By JOACHIM KLEMENT

When it comes to ESG risks, investors are increasingly aware that they may cause significant costs to a company and its shareholders. This is the reason why I am such a fan of ESG momentum strategies, i.e. investing in companies that are making credible and sustained efforts to reduce their ESG risks. With lower ESG risks and better management of these issues come lower costs and higher profitability. After all, every prevented accident will increase your bottom line, even if you can’t measure the costs from an accident avoided.

But many companies still make no concerted effort to reduce their ESG risks and some even try to reduce their compliance with rules and regulations or comply only with the minimum requirements in an effort to save costs. And that may turn out to be a truly short-sighted strategy.

Who are the main culprits?

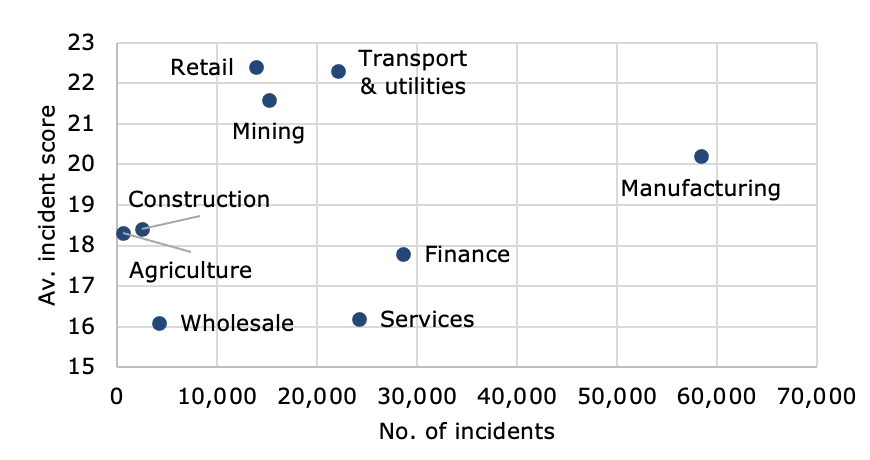

Research from the University of Virginia has investigated the number and severity of ESG-related incidents across a large number of companies in the United States and Europe.

First, they found something that I find somewhat surprising. While companies in the mining, energy, and power sectors tend to get the most attention on ESG incidents, they are not the main culprits. The number of incidents in the manufacturing sector is much larger, though the average severity of the incidents is somewhat lower.

I guess it is the fact that if a mining company blows up caves on aboriginal lands or an oil company spills the groundwater of a township it is so much more intense and impactful that it makes the news and sticks in our memory. But if a retailer violates minimum wage rules or an industrial company skimps on health and safety procedures in its factors that is just not spectacular enough.

Number and severity of ESG incidents by industry

Source: Glossner (2021)

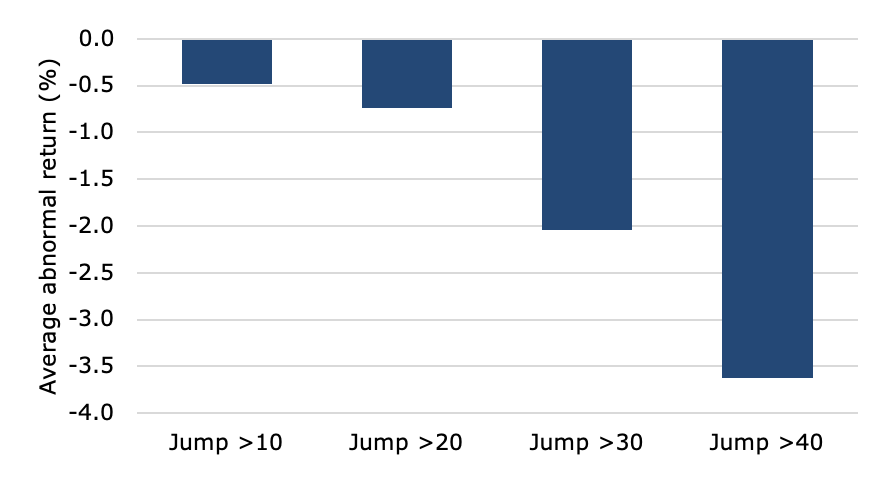

How severe an incident is does make a difference to investors as well. On average, smaller incidents create only a small stock market reaction but once incidents cross a certain threshold, share prices react much more.

Average share price reaction in the four weeks around an ESG incident by severity

Source: Glossner (2021)

Smaller incidents go unnoticed

But what investors really should pay attention to are the many small incidents that often go unnoticed. The research showed that companies that had many incidents in the past are more likely to experience more incidents in the future and are more likely to experience more severe incidents as well. In essence, companies with a lackadaisical approach to health and safety tend to get away with it for a long time, always experiencing small but not very costly incidents. But one day, an incident may not be so small anymore. Or the many small incidents may add up to a large cost.

Indeed, one major result of the study is that companies with many ESG incidents tend to experience lower profitability and larger share price drops at the next earnings announcement. Because most analysts and investors don’t pay much attention to these small incidents, they tend to ignore them in their forecasts. As a result, the forecasts for profitability tend to be overly optimistic and when the reality check eventually arrives, the costs of these incidents tend to lead to negative surprises — with correspondingly larger losses for investors.

The lesson to learn

The lesson for analysts and investors alike when considering ESG risks is to really pay attention to these small events and look at the number of past events. In many instances, the past is prologue and a high incident rate in the past will be a predictor of high incident rates in the future and correspondingly lower profitability.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

ALSO BY JOACHIM KLEMENT

Taking on the dependency problem

We deceive ourselves about financial incentives

Transparency is good for business for asset managers

Another sign that market efficiency is increasing?

How hard is it to find the next Amazon?

Practitioners still pay too little attention to academia

PREVIOUSLY ON TEBI

The case for tracking the venerable Dow Jones

The all-important pension question

Advising on life’s big changes

How to avoid foolish behaviour

Taking on the dependency problem

The endowment effect and difficult decisions

OUR SISTER BLOGS

If you’re a financial adviser or planner and you enjoy TEBI’s articles, why not try our sister blogs, Adviser 2.0 and Evidence-Based Advisers?

© The Evidence-Based Investor MMXXI