Pick up any investment magazine, and chances are there’ll be at least one article about a popular investment theme and how you might be able to profit from it. Themes such as healthcare, robotics and green technology are especially popular at the moment.

As Morningstar’s ALEX BRYAN explains, so-called thematic funds often come with a compelling story. But good stories don’t necessarily make for good investments, and consumers should be on their guard.

Thematic exchange-traded funds typically come with a good investment story, often seeking to capitalise on well-publicised long-term macro trends that transcend the business cycle. These include things like the increasing adoption of robotics and artificial intelligence, electric vehicles and genetic research, or demographic shifts.

But good stories are often the best thing these funds have going for them; they don’t necessarily make sound investments. Exercise caution with these funds, and do your homework before buying.

What can go wrong?

On the surface, some thematic ETFs may seem like great ideas. They attempt to capitalise on a seemingly inevitable long-term trend. It may seem plausible that stock prices don’t fully reflect those trends, given the widely held perception that the market is focused on the short term. But investors in these funds must get three bets right for these stories to translate into market-beating performance, and the odds of winning all three are low.

- The macro trend must play out as expected.

- Companies in the portfolio must benefit significantly from that trend.

- Stock prices don’t fully reflect the impact of this expected growth.

The first bet is the easiest, and it’s where many investors stop their due diligence. Yet long-term trends don’t always play out as expected. For example, in the late 1990s, investors were enamoured with Internet stocks, convinced they would fundamentally transform the economy and allow e-retailers to take market share away from brick-and-mortar stores. The story was right, but the timing was wrong. It took longer than many expected for that transition to happen, which prevented many from profiting from it.

Lost in translation

It’s tempting to take for granted that the stocks in a thematic ETF are positioned to benefit significantly from the targeted theme. After all, fund providers wouldn’t be doing their jobs if they delivered a portfolio incongruent with the fund’s mandate.

Yet it’s often challenging to craft a portfolio of companies that are pure plays on a given theme, particularly when that theme is still in its early stages. Consider First Trust Indxx Innovative Transaction & Process ETF (LEGR), which targets firms that are developing or using blockchain technology. While many of its holdings are leaders in blockchain adoption, this technology isn’t a significant earnings driver for many of them, like AT&T, Microsoft, Amazon.com and London Stock Exchange. As such, it may not have a significant impact on their stock prices. At the very least, this fund’s performance will be influenced by many things other than blockchain.

Same theme, very different portfolios

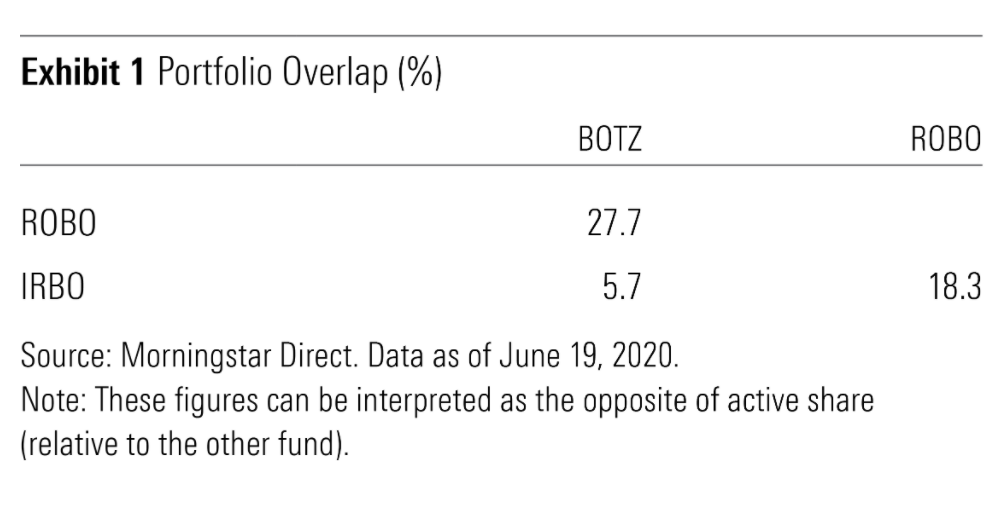

Even funds that target the same theme often have very different portfolios. For example, iShares Robotics and Artificial Intelligence ETF (IRBO), Global X Robotics & Artificial Intelligence ETF (BOTZ) , and Robo Global Robotics & Automation ETF (ROBO) all target stocks that are likely to benefit from the growing adoption of robotics, automation, and AI. Yet there is little common ground among their portfolios, as Exhibit 1 shows.

BOTZ has the most compact portfolio, owing to its inclusion of the fewest stocks and market-cap weighting. ROBO and IRBO have broader, modified equal-weighted portfolios, giving them less exposure to firm-specific risk.

Usually, more diversification is a good thing. However, there aren’t many companies that offer clean exposure to robotics and AI. So, to improve diversification, ROBO defines its theme more broadly than the others, while IRBO has less stringent requirements for inclusion than BOTZ, diluting its exposure to the theme. For example, BOTZ targets companies that generate most of their revenue from AI, robotics, autonomous vehicles, or industrial automation or that have a core competency in those areas.

In contrast, IRBO focuses on firms that either generate most of their revenue from select industries, which are considered to have significant exposure to robotics and AI, or are market leaders in those industries. However, that revenue doesn’t have to come directly from robotics and AI. For example, it takes firms operating in the web search and software, hosting services, and smartphone manufacturing industries. As a result, it owns some firms that generate little direct revenue from robotics and AI.

As these examples illustrate, it’s necessary to look beyond the fund name to understand the exposure the portfolio delivers. Not all thematic funds will effectively profit from the growth of their targeted trend.

Has the market appropriate priced the trend?

Even if a trend plays out as expected and a fund is well-positioned to take advantage of it, that won’t necessarily translate into market-beating returns. The market may have already priced in that trend. Macro trends aren’t a secret. If you know about it, the odds are so does everyone else. The key is to identify under-appreciated trends, which is no easy feat.

The relationship between earnings growth and stock returns is tenuous at best, as faster-growing companies tend to trade at higher valuations, which offsets the benefit of that growth.

What matters is growth relative to the market’s expectations, not the absolute level of growth. It is difficult to forecast the impact of a trend on businesses more accurately than the market. Doing so requires more than just an understanding of the macro story, but also understanding what the market is currently pricing in and how the competitive landscape might evolve. That’s a tall order.

Most thematic ETFs fail

Given the difficulty of getting all three bets right, most thematic ETFs fail to beat the market. In fact, most don’t even survive over the long term. According to the Morningstar Global Thematic Funds Landscape report, published in February 2020, only 45% of all thematic funds listed at the end of 2009 survived until the end of 2019. Of the funds that survived, just 26% beat the MSCI World Index.

So, the odds of picking a winning thematic fund from the lineup that existed at the end of 2009 were 11.7% (45%*26%). While investors could improve those odds by sticking to lower-cost funds and digging into portfolio construction, it’s clear that good stories often don’t translate into strong investments.

More valuable to asset managers than investors

Thematic funds are often more valuable to asset managers than they are to investors. Most have a good marketing story and face much less competition than traditional market index and factor funds, allowing them to carry higher fees. If a fund doesn’t gain traction, providers can close it and move on. If the theme resonates with investors, these products can be quite profitable.

Most investors would probably be better off skipping thematic ETFs altogether. It’s tough to find thematic ETFs that will likely beat the market. Most also come with high active risk, narrow portfolios, and unintentional sector and style bets. That said, this active risk also creates considerable upside potential for those fortunate enough to find one of the few winners. If you find a thematic ETF appealing, it’s generally prudent to keep the position small and do your homework before buying.

Is the theme durable and broad enough?

Start by evaluating the investment merit behind the theme, but don’t stop there. Is the theme durable and broad enough to adapt with changes in the market, but not so broad that it just repackages traditional industry exposures?

Durability is a low bar, but don’t take it for granted. For example, Innovation Alpha Trade War ETF could have easily been derailed by a shift in U.S. foreign policy, though it was liquidated before that could happen.

Some broad thematic ETFs don’t offer very different exposure than traditional industry ETFs, which may be cheaper. For instance, Principal Healthcare Innovators ETF has considerable overlap with SPDR S&P Biotech ETF. Its active share against that traditional alternative was only 46% at the end of May 2020. It’s only worth paying up for a thematic ETF if it offers a truly distinctive exposure. As always, keep a close eye on fees.

Unique risks

It’s also necessary to have a firm grasp of the unique risks a thematic fund faces. For example, it might take longer than anticipated for a new technology to be adopted. Firms might also have trouble profiting from the trend — just as many early Internet companies enjoyed tremendous growth in traffic but no profits to show for it. Competition may be fiercer than expected, eroding profits, or regulators might step in and change the economics of the business.

One of the biggest risks is overpaying for long-term growth, which may fall short of the market’s expectations. To gauge the market’s growth expectations for a thematic ETF’s holdings, reference the long-term earnings growth estimates under the portfolio section of the fund’s quote page on Morningstar.com, which reflects analysts’ earnings growth forecasts for those holdings over the next five years. If those figures are lower than your estimates, the theme might be under-appreciated. But it’s worth asking what the market is missing. Some humility can save a lot of pain. You might be the one making the mistake.

It does no good to find a durable, under-appreciated theme if the fund you buy doesn’t survive long enough to profit from it. Pay attention to fund size, as larger funds are less likely to be liquidated.

Look at the fund’s holdings

Portfolio construction is an even more important area for due diligence. Look at the fund’s holdings and selection criteria. Are those stocks likely to significantly benefit from the targeted trend, or are unrelated factors likely to have a bigger impact on performance? For example, IRBO holdings Amazon, Spotify, and Netflix all use AI to enhance their customers’ experience. But changes in consumers’ discretionary spending power will likely have a much bigger impact on their stock performance than the adoption of AI.

Firm-specific risk factors that dilute exposure to a theme can be partially mitigated through diversification. But it often is hard to find a diversified portfolio that offers clean exposure to a long-term trend. It’s important to be aware of unintended biases that creep into the portfolio. Thematic funds often favour small-growth stocks concentrated in one or two industries, which can drive performance independent of the longer-term macro trend.

Write it down

Finally, it’s important to establish a strategy for selling the fund before you buy it. Write down the investment thesis. If the theme doesn’t develop as expected, the fund doesn’t adequately profit from that theme, or if valuations rise significantly, it may be time to sell.

It’s challenging to find winning thematic funds, or even funds that will live up to their names. Proceed with caution.

This article was first published on the Morningstar blog.

For more insights from our friends at Morningstar, take a look at these other recent articles:

Three truths about ESG investing

Fees crucial to ESG investing success — Morningstar

US fund fees cut in half in 20 years

Three risks you take when choosing a thematic fund

Is market-cap indexing a form of momentum investing?

A critical look at the arguments against index investing

US value and growth performance under the microscope

Picture: Jelleke van Ooteghem via Unsplash