Most TEBI readers will be familiar with the concept of investment risk factors — i.e. characteristics of a stock or bond that make that security more likely to outperform the broader market over the very long term. The most common ones are factors like size and value. But what about ESG? Is ESG a factor in the same way? MARK NORTHWAY, Investment Manager at Sparrows Capital, weighs up the evidence.

Factor investing is an approach that systematically targets specific, known, persistent drivers of return across markets. Academic studies have revealed that stocks and bonds displaying certain characteristics have historically provided higher returns than the broader market.

So, what are the fact(or)s?

Over the decades, hundreds of purported factors have been identified by the industry, a frenzy that has somewhat detracted from the validity of the approach.

But most of these are little more than short-term style trends, and very few are supported by genuine academic research. For this reason, we focus on the factors most acknowledged by academics in terms of empirical and persistent outperformance over time: small size, value, low volatility, and momentum for equities.

The concept of factor investing is that by using a rule-based approach, practitioners can tilt portfolios towards these rewarded risk factors.

At Sparrows we implement factor allocations passively using global single factor exposure indices. The weighting of different factors within our portfolios depends on the risk rating of the portfolio in question.

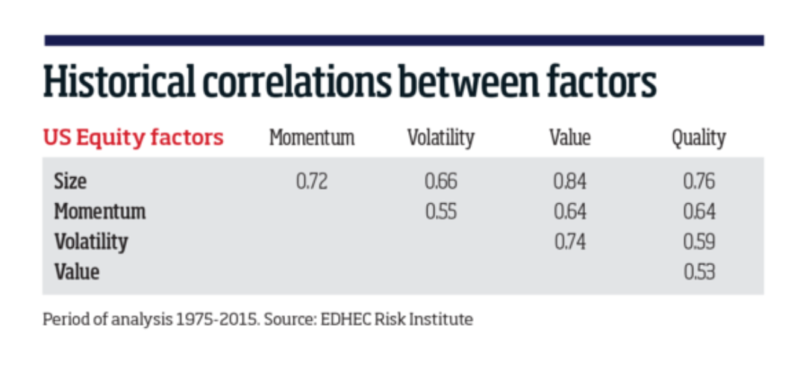

We take account of the cross correlation of factors and the objectives of the portfolio (capital preservation, balanced or growth, for example).

We do not attempt to time factors or tactically allocate between them, but we do systematically rebalance the portfolio back its strategic allocation.

Correlations of risk factors

Mixing factors has implications for portfolio volatility and drawdown: small size is more volatile and exhibits greater drawdown than minimum volatility, but the two factors are generally negatively correlated. Hence, in our lower equity risk portfolios we include an exposure to both these factors, but with minimum volatility given greater weighting.

The primary advantages of this approach are:

• Diversification: Dpreading risk within and across markets reduces the variance of portfolio returns, improving the expected risk/return performance as expressed by the Sharpe ratio.

• Cost efficiency: Reduced research dependence, investment via ultra-low fee index products and minimal portfolio turnover result in significant cost reduction relative to traditional managed portfolios.

• Transparency: Replication methods and the passive investment process are simple and transparent, with attendant informational and risk management benefits to the investor.

There is no guarantee that factors will outperform in every market environment and indeed they can underperform for extended periods.

Momentum underperformed in the 2008 crisis, and more recently we have seen the low-volatility and value factors underperform through the Covid turbulence.

Low volatility portfolios traditionally favour asset-heavy sectors such as real estate and utilities, underweighting technology and IP heavy growth stocks. This selection bias proved unpopular in 2020 as capital adjusted to the implications of the pandemic.

There has even been debate recently about whether value remains a factor at all, as capital flows have favoured increasing valuations for the FAANG stocks, largely ignoring pricing anomalies in traditional asset-heavy sectors.

Sparrows Capital takes the view that underperformance of a factor is unlikely to be indicative of its demise. Indeed, we see it as an indication that the traditional value versus growth tension may have favoured growth for too long, and that value stocks may prove a useful shelter in due course.

So, is ESG a factor?

Responsible investing is a positive force for change, and one that Sparrows Capital applauds and supports. But ESG is not a factor in its true sense – yet.

Relatively speaking, responsible investing is a new trend. There is, therefore, only limited performance data available and very few serious academic studies.

In comparison, there are more than 100 years of granular data available on small cap, value, momentum and low volatility in equities.

There is, however, an abundance of marketing literature which uses recent performance data to suggest both ESG and SRI approaches are associated with outperformance relative to the market.

Investors should approach such claims with caution, since the analysis is both biased and influenced by the flow of capital into ‘sustainable’ assets over the past couple of years.

Certainly, regulatory intervention will continue to bolster the relative flow of capital into sustainable assets. Take for example the European Commission, which announced an action plan on sustainable finance with a view to aligning financial flows with the UN 2030 Agenda and Sustainable Development Goals.

But in our view, until there is significant empirical data, ESG should be regarded as a filter, not a factor, and an investor’s decision to select a responsible portfolio should be driven by conscience rather than by return expectation.

This article first appeared in Investment Week and is re-published here with kind permission.

MARK NORTHWAY is Investment Manager at Sparrows Capital and chairman of ShareSoc, the UK Individual Shareholders Society. Based in London, Sparrows is a pioneer of capped-fee evidence-based model portfolios for financial advisers and is one of three strategic partners of TEBI’s in the UK.

ALSO BY MARK NORTHWAY

The ESG momentum trade is fraught with danger

DIY trading boom storing up problems for the future

Coming soon — a Darwinian cull of active management

How we limited losses when markets plummeted

What Woodford teaches us about illiquid assets

PREVIOUSLY ON TEBI

Endowment performance has sharply deteriorated since 2008

Young investors are more cautious than you think

Is this a new frontier for pay?

Could reading literature make you better with money?

How does investor sentiment affect returns?

WFH or office — which way will financial services go?

RUN AN ADVICE BUSINESS?

Our sister blog Adviser 2.0 regular curates the best and most important articles for growing advice firms.

Here’s the latest list of articles it thinks you’ll find interesting.

© The Evidence-Based Investor MMXXI