As the recent damning review by the Financial Conduct Authority of its Assessment of Value regime shows, most UK fund managers just aren’t getting the message on value for money. St James’s Place was one of the firms we criticised last year for issuing a less than transparent value assessment. SJP has just released its second AoV report, and, as HENRY TAPPER explains, it still leaves much to be desired.

“The value assessment process was introduced to make it easier for investors to understand what they’re getting in exchange for the fees they pay. So, we’ve taken care to outline the full range of services that you receive from us: from the investment

solutions that grow and protect your wealth over the long term, to the ongoing financial advice you receive from your St. James’s Place Partner.

“We believe that legislation to make our industry more transparent is not a burden, or a hoop to jump through. It’s a catalyst for change, with the power to improve standards and get better outcomes for you. We recognise there is always room for further improvement and this year’s statement sets out where we have been focusing our efforts and the progress we have made.”

So begins SJP’s monster 81-page Value Assessment, introduced by non-executive director Emma Griffin.

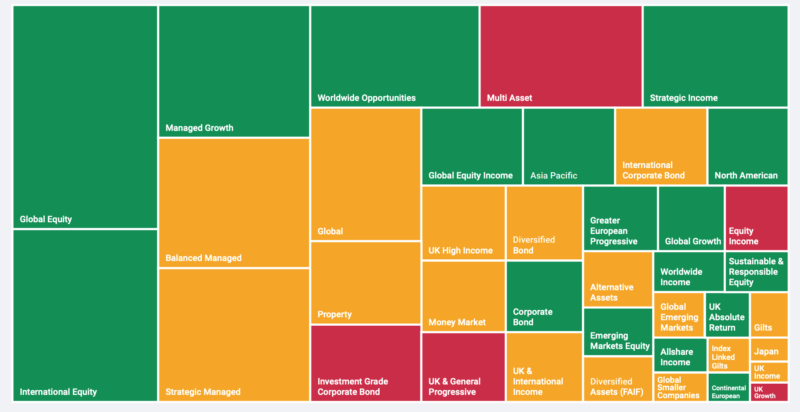

The Assessment itself is achieved with one simple graphic which shows a carpet of green , with patches of yellow and two stains of red (alternatives and Japan).

Compare this to last year’s carpet (below) and you can see an improving picture. The size of the boxes represents their use by SJP partners in implementing wealth strategies.

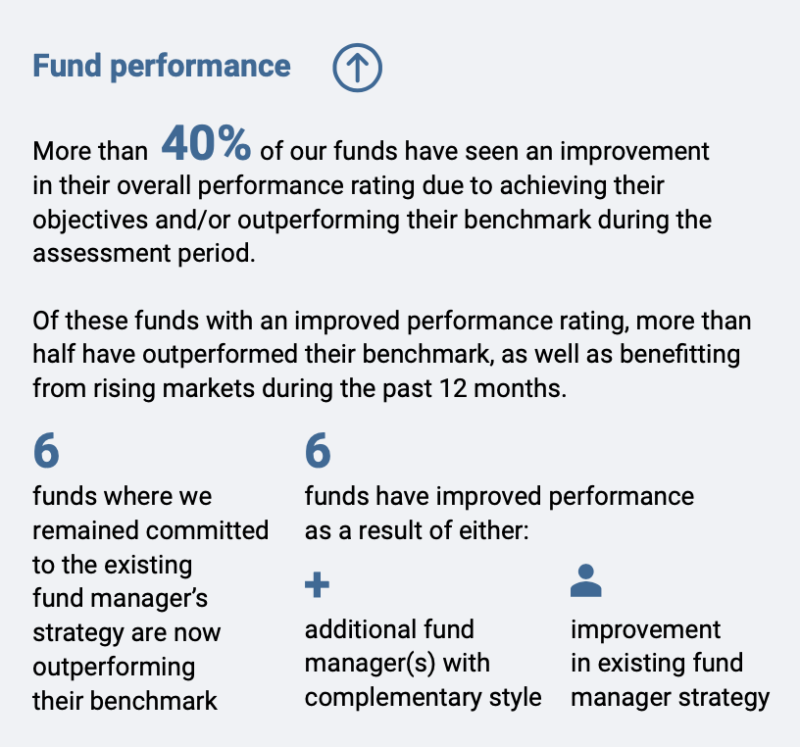

SJP aren’t shy in singing their own praises:

But it would be churlish not to see an improvement in the customer experience over the year.

Measuring value for investors’ money

The term value for investors’ money is mine, but I want to differentiate what is going on in this report from the Value for Money statements produced by IGCs and GAAs. The workplace VFM reports are for people who are starting from a point of zero engagement and working up, SJP clients have advisers and will have been through a serious engagement with their financial goals and the solutions put forward by SJP partners. This report should be helping them to look down and deeper into matters they have some knowledge of.

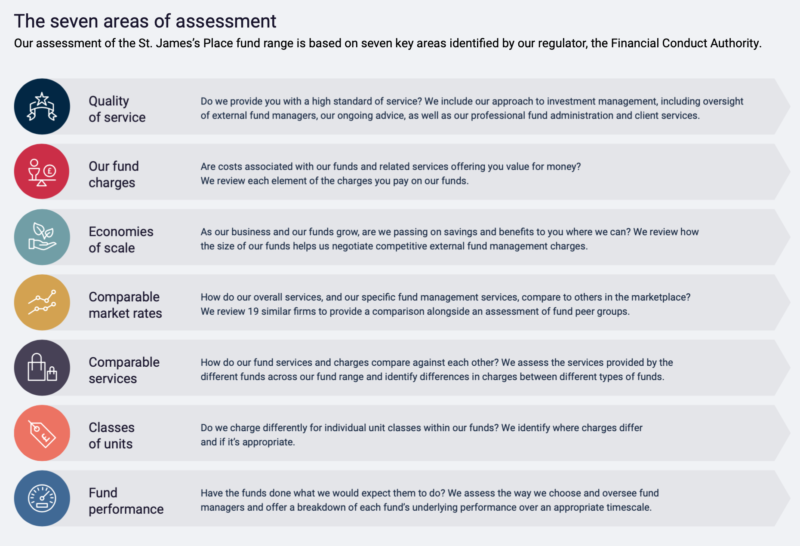

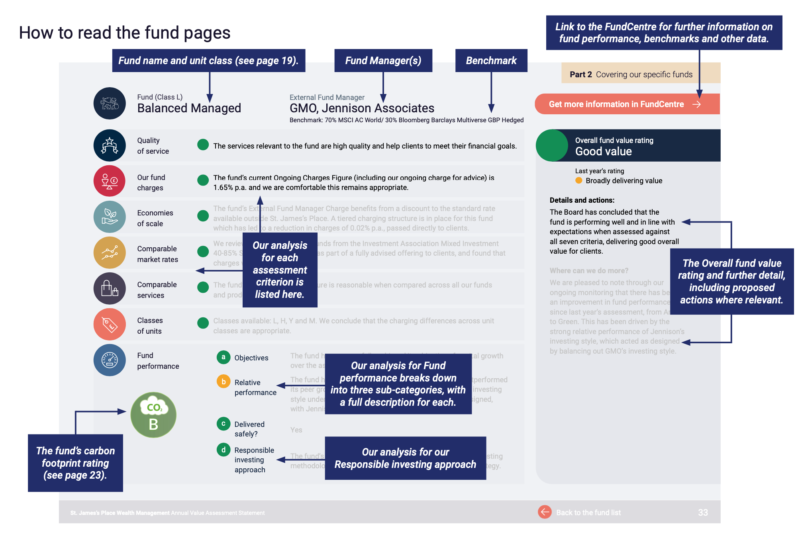

The report adopts the measures put forward by the FCA and is very clear about its structure:

There is much or the explanation of these sections which reads like any other corporate brochure, I will focus on the areas of contention for critics of SJP, principally costs and returns.

Fees and charges

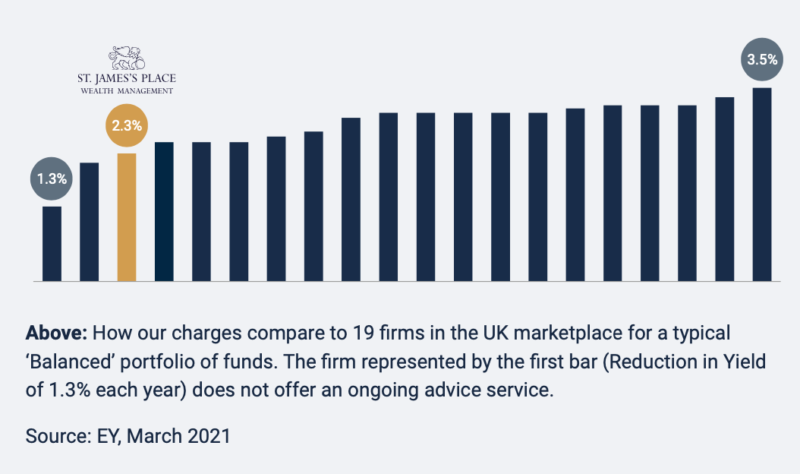

For 2021, SJP repeat a chart supplied by Ernst and Young, which shows SJP in a favourable light against a peer-group of UK firms.

This compares with last year’s chart, which was prepared by Grant Thornton:

I criticised the chart last year and I do again this year, these charts are showing SJP as the tallest dwarf but they’re not showing the investor what they could get from Vanguard, another firm not offering advice who do offer wealth management at a fraction of the costs quoted here.

I am disappointed that this chart is still being used as I would like SJP to justifying themselves against the entire market and not one created by a consultant to replicate a previous survey.

SJP’s value proposition is quite strong enough to withstand any accusation of it being over-priced. Its clients enjoy paying over the odds for exclusive services and that does not make SJP bad value.

What SJP needs to be doing is focusing on the outcomes of this excess charging, are those outcomes valuable to clients or are they, relative to outcomes to be had elsewhere, lousy.

Value

To understand that, we need to look at the value end of the equation and here the report is excellent.

Each fund is given a scorecard that looks remarkably like the form page for a racehorse.

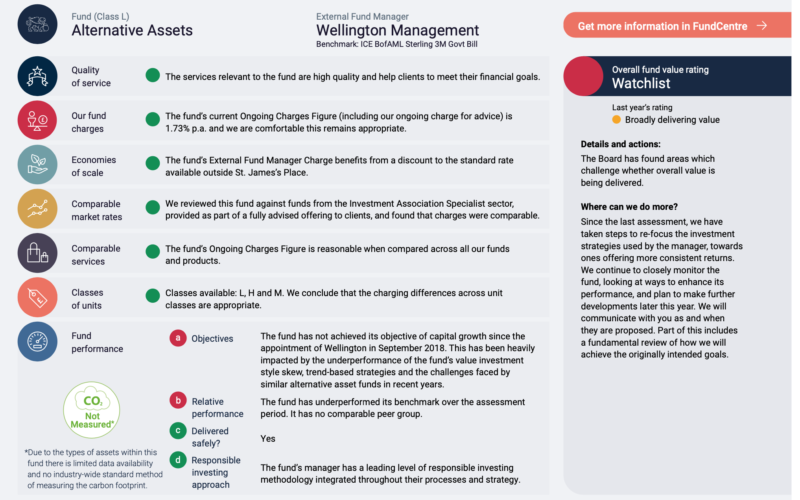

In this instance, the fund is adjudged good value. Here is an example of Wellington’s Alternative Assets fund, which is on the SJP watch list:

The bulk of the reports 81 pages consists of these individual fund assessments and very good they are too.

If you are looking for value from SJP it is in this kind of work that it is to be found. SJP want their customers to feel they are on a consistent journey. The production values are impressive.

Conclusions

The FCA have taken a very dim view of fund managers’ efforts at Value Assessments overall as I recently reported

There are still elements of this report that will annoy the FCA as they annoy me (see my criticism on cost comparisons).

More generally, I would like to see greater emphasis on outcomes and less on SJP’s achievements. SJP tell me that they have 300,000 clients in drawdown and I’d like to hear more about their new retirement funds

How do these funds deliver in practice? What is the customer’s actual experience and how does this compare with people using investment pathways on a non-advised basis. Can we measure the value of a Partner’s advice this way and if so what is the value for the funds and advisory package?

SJP are the market leaders in their field. Despite all the criticism from Times Newspapers and other commentators , they continue to grow and have happy clients. Boring Money evidence that in a report commissioned by SJP.

As SJP grow, they need to become more confident to show transparently what they deliver and they must look beyond their service levels to the overall experience of their clients.

There is scope for them to do this, in future reports. Right now, I am a man with my cup half full, and, being naturally sceptical, I expect the other half of the content I should have, is a little less tasty.

For the financial services market to really accept SJP, it needs to feel confident that SJP is doing in its space what market leading firms like Vanguard, Nest and PensionBee are doing in theirs.

Right now, this document talks to its customers, the next step is for SJP to talk to all of us.

HENRY TAPPER is an entrepreneur who helps people make good pension decisions. He founded AgeWage and the Pension PlayPen to map the pensions genome and ensure everyone gets data driven information on value for money. This article was first published on Henry’s blog and is republished here with his kind permission.

PREVIOUSLY ON TEBI

Do cryptocurrencies serve the public interest?

Genuinely bespoke portfolios are largely a myth

How does monetary policy affect asset prices?

The investing industry is not your friend

Does the low-volatility premium actually work?

The role of “active fee” in fund selection

Should you invest in a dividend ETF?

WOULD YOU LIKE TO PARTNER WITH US?

Content such as this would not be possible without the support of our strategic partners, to whom we are very grateful.

TEBI’s principal partner is Sparrows Capital, which manages assets for family offices and institutions and also provides model portfolios to advice firms. We also have a strategic partner in Ireland — PFP Financial Services, a financial planning firm in Dublin.

We are currently seeking partnerships in North America and Australasia with firms that share our evidence-based and client-focused philosophy. If you’re interested in finding out more, do get in touch.

© The Evidence-Based Investor MMXXI