How have Australia’s active fund managers handled the coronavirus crisis so far? PRISCILLA LUK from S&P Dow Jones Indices has been looking at the numbers.

With the COVID-19 pandemic, equity markets around the world experienced massive declines with heightened volatility, and the Australian equity market was not immune. Various equity market segments experienced rapid market sell-offs followed by slow recoveries in H1 2020, with the S&P/ASX 200, S&P/ASX Mid-Small, and S&P/ASX 200 A-REIT decreasing 10.4%, 6.9%, and 21.3%, respectively.

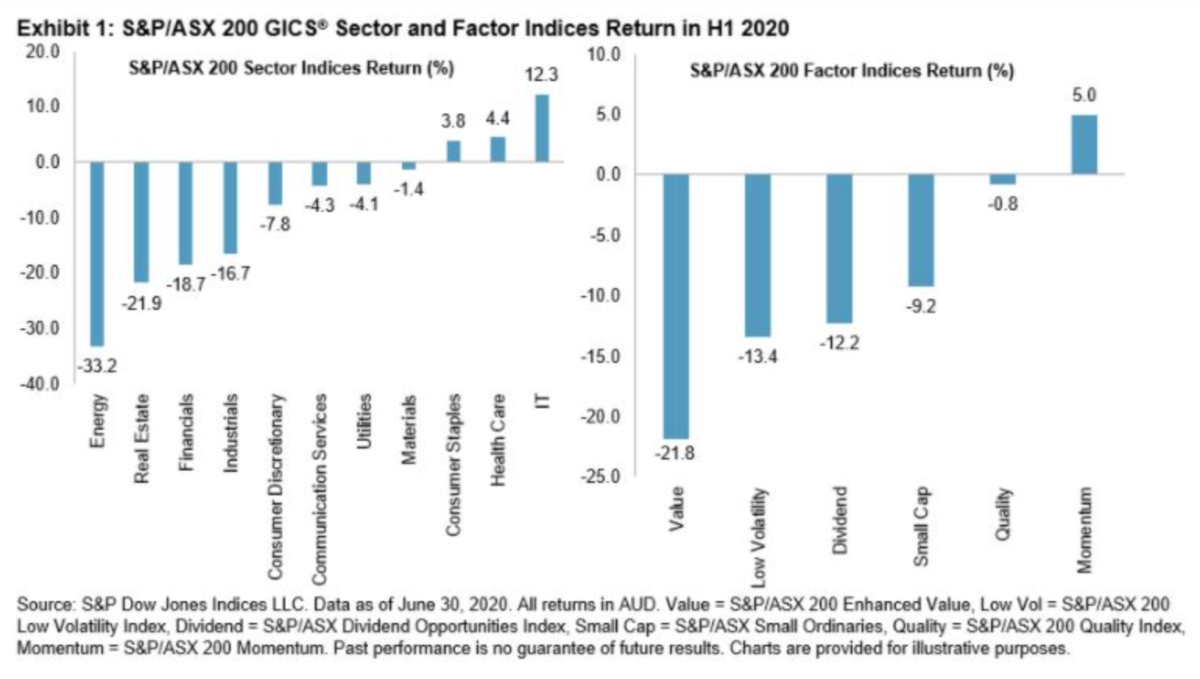

Due to the volatile environment, stock return dispersion in global equity indices rocketed to historic highs in March,1 providing fertile ground for stock picking. Return spreads across the S&P/ASX 200 Sector Indices and S&P/ASX 200 Factor Indices were widened to 45.5% and 26.8% in H1 2020, respectively (see Exhibit 1). This market condition may prompt fund investors to question: did Australian active funds outperform benchmarks amid the COVID-19 pandemic?

The answer does not seem favourable for Australian active managers according to their fund performance versus the benchmark in H1 2020.

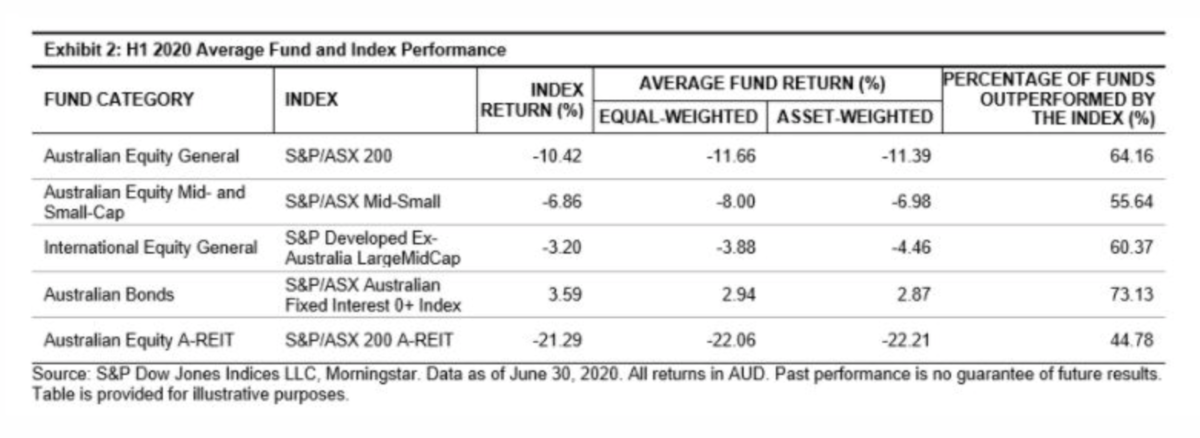

In the recently published SPIVA® Australia Mid-Year 2020 Scorecard, we observed the majority of active funds had worse performance than their respective benchmark indices across most fund categories in H1 2020. Of funds in the Australian Equity General, Australia Equity Mid- and Small-Cap, and International Equity General categories, 64%, 56%, and 60% underperformed their benchmarks, respectively.

The portion of underperforming funds was smallest in the Australian Equity A-REIT category, with 45% of funds underperforming the S&P/ASX 200 A-REIT. Australian Bonds was the only category that recorded a positive average return in H1 2020, though more than 70% of funds in this category failed to outperform the S&P/ASX Australian Fixed Interest 0+ Index.

All fund categories underperformed their respective benchmarks over the same period in terms of their equal- and asset-weighted returns. Despite mid- and small-cap funds delivering better average returns than the benchmark over longer time horizons, they recorded a larger average drawdown than the S&P/ASX Mid-Small in H1 2020.

The asset-weighted returns exceeded the equal-weighted returns for the Australian Equity General and Australian Equity Mid- and Small-Cap fund categories, indicating larger equity funds tended to suffer less drawdowns during the COVID-19 crisis in these two categories.

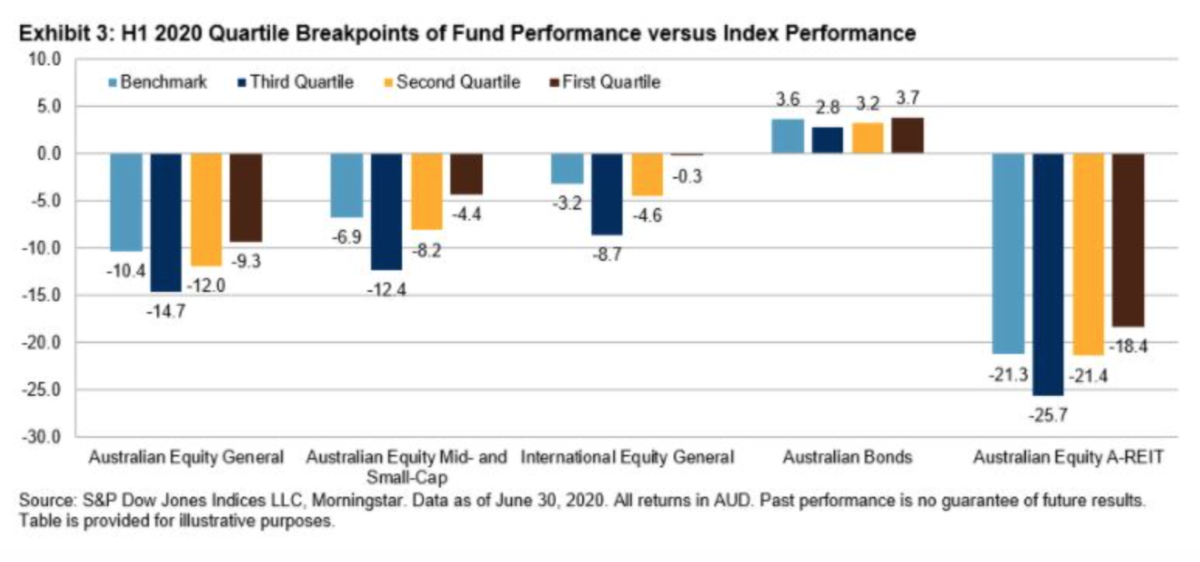

During this volatile period, some active managers harvested the benefit of high stock return dispersion, but some were badly hurt. Equity fund return spreads were high in H1 2020, as most obviously seen among the Australian Mid- and Small-Cap funds and International Equity General funds, with the first and third quartile return breakpoints differing by 8.0 % and 8.4%, respectively.

One-quarter of Australian Mid-Small-Cap funds outperformed the S&P/ASX Mid-Small by more than 2.5%, but one-quarter underperformed the benchmark by more than 5.5%. Among International Equity General funds, one-quarter delivered excess returns of more than 2.9%, though one-quarter of these funds lost more than 8.7%, which was more than double the benchmark’s drawdown (3.2%).

In our semiannual SPIVA Australia Scorecard, we have consistently observed underperformance for the majority of Australian active funds across most categories over time. The high market volatility seen during the COVID-19 crisis was an excellent time for active fund managers to reveal their portfolio skills, as record-high stock return dispersion resulted in a good opportunity for stock pickers to outperform. However, the results of the mid-year 2020 scorecard revealed that the majority of active fund managers failed to capture this opportunity.

1 For tables and charts on equity index dispersions in March 2020, see the Dispersion Dashboard.

This article was first published on the Indexology blog.

For more valuable insights from our friends at S&P Dow Jones Indices, here are some other articles you might like to read:

Active or passive — which is more volatile?

How long do top-quartile funds stay there?

Three hundred and twenty billion dollars

US fund managers flopped in the crisis

92% of Canadian fund managers underperformed in 2019

Does adjusting for risk make active performance any better?

How did Australian active managers handle Q1 volatility?

Picture: Hugo Heimendinger via Pexels