It was apparently Professor John Cochrane of the University of Chicago who coined the term “zoo of factors” in his 2011 presidential address to the American Finance Association. Since then, the factor zoo has grown considerably. Several hundred risk factors have been identified which, it’s been claimed, have beaten the broader stock market over time.

But very few risk factors have outperformed with any degree of consistency. For JOACHIM KLEMENT, it would be wrong to abandon factor investing altogether. But, he says, investors would be wise not to get their hopes up whenever a new factor emerges.

Factor investing, or smart beta investing, as some people call it, has become all the rage. Admittedly it’s more popular in the United States than in the UK and Europe, but it’s been growing in popularity outside the US too.

In their efforts to reduce costs while still generating above-market returns, many pension funds have shifted their assets into smart beta ETFs that try to mimic one factor or another.

Meanwhile, the factor zoo has grown bigger and bigger and by now encompasses several hundred anomalies that promise significant outperformance. At least within the sample of the publication exploring the anomaly.

The quest for publication

The typical procedure for research is to describe the anomaly, and then measure the performance of a long/short-portfolio that is long the 20% best stocks (with regards to the anomaly) and short the 20% worst stocks. You win a prize (i.e. being published in a journal or launching a fund) if the performance of that long/short-portfolio has strong performance.

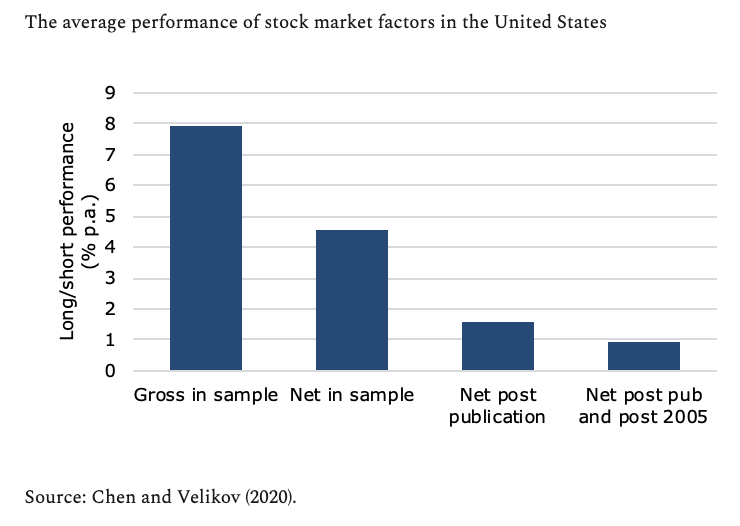

Andrew Chen from the Federal Reserve Board and Mihail Velikov from Penn State recently examined 120 factors that are described in the academic literature. On average, the annual return of the long/short-portfolios formed on a factor had an annual return of almost 8%. That is impressive, but unfortunately, most studies don’t take transaction costs into account. So Chen and Velikov did it for them.

Assuming that investors have to pay the typical bid-ask spread for the stocks they trade (the authors make sure to use historical transaction data where available instead of quoted prices that may have a narrower spread than investors pay in real life) the authors conclude that the average annual performance of the long/short-portfolio is lower, but a still-respectable 4.6% per year.

The replication crisis

But investors today are very much aware of the replication crisis (and if you aren’t, read about it here). Thus, most investors expect the performance of the factor to decline after publication for a number of reasons. And that is what the Chen and Velikov observe as well. After an anomaly has been published, its average performance net of trading costs drops to 1.6% per year.

Ugh. It’s starting to look ugly.

But wait, there is more.

Stock market trading has changed dramatically in the 21st century. The rise of algorithmic trading and high-frequency trading has changed the dynamics of share prices and made it much easier for hedge funds to exploit market anomalies.

When Chen and Velikov looked at the performance of factors net of trading costs and after publication but restricted their sample to data from 2005 onwards, all that was left of the performance of the average long/short-portfolio was a meagre 1% per year or 8bps per month.

Two important caveats

But before you abandon factor investing altogether, let me stress two important caveats:

— The chart above shows the average performance of 120 factor portfolios. Some factors continue to have much better performance than others and indeed, Chen and Velikov show that the two factors that appear in one study after another as the most reliable factors, momentum and value, still have better than average returns after 2005 (despite the underperformance of value in the last decade).

— There is an increasing amount of studies that show that combining different factors in a portfolio can significantly enhance performance.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

Joachim is a regular contributor to TEBI. Here are some of his most recent articles:

Boohoo teaches ESG investors a lesson

Stop admiring your successful trades

Is there a link between intelligence and performance?

Wall and Main are two different streets

Is book-to-market still the best measure of value?

Are we heading for another financial crisis?

Here are some other posts on factor investing which we think you’ll find interesting:

Have we seen the death of value?

How inflation affects growth versus value

How different risk factors performed in Q1

What the latest research tells us about the value premium

Is market-cap indexing a for of momentum investing?

Can we help you find a financial adviser?

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we’re trialling a new service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

For compliance reasons, this service is currently unavailable to readers in the US.

Need help? Click here.

Picture: Nikolay Tchaouchev via Unsplash