As regular TEBI readers know, active funds that outperform the market over the long term are vastly outnumbered by those that fail to beat it. And you don’t need a degree in marketing to work out that the funds which attract the most publicity are the winners. CRAIG LAZZARA from S&P Dow Jones Indices says we can expect to read about plenty of success stories in the coming weeks. Why? Because although the proportion of funds that are beating the market is even smaller than usual, the ones that do are, on average, beating it by a larger margin.

Investment management is a zero sum game. The source of outperformance for a market’s outperformers is the underperformance of the same market’s underperformers. Properly measured, the weighted average sum of the winners’ gains is exactly equal (before costs) to the weighted average sum of the losers’ losses. This identity, along with the professionalisation of the investment management business globally, helps explain why our SPIVA reports consistently show that most active managers underperform most of the time.

Wins and losses might be, but need not be, distributed symmetrically. If half the assets in a market underperform by 3%, then the other half (on average) will outperform by 3%. But if 70% of assets underperform by the same 3%, the average outperformance of the winners will be a much more impressive 7%. A simple example will illustrate an important principle: if stock returns are skewed and portfolios are concentrated, most assets will underperform.

Positively-skewed returns

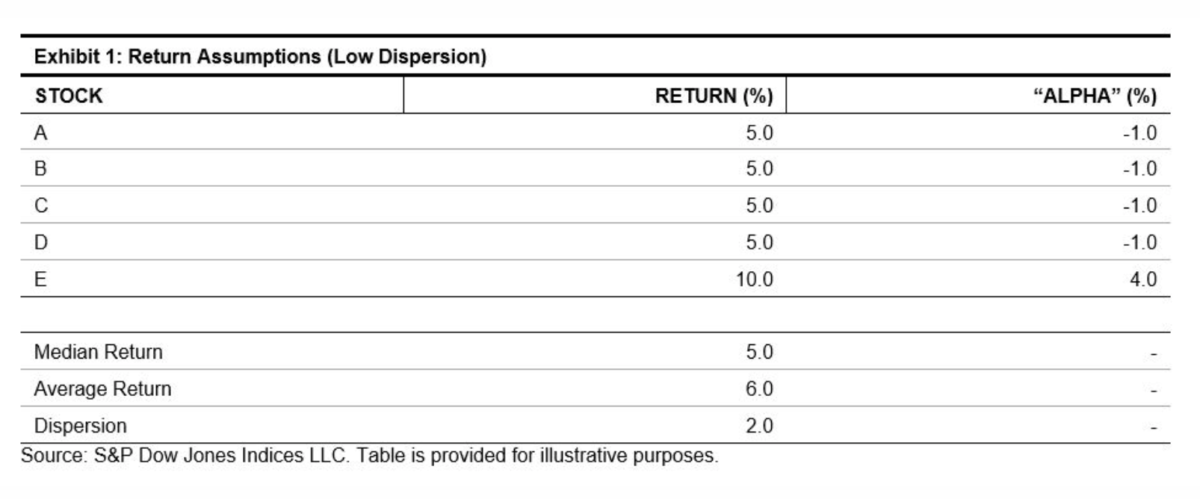

Exhibit 1 shows a simple model of positively-skewed returns; we assume a market with five stocks, one of which outperforms the others. Assuming each stock has the same capitalisation, the market’s overall return is 6.0%, with a narrow dispersion.

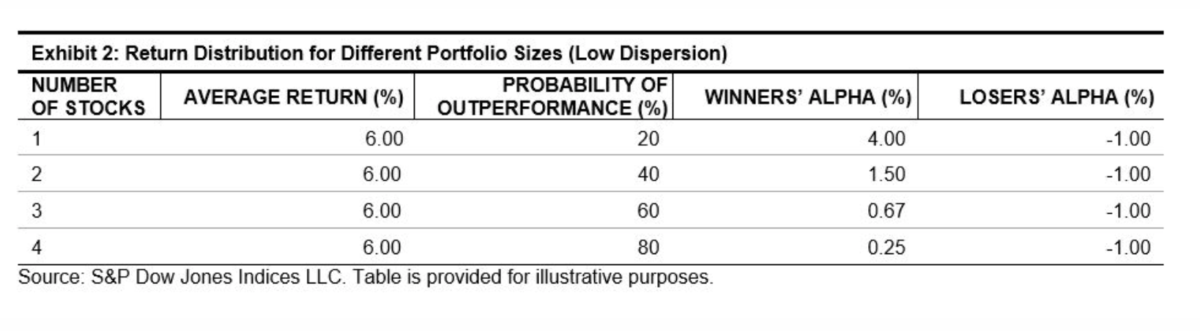

In Exhibit 2, we use these five stocks to build portfolios of different sizes. There are, for example, five possible one-stock portfolios, four of which underperform the market. Alternatively, there are five possible four-stock portfolios, four of which outperform. Since the market, in this example, is up 6%, the average return of the portfolios is also 6% — if the market gives us 6%, it doesn’t matter how we slice it up. What changes is the distribution of returns across portfolios.

Two effects of concentration

Exhibit 2 suggests that two things happen as portfolios become more concentrated:

- The probability of outperformance falls.

- The gap between the winners and losers grows; the winners’ alpha rises, albeit for a smaller number of winners.

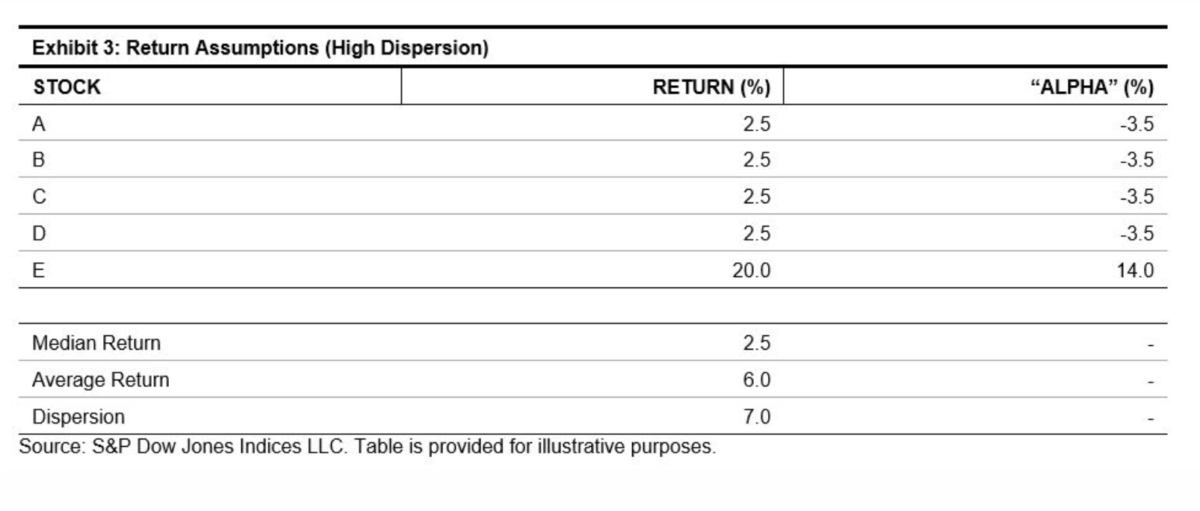

These differences become more pronounced as the dispersion of returns grows. Exhibit 3 shows a hypothetical market with the same average return, similar skewness, and wider dispersion than in Exhibit 1.

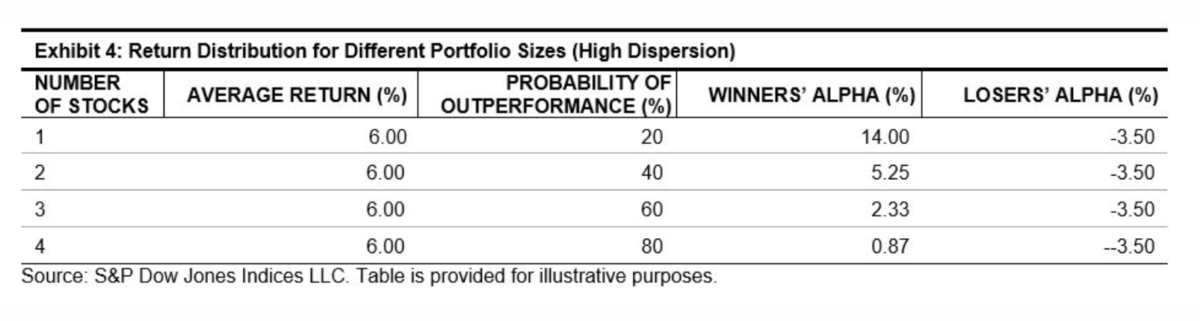

If we repeat our portfolio construction exercise, Exhibit 4 shows identical probabilities of success, but with much wider gaps between winners and losers.

Fewer, but bigger, success stories

As before, concentration lowers the odds of success, but dramatically raises the payoff for the relatively small number of winners.

Why is this simplistic exercise relevant to the real world?

— As is the case in most years, returns for 2020 look to be positively skewed, as the median stock in the S&P 500 underperforms the average.

— Most active portfolios are relatively concentrated. Coupled with skewness, higher concentration implies that the majority of assets are likely to underperform.

— Dispersion is well above historical average for every equity market we cover. This implies big gaps between winners and losers.

As the year draws to a close, we should expect to hear reports of spectacular success stories. Don’t let the well-advertised big wins obscure the more dismal landscape of active underperformance.

This article was first published on the Indexology blog.

For more valuable insights from our friends at S&P Dow Jones Indices, you might like to read these other recent articles:

2020 and the danger of extrapolation

Three reasons why the index advantage will persist

How courageous is your fund manager?

A wasted opportunity for Australia’s fund managers

Active or passive — which is more volatile?

PREVIOUSLY ON TEBI

Here are some other recent posts you may have missed:

Victory belongs to the patient

Five ways to develop a millionaire mindset

Stocks are risky no matter how long the horizon

Making the most of working from home

2020 and the danger of extrapolation

Why most Robinhood traders earn lousy returns

CONTENT FOR ADVICE FIRMS

Through our partners at Regis Media, TEBI provides a wide range of content for financial advice and planning firms. The material is designed to help educate clients and to engage with prospects.

As well as exclusive content, we also offer pre-produced videos, eGuides and articles which explain how investing works and the valuable role that a good financial adviser can play.

If you would like to find out more, why not visit the Regis Media website and YouTube channel? If you have any specific enquiries, email Sam Willet, who will be happy to help you.

Picture: Ameer Basheer via Unsplash

© The Evidence-Based Investor MMXX