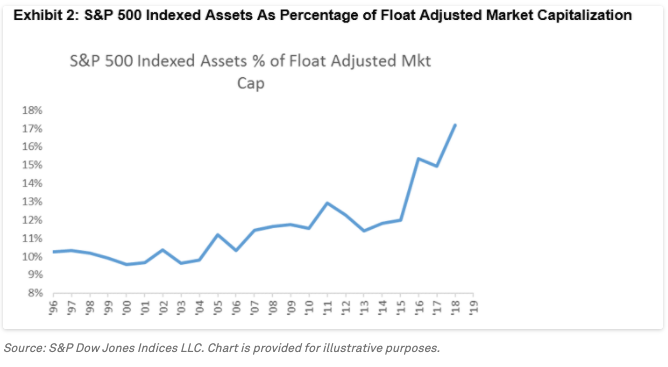

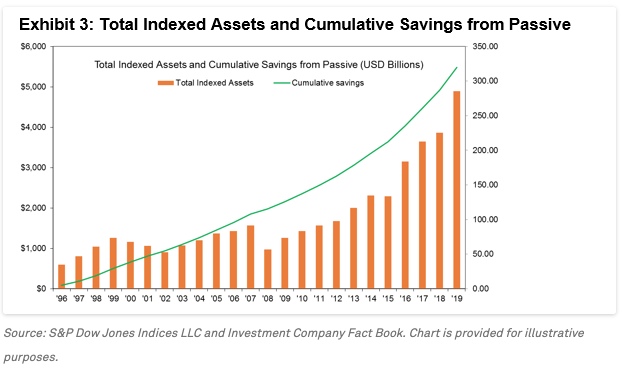

$320 billion is a colossal sum of money. And that’s the value of the cumulative savings in fund management fees that US investors have made over the last 24 years by using investment products linked to the different S&P Dow Jones indices. S&P’s ANU GANTI has been running the numbers.

The evolution of indexing is one of the most noteworthy trends in modern financial history. The rise of passive investing is the consequence of shortfalls in active performance, as regular readers of our SPIVA reports will recognise.

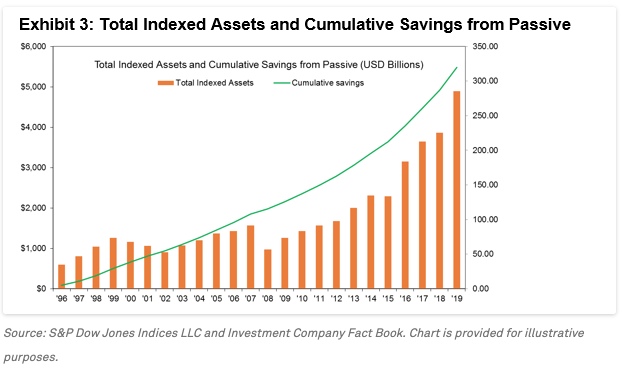

Our recent annual Survey of Indexed Assets shows a surge in S&P 500 indexed assets to $4.6 trillion as of December 2019. Exhibit 1 illustrates that the growth in assets tracking the S&P 500 dwarfed the growth due to market gains, indicating a substantial increase in flows.

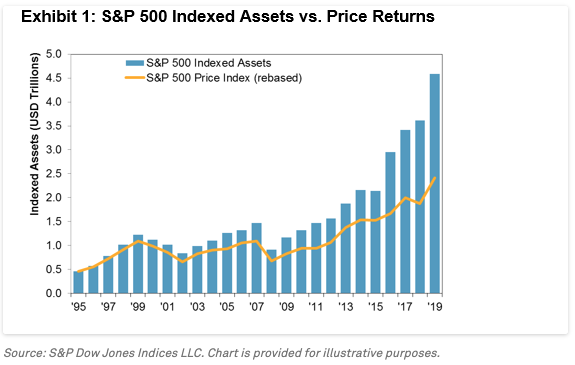

To provide context, we can analyse indexed assets historically as a percentage of float adjusted market capitalisation. Exhibit 2 shows that this percentage has grown dramatically, from 10% in 1996 to 17% in 2019, highlighting the increasing importance of index funds to the overall market.

One of the reasons for the popularity of indexing is its low cost relative to active management. As indexing has grown, investors have benefited substantially by saving on fees and avoiding underperformance. We can quantify the fee savings each year by taking the difference in expense ratios between active and index equity mutual funds, and multiplying this difference by the total indexed assets for the S&P 500, S&P 400, and S&P 600. When we aggregate the results, we observe in Exhibit 3 that the cumulative savings in management fees over the past 24 years is $320 billion .

ANU GANTI is Senior Director, Index Investment Strategy at S&P Dow Jones Indices. This article was first published on the Indexology blog.

Here are some other recent articles from S&P Dow Jones Indices that we’ve featured on TEBI:

US fund managers flopped in the crisis

92% of Canadian fund managers underperformed in 2019

Does adjusting for risk make active performance any better?

How did Australian active managers handle Q1 volatility?

European active funds lagging the index in the crisis

How long will the dividend drought last?

Here are some more articles we think you’ll find interesting:

Fees crucial to ESG investing success — Morningstar

Index funds 43 College endowments 0

Investors prefer past performance to lower fees — research

US fund fees cut in half in 20 years

Are tactical ETFs worth using?