By LARRY SWEDROE

If investors were asked who is the greatest investor of all time, the name Warren Buffett would surely be at, or near, the top of almost everyone’s list. However, with his 89th birthday arriving on August 30, 2019, Berkshire’s recent performance has led some to question whether he is still at the top of his game. As of August 27, year-to-date Berkshire’s A shares had lost about 2.5%, underperforming the S&P 500 by about 18.5%. And this isn’t a new trend.

In March 2018, Wall Street Journal columnist Jason Zweig noted that Berkshire Hathaway’s stock had underperformed the S&P 500 Index over the 10 years ending in 2017, 7.7 percent versus 8.5 percent. Zweig hypothesised that the reason for the underperformance was that the size of Berkshire Hathaway’s portfolio had grown so large that it created a burden that is difficult to overcome. “Too much money” is a long-known problem for active managers because success contains the seeds of future failure as cash flow, and the problems that come with it, swamps skill.

While size can become a problem for active managers, I suggest that there is a far more important factor at work. As my co-author, Andrew Berkin, and I discuss in our book, The Incredible Shrinking Alpha, the market has become an increasingly difficult competitor. We provide four explanations: academics have converted alpha into beta; the pool of victims that can be exploited has dramatically shrunk; the competition has become increasingly skilful; and the supply of capital chasing alpha has increased. I’ll focus on the publication of academic research converting what once were sources of alpha for Buffett into common factors (beta), removing sources of excess risk-adjusted returns.

Buffett’s Alpha

The conventional wisdom has always been that the success Warren Buffett has had is explained by his stock-picking skills and his discipline — keeping his head while others are losing theirs. However, the 2013 study Buffett’s Alpha by Andrea Frazzini, David Kabiller, and Lasse Pedersen offered some very interesting and unconventional answers. They found that, in addition to benefiting from the use of cheap leverage provided by Berkshire Hathaway’s insurance operations, Buffett bought stocks that are “safe” (have low beta and low volatility), “cheap” (value stocks with low price-to-book ratios), high-quality (profitable, stable, growing and with high payout ratios) and large.

The most interesting finding of the study was that stocks with these characteristics — low risk, cheap and high quality — tend to perform well in general, not just the ones that Buffett buys. High-quality companies, according to the study, have the following characteristics: low earnings volatility, high margins, high asset turnover (indicating efficiency), low financial leverage and low operating leverage (indicating a strong balance sheet and low macroeconomic risk), and low specific-stock risk (volatility unexplained by macroeconomic activity). Companies with these attributes historically have provided higher returns, especially in down markets.

In other words, it’s Buffett’s strategy that generated “alpha,” not his stock-selection skills. The authors adjusted Buffett’s performance for the betting-against-beta (BAB) factor — from Frazzini and Pedersen’s 2014 study Betting Against Beta — the new quality factor. The authors found that once all the factors (beta, size, value, momentum, BAB and quality) and leverage are accounted for, a large part of Buffett’s performance is explained and his alpha is statistically insignificant.

It’s important to understand that this finding doesn’t detract in any way from Buffett’s past performance. After all, it took decades for modern financial theory to catch up with Buffett and discover his “secret sauce.” However, the research does provide insights into why Buffett was so successful — it was strategy and not stock picking. Buffett’s genius, as Frazzini, Kabiller and Pedersen observe, thus appears to be in recognising long ago that “these factors work, applying leverage without ever having a fire sale, and sticking to his principles.” Buffett himself stated in Berkshire Hathaway’s 1994 annual report: “Ben Graham taught me 45 years ago that in investing it is not necessary to do extraordinary things to get extraordinary results.”

The bottom line is that we now know Buffett’s secret sauce is to buy safe, high-quality value stocks coupled with the application of low-cost leverage. And with the publication of the academic findings, many investment firms (such as AQR and Dimensional), have incorporated the information into their portfolio construction rules, giving investors a way to invest like Warren Buffett. (Full disclosure: My firm, Buckingham Strategic Wealth, recommends AQR and Dimensional funds in constructing client portfolios.) In other words, Buffett’s alpha had been converted to beta and his advantage was no longer there.

Comparing performance

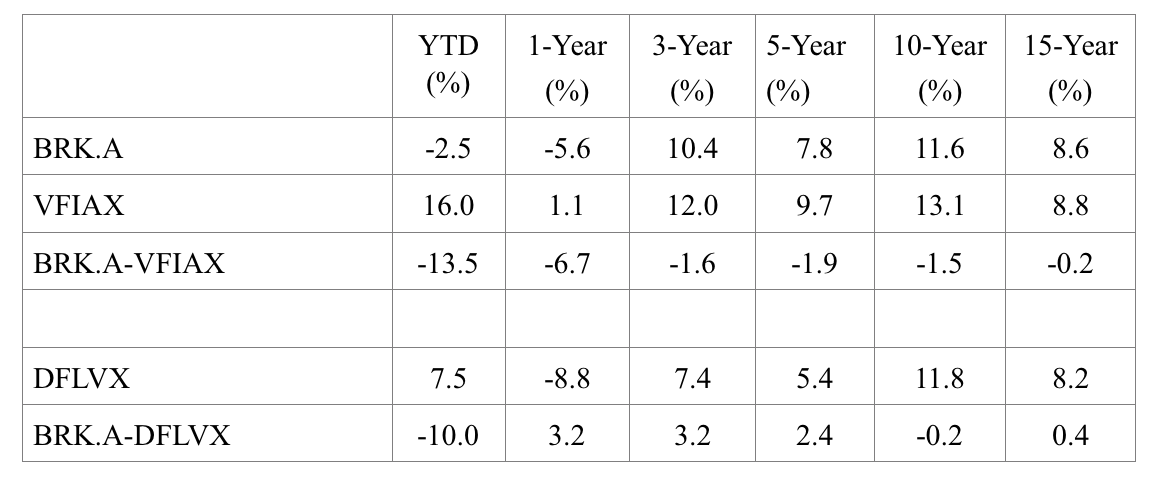

With an understanding of the literature, we can now take a closer look at Buffett’s recent performance. To properly analyse his (that is, Berkshire’s) performance, we will compare BRK.A’s returns to not only Vanguard’s 500 Index Fund (VFIAX), but also to those of DFA’s Large Value Fund (DFLVX). As noted, Buffett’s investment strategy has always been a value strategy, and the underperformance might just be a result of the fact that the value premium has been negative over the recent past.

The table below, using Morningstar data, shows the performance through August 27, 2019.

While BRK.A has underperformed both VFIAX and DFLVX by wide margins so far this year, as we extend the period, we see that its underperformance relative to the market is well explained by the fact that the U.S. value premium has been negative over the last 15 years. In fact, its performance has been relatively similar to that of DFLVX over the past 10 and 15 years.

There’s nothing new in investing — only the history you don’t know

While such long periods of underperformance for the value premium is “unusual”, Buffett knows that it should not be unexpected. He knows that all risky assets experience long periods of underperformance. If that were not the case, there would be no risk for long-term investors (and there should not be any other kind). In fact, there have been three periods of at least 13 years, and as long as 17 years, when the S&P 500 underperformed totally riskless one-month Treasury bills. And there have also been long periods when value underperformed as well. In fact, during the dot.com era many were questioning whether Buffett’s best days were behind him as from 1995 through 1999 BRK.A underperformed the market by more than 6 percent per annum while experiencing almost twice the volatility (data from www.portfoliovisualizer.com).

Recency — a deadly disease

The recency effect — in which the most recent observations have the largest impact on an individual’s memory and, consequently, on their perception — is a well-documented cognitive bias. This bias impacts investment behavior if investors focus on the most recent returns and project them into the future. This is a very common mistake, leading investors to buy what has done well recently (at high prices, when expected returns are now lower) and sell what has done poorly recently (at low prices, when expected returns are now higher). Buying high and selling low is not a prescription for investment success. Yet, the research shows that is exactly what many investors do, presumably because of recency bias. The problem of recency is compounded by the problem of relativism.

Relativism

Unfortunately, investor satisfaction or unhappiness (and by extension, the discipline required to stick with a strategy) is often determined by the performance of their portfolio relative to some index. Relativism, sadly, can best be described as the triumph of emotion over wisdom and experience. The history of financial markets has demonstrated that today’s trends are merely “noise” in the context of the long term. Which is why Buffett ignores it, sticking to his principles.

The twin problems of recency and relativism are compounded by the problem that most investors think that when it comes to judging the performance of an investment strategy, three years is a long time, five years a very long time, and 10 years an eternity. Yet, financial economists know that when it comes to risky assets, 10 years is likely nothing more than noise. Which is why Warren Buffett has noted that, temperament, which provides the discipline to ignore what economists know are random periods of underperformance and adhere to a well-thought-out plan, is far more important than intelligence. No more proof is required than the negative 0.9% per year return to the S&P 500 Index over the first decade of this century, underperforming riskless one-month Treasury bills by 3.7 percentage points a year. The difference in total returns was 40%! Investors in stocks shouldn’t have lost faith in their belief that stocks should outperform safe Treasury bills due to the experience of that decade.

Temperament, and the knowledge that all risky assets go through long periods of unpredictable performance, is what allowed Buffett to stay the course with his value strategy. And, after underperforming the S&P 500 by more than 6 percent from 1995 through 1999, over the period from 2000 through 2007 BRK.A outperformed by an even greater 10.7 percent a year!

It’s important to note that, just as was the case in the late 1990s, the underperformance of value has widened the spread between valuations of growth stocks and value stocks. According to data from AQR, that spread is wider than in about 90 percent of the data points. Historically wider spreads tend to predict a larger than historical value premium. Valuations do matter.

Summary

The great returns Warren Buffett has achieved over the long term have been earned by having conviction in his investment principles (investing in quality, value stocks) and having the discipline to stay the course, avoiding panicked fire sales that destroy the performance of so many portfolios. The great tragedy is that while so many investors idolise Buffett, they fail to take his advice and invest just like him.

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of 17 books on investing, including Think, Act, and Invest Like Warren Buffett.

Larry is a regular contributor to TEBI. Here are some of his other recent articles:

Persistent outperformance remains very elusive

US hedge fund performance underwhelmed again in Q2

Resulting — what it is and why it misleads poker players and investors alike

Why use passively managed structured portfolios like Dimensional’s?

Active managers no better able to manage risks than passive indices

Four reasons why the SEC’s Best Interest rule doesn’t cut it

TEBI has written about Warren Buffett many times. Here are three of the more recent examples:

When the wind blows

Buffett’s advice in 25 quotes

Fees never falter