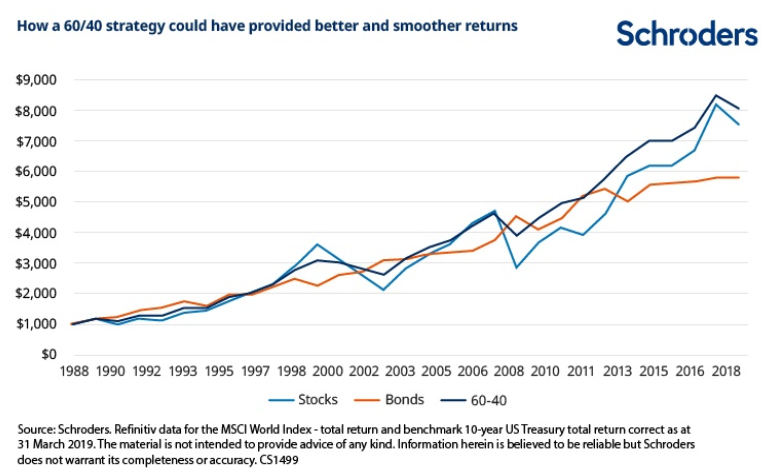

Research by fund manager Schroders confirms that a systematically rebalanced 60/40 portfolio has produced better and smoother returns in the past 30 years than one entirely made up of either stocks or bonds.

The barrage of criticism against the 60/40 portfolio for the next decade and beyond is that it simply can’t be so successful through an inflationary scenario, or one where interest rates begin to normalise. But claims that it ‘won’t work’ are perhaps wide of the mark.

Negative correlation

It’s difficult to argue against the notion that the rally in bonds in its recent form has finished, but holding fixed income could still be hugely valuable for investors — just not purely in the monetary sense.

Over the past two decades, the correlation between stocks and bonds has largely been negative, according to Pimco.

This is important because an investor wants, or rather needs, different parts of their portfolio to act in varying ways in reaction to a market or economic event.

Even though correlations converged in the 2008/09 financial crisis, they remained negative.

This characteristic is vital from a behavioural finance perspective; the 60/40 portfolio’s steadier navigation through markets compared to a pure-equity play can be calibrated to reduce an investor’s stress levels and to mitigate the likelihood that they will panic sell at the wrong moment when the pressure of falling markets gets too much.

What’s the alternative?

Furthermore, bonds are a store of value. It’s true that the amount of income they provide is waning, but targeted investment decisions — such as shortening duration, or focusing on high-quality assets that are being supported by central bank intervention — can help mitigate drawdowns.

In a recent interview, Professor Elroy Dimson said that despite the amount of negatively yielding government bonds in circulation, on a real-return basis (as opposed to nominal returns) bonds aren’t behaving that far outside their historical norm.

He said for any return you need to take on additional risk and concluded that there is still a place for bonds in a portfolio as they remain a good diversifier. He added that it’s up to the adviser and the client how much additional risk to take on but the notion that bonds are a terrible idea is something to be read in “Saturday newspaper financial columns”.

Given concerns about the valuations of equities, particularly in the US, questions about whether gold really is a store of value, and the truly lacklustre performance of some of the most eminent alternatives managers in the past couple of years, fixed income could be the least worst option.

Essentially, what needs readjusting in this central-bank-stimulus-infused world is our expectation for overall portfolio return rather than our allocation to bonds.

MARK NORTHWAY is Investment Manager at Sparrows Capital and chairman of ShareSoc, the UK Individual Shareholders Society. Based in London, Sparrows is a pioneer of capped-fee evidence-based model portfolios for financial advisers and is one of three strategic partners of TEBI’s in the UK.

This article was first published in Professional Adviser and is republished here with kind permission.

ALSO BY MARK NORTHWAY

Is ESG a factor like size or value?

The ESG momentum trade is fraught with danger

DIY trading boom storing up problems for the future

Coming soon — a Darwinian cull of active management

How we limited losses when markets plummeted

PREVIOUSLY ON TEBI

Passive growth makes it harder to generate alpha

A mindful way to pay your bills

What does history tell us about the value rally?

Should you buy stocks with very negative performance?

Can you measure your financial wellbeing?

Should investors we worried about US government debt?

FINANCIAL ADVISER?

If you’re a financial adviser or planner and you enjoy reading TEBI, why not try our sister blogs, Adviser 2.0 and Evidence-Based Advisers?

© The Evidence-Based Investor MMXXI