By JOACHIM KLEMENT

We all know that both stocks and bonds have benefited from declining interest rates over the last couple of decades. For bonds, the interest rate sensitivity is usually captured in a first approximation by the duration of the bond. A bond that has a duration of 10 will increase by 10% in price for every one percentage point drop in interest rates.

Similarly, one can look at equities as a form of bonds with variable coupons (aka dividends) and infinite maturity. This leads us to the concept of equity duration, which became popular in the 1980s and 1990s and has since lost some of its prominence. In theory, the duration of a dividend-paying stock should be the inverse of its dividend yield. In practice, it is substantially shorter because variations in interest rates don’t directly flow through to dividends.

Nevertheless, one can approximate stock markets as a stream of dividends and then match this stream of dividends with a stream of government bond coupons. Theoretically, because government bond coupons are (almost) risk-free while dividends are not, there should be a risk premium attached to dividends. And this means that stocks should, in the long run, outperform a matched stream of government bond coupons.

Except, they don’t.

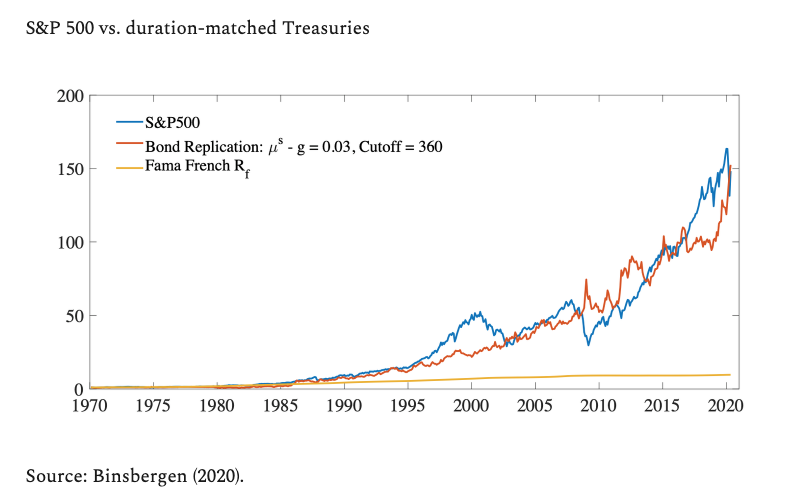

Jules van Binsbergen tested the performance of a series of Treasury coupon strips between 1970 and 2020 that matched the dividend strips of the S&P 500 index. Going out to maturities of up to 30 years (where Treasury strips are available in the market) he showed that between 1970 and 2020 the bond portfolio with the same duration as the S&P 500 had roughly the same return over the last 50 years as the S&P 500 but significantly lower volatility. Thus, risk-adjusted returns for bonds were higher than for stocks.

This opens up a couple of questions:

— Why did dividends not provide a risk premium to investors despite significant uncertainty around dividend payments both in the short term and in the long term (as we have seen in the latest crisis)?

— Why did stocks not provide additional returns despite the fact that they are subject to many more systematic risks than just interest rate risks?

We don’t know the answer to these questions. But what we do know from the research of Binsbergen is that if you combine the S&P 500 with a 20-year US Treasury (this Treasury roughly matches the long-term interest rate sensitivity of the S&P 500) then you can get a lot of short-term diversification between stocks and bonds while not reducing the long-term expected return of a pure stock portfolio. For some investors, it might just be the better alternative than a traditional stock/bond portfolio with shorter duration bonds that reduce long-term returns.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

Joachim is a regular contributor to TEBI. Here are some of his most recent articles:

No more room at the factor zoo

Boohoo teaches ESG investors a lesson

Stop admiring your successful trades

Is there a link between intelligence and performance?

Wall and Main are two different streets

Is book-to-market still the best measure of value?

Are we heading for another financial crisis?

Knowledge can be dangerous for stock pickers

Finding the right level of patience

Good financial advice is worth paying for

Did you know that TEBI can now put readers in touch with an evidence-based financial adviser in their area?

If you’re looking for advice on your investments or on your financial situation in general, simply click on this link and enter your name and email address. You will then be sent a short questionnaire to complete. Your answers will enable us to identify a suitable firm for you to speak to.

We will only recommend advisers who share our evidence-based investment philosophy and who we know and trust. If we can’t help you we will tell you.