By ROBIN POWELL

Anyone familiar with the SPIVA analysis provided, and regularly updated, by S&P Dow Jones Indices, will tell you that most active managers underperform for most of the time. It’s possible for a manager to underperform for their entire career; indeed some do.

It begs an obvious question: why do investors keep paying these managers to underperform simple, low-cost index funds year after year?

Richard Thaler and Cass Sunstein partly answered that question in their landmark book Nudge: “never underestimate the power of inertia.” But it’s not that simple. Yes, we lead busy lives, but surely everyone would like the best returns for the fees and charges they pay? Why would anyone deliberately persist with a losing strategy?

Investment consultant Brian Schroeder addressed this issue the other day in an article that every investor should read. It specifically looks at why pension fund trustees — or plan sponsors as they’re known in the US — keep hiring consultants whose fund recommendations have caused them to lag the market for years.

There are, Brian suggests, several reasons why that is. For a start, consultants control the performance narrative; and as TEBI readers know, there are all sorts of ways to dress the figures up to make you look smarter than you really are.

Trustees are also very keen to convince the people they’re investing on behalf of that they’re doing a good job; firing an investment consultant is effectively admitting past mistakes. And then there are all the perks that consultants offer, such as lavish dinners, tickets to shows and sporting events, and supporting charitable events. Get rid of the consultant and you’re saying goodbye to all of those.

But, for me, there are two more important reasons Brian cites which explain why investors — trustees and retail investors alike — stick with funds and strategies they should have ditched years ago.

Active investing demands patience

The first reason is that active investors, including advisers and consultants who use active funds, like to tinker. They think they can spot an investment opportunity, or they’re anticipating markets going sharply up or down, and they modify their portfolio accordingly.

The point is that when you constantly change your strategy, you’re obliged to be patient to see if the latest tweaks pay off. Active investing, in other words, demands patience.

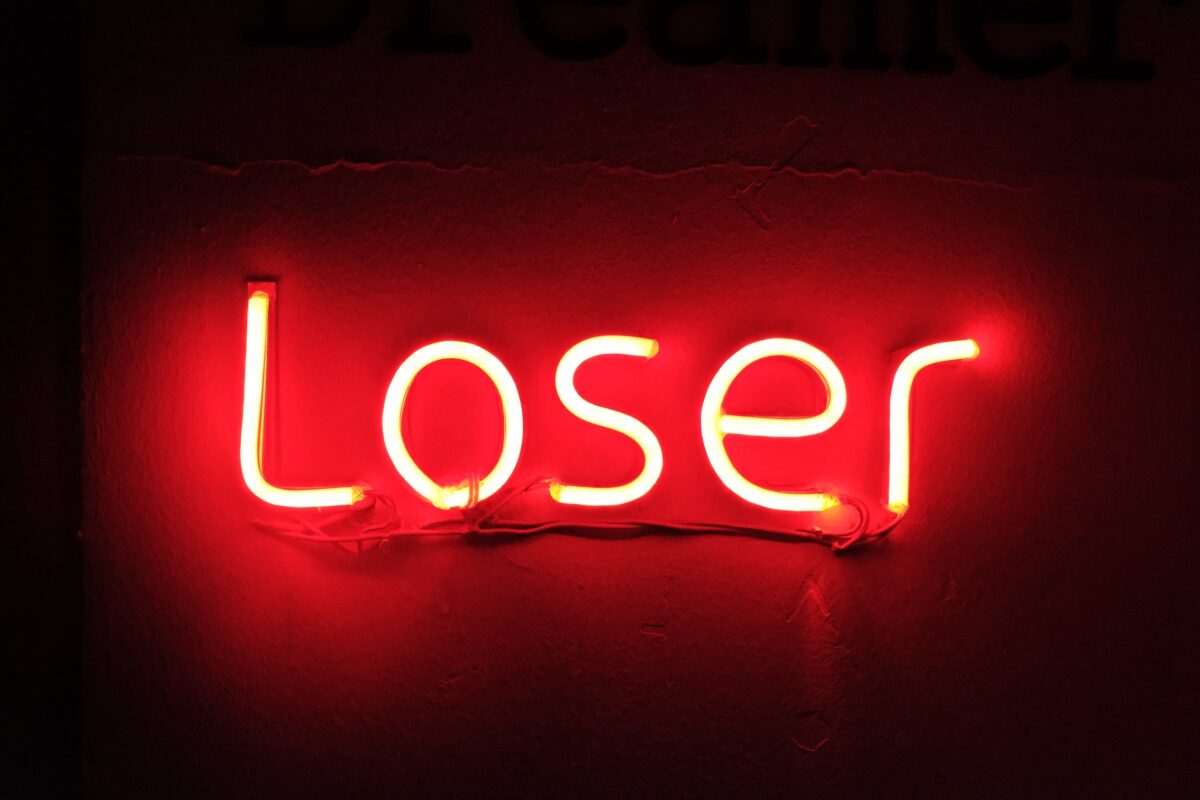

Losers always have excuses

The second main reason why we persevere with losers is that they always have an excuse. And the most common excuse of all is that the fund or portfolio is defensively positioned. As well as finding alpha, we are reminded, active managers have a duty to protect us from downside risk and may not capture.

Most investors, and sadly most trustees, don’t stop to question what they’re told. Simply comparing the returns of previous asset allocations against the newer defensive asset allocation during times of market declines will tell you whether or not you’re being fobbed off. “For recent history,” Schroeder suggests, “try using Q4-2018 and Q1-2020. Doing so will prove or debunk the contention that the portfolio is indeed more defensively positioned.”

Ignore the pleas for more time

Of course, the big advantage the industry has is an almost bottomless PR and marketing budget. Fund management companies spend eye-watering sums persuading us to invest in a particular fund. When, inevitably, performance falters, they bombard investors, via the financial media, with reasons for staying patient and allowing the fund’ management team more time to prove their worth.

This article about Magellan in the Australian trade press yesterday is a classic example. Magellan, like Woodford in the UK or Ark Invest in the US, used to be a media darling. Financial advisers loved Magellan too. But, in recent years, its fund performance has been dreadful, and its dismal run continued in 2021.

Yet in this article Magellan’s billionaire chairman and chief investment officer Hamish Douglass comes out fighting (and who would expect him to do anything else?)

“I think the big story of 2022 is what happens with inflation in the world,” says Douglass.

“If the Federal Reserve is forced to stamp out inflation next year, it is hold onto your chairs. The markets are so wound up in crowded trades that if that was to happen, people are in for a rude shock. The great party of 2021 will become the great unwind of 2022 and I put the probability of that (happening) at 30%.

“If that happens in 2022, I think people will say ‘thank god we’re with Magellan’ because half our portfolio is in super defensive assets. It’s the mirror image of us being conservative through 2021.”

The market return is there for the taking

Of course, Douglass may be right. But even if you knew, in advance, what will happen in the economy, turning that into market-beating returns is another matter entirely. Besides, it’s going to take several years of stellar outperformance for Magellan investors to recoup the money they would by now have made by investing in low-cost index funds.

The odds are very heavily stacked against that happening. And can you really afford to wait that long to see if it does?

The lesson is simple. Whether you’re investing for your own retirement, or on behalf of other people, stop wasting energy, time and money backing losers. And remember: few investors, in the long run, achieve anything like the market return, but it’s always there for the taking.

ROBIN POWELL is the editor of The Evidence-Based Investor. He is a journalist specialising in finance and investing He is the founder of Ember Television and Regis Media, and is Head of Client Education for the financial planning firm RockWealth. His book, Invest Your Way to Financial Freedom, co-authored with Ben Carlson, was recently published by Harriman House.

ALSO BY ROBIN POWELL

The chart that shows active management is dead

Market efficiency is nothing new

Helping a “lost” generation to invest

Are we living in the 1970s all over again?

Learning to say no is key to a fulfilling life

A good job requires more than a good salary

FIND AN ADVISER

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we offer a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Need help? Click here.

Picture: Liam Nguyen via Unsplash

© The Evidence-Based Investor MMXXI