By ROBIN POWELL

Being a business owner is hard work and often stressful (tell me about it!) So, if there were something you could do to make your life simpler, give you more time and improve outcomes for your clients, why wouldn’t you consider it?

Historically, owners of financial advice firms around the world have built their value proposition around beating the market. But the fact is, beating the market in the long term on a cost-and risk-adjusted basis is extremely difficult. Many advisers claim to have done it, but few of them actually have done and are genuinely able to prove it.

SPIVA doesn’t lie

The SPIVA analysis from S&P Dow Jones Indices shows us time and again that only a very small proportion of active managers outperform the index and that any outperformance they do produce tends to be short-lived. It’s nigh on impossible for an adviser to pick the winners in advance and to dip in and out of the market at the right time with any degree of consistency.

Thankfully, though, they don’t have to. By just putting their clients’ money in a diversified portfolio of low-cost ETFs or index funds, they can help those clients achieve their investment goals far more simply and efficiently. Even those advisers who still want to place active bets on specific asset classes, countries or sectors are better off doing so using passive investment vehicles.

Best for clients, best for advisers

But indexing is not just best for clients; it’s the best solution for advisers too. It saves you unnecessary stress and anxiety for a start. It allows you to be honest with clients about how the financial markets work. Most of all, it frees up a huge amount of time to spend on areas where you really can add value — behavioural coaching, for example, client education, tax planning, estate planning and, most of all, holistic financial life planning. It also means having more time to spend talking to clients, developing your staff and building your business.

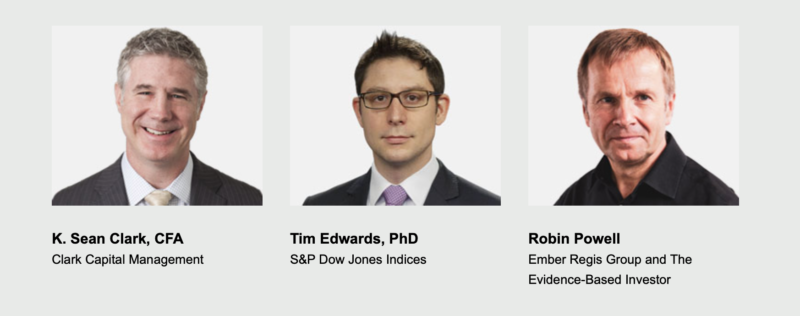

I’m going to be discussing all of these issues in a complimentary webinar organised by S&P Dow Jones Indices on Wednesday 15th December at 4pm GMT/ 11am EST. It’s called The Persistent Power of Passive Solutions. The other speakers are Sean Clark, Chief Investment Officer at Clark Capital Management, based in Philadelphia, and Dr Tim Edwards, Managing Director, Index Investment Strategy, at S&P.

If you’ve been considering shifting your firm away from using actively managed funds, this is the event for you. But spaces are limited, so if you’d like to join us, book now and learn how switching to an index-based investment proposition could transform your business and change your clients’ lives for the better.

Come on in — the water’s lovely.

MORE FROM S&PDJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles, or visit the Indexology blog:

Australia the only exception as fund managers flop again

How index investing can help tackle climate change

Emerging markets: what investors need to know

Relative returns vs absolute performance

What if the last 40 years had turned out differently?

PREVIOUSLY ON TEBI

Do capture ratios actually tell us anything?

ESG: the measurement challenge

Private debt funds: how have they performed?

Charles Ellis on the game you shouldn’t play

Active share has been a big disappointment

The disposition effect: why traders sell at the wrong time

Picture: Erik Dungan via Unsplash

© The Evidence-Based Investor MMXXI