By JOACHIM KLEMENT

If you are younger than 65 right now and live in a developed country, you have a problem. On the one hand, you know that your society is ageing rapidly and that means that the dependency ratio (i.e. the number of working age people who have to finance pensioners) increases rapidly. This will either lead to a reduction in social society and pension benefits over time or to higher taxes on both the working age population and pensioners. Either way, your expected net income after taxes declines, and your lifestyle is increasingly threatened.

The two ways to deal with this problem are either to accept a lower income and a reduced lifestyle or to save more. But with central banks introducing zero interest rates everywhere, saving more has become increasingly difficult because even if you are able to save more today, the savings just aren’t growing like they used to.

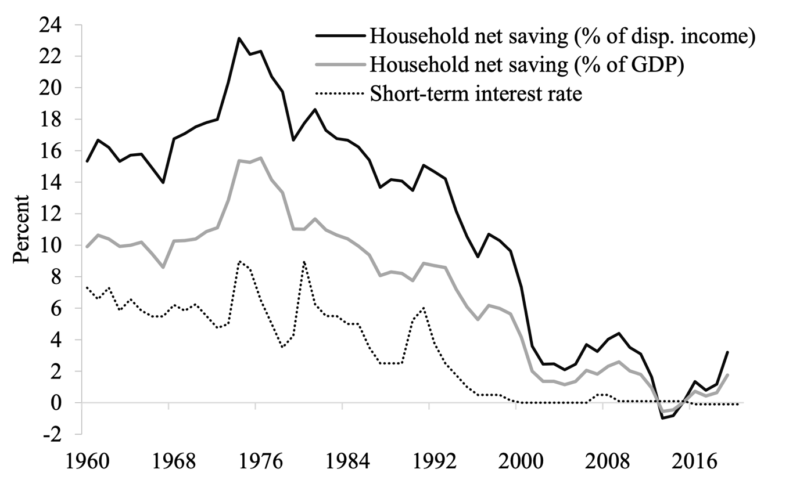

It is not clear which one of these forces will win in the end, the incentive to save more due to an ageing society or the incentive to save less due to lower interest rates. In this respect, studying the example of Japan, which has a head start of about two decades on the situation in Europe and the United States can be very informative. And when it comes to savings behaviour, the verdict is pretty clear. After two decades of zero interest rates, savings rates in Japan have plummeted.

Savings rates and monetary policy rates in Japan

Source: Latsos and Schnabl (2021)

I find it hard to believe that the outcome in Europe or the United States should be any different. People really don’t like to save for the future and if the incentive to do so is reduced through lower interest rates they are all too willing to spend their money today, rather than save for tomorrow.

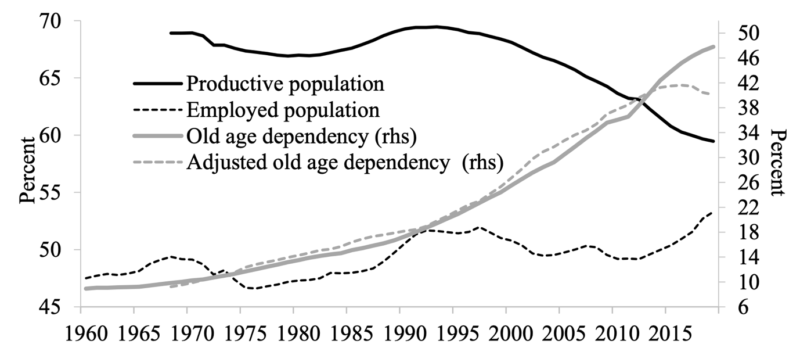

The problem of course is that this aggravates the problem for pensioners since they now face an ageing society and lower savings than their parents and grandparents. The Japanese are solving that problem in a very simple way. They have managed to turn around the trend in the dependency ratio. Since about 2015, the dependency ratio is declining again in Japan.

Dependency ratios in Japan are declining again

Source: Latsos and Schnabl (2021)

The solution in Japan is simply that the employed population is growing fast again. And no, it is not through higher immigration, but through older people re-joining the workforce at age 65 or older.

Obviously, this is not some romantic version of being active and productive in old age. Most of the time, older Japanese have to go back to work in some minimum wage jobs just to make ends meet. And with more and more older people being forced to go back to work the wages for these jobs are coming increasingly under pressure. Japan faces an increasing income inequality without any meaningful immigration or outsourcing of manufacturing jobs to emerging markets. I wouldn’t be surprised if, in ten or twenty years, we in Europe and the United States would face the same problems. And I wonder how populist politicians will blame them for the lack of opportunity and income growth of the working class.

Of course, demographics is NOT destiny, as I always say, so the example of Japan is not a necessary result of the current developments in Europe and the United States. But we had better start thinking about solutions to this problem today, to be able to fix it. Because it will be pretty hard to manage rising income inequality and declining real wages if you can no longer blame outsiders for your problems but have to pit different parts of your own population against each other.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

ALSO BY JOACHIM KLEMENT

We deceive ourselves about financial incentives

Transparency is good for business for asset managers

Another sign that market efficiency is increasing?

How hard is it to find the next Amazon?

Practitioners still pay too little attention to academia

Stocks have lagged bonds since 1970. Why?

WHAT TO READ NEXT

If you found this article interesting, we think you’ll enjoy these too:

What can you do about bubbles and crashes?

How to manage your cashflow properly

Young investors are more cautious than you think

Older investors handled last year’s volatility worst

DIY trading boom storing up problems for the future

NEED AN ADVISER?

If you need a financial adviser, we may be able to help.

Wherever you are in the world, we will try to put you in contact with an adviser in your area whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help you. If we don’t know of anyone suitable we will tell you.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Click here and let’s get started.

© The Evidence-Based Investor MMXXI