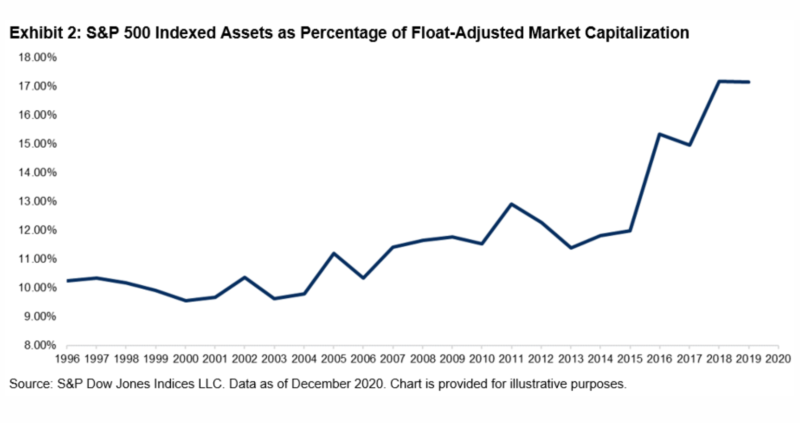

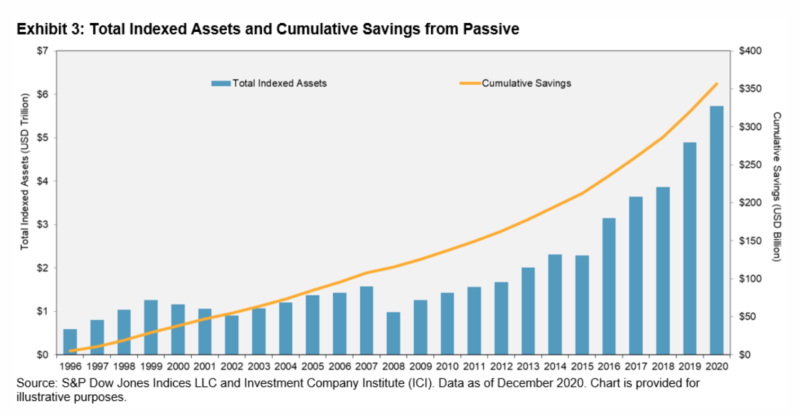

$357 billion is not an insignificant sum. And that’s what investors in the United States have saved over the last 25 years by using index funds tracking the S&P 500, S&P 400 and S&P 600. The good news is that, although indexed assets as a percentage of float-adjusted market capitalisation have grown sharply in that time, the figure still stands at a relatively modest 17%. As ANU GANTI from S&P Dow Jones Indices explains, the potential for even greater savings in the future is huge.

In the 20 years ending in 2020, 94% of all large-cap U.S. managers lagged the S&P 500. Mid- and small-cap results were almost equally disappointing. A notable consequence of these shortfalls in active performance has been the rise in passive investing, one of the most significant trends in modern financial history.

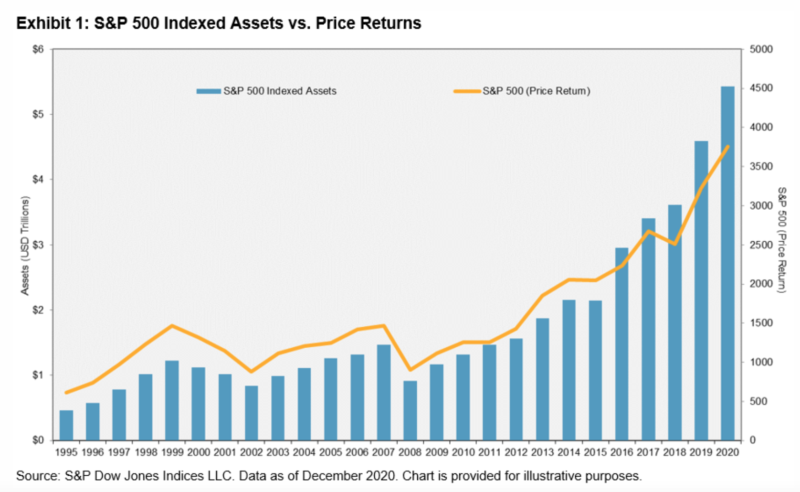

Our recent Annual Survey of Indexed Assets shows a surge in assets tracking the S&P 500 to $5.4 trillion as of December 2020. Exhibit 1 illustrates that this growth outpaced the growth due to market gains, indicating a substantial increase in flows.

To provide perspective on the size of the passive market, we can analyse indexed assets historically as a percentage of float-adjusted market capitalisation. Exhibit 2 shows that this percentage has grown dramatically, from 10% in 1996 to 17% in 2020. While indexing has grown substantially, the potential for future growth is promising.

Among the many benefits of indexing is its low cost relative to active management. As indexing has grown, investors have benefited substantially by saving on fees and avoiding underperformance. We can estimate the fee savings each year by taking the difference in expense ratios between active and index equity mutual funds, and multiplying this difference by the total value of indexed assets for the S&P 500, S&P 400 and S&P 600. When we aggregate the results, we observe that the cumulative savings in management fees over the past 25 years is $357 billion (see Exhibit 3).

ANU GANTI is Senior Director, Index Investment Strategy, at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

MORE FROM S&PDJI

For more valuable insights from our friends at S&P Dow Jones Indices, you might like to read these other recent articles:

Has size contributed to value’s recent revival?

What does history tell us about the value rally?

The case for tracking the venerable Dow Jones

A diverse portfolio is a strong portfolio

Why even Buffett has been buffeted by the index

The case for looking beyond the S&P 500

PREVIOUSLY ON TEBI

Specialised ETFs: high fees, poor performance

David Booth on 50 years of indexing

Does momentum investing make sense?

Why and how systematic strategies decay

Where are you looking for information?

WOULD YOU LIKE TO PARTNER WITH US?

We at TEBI are very grateful for the support of our strategic partners.

TEBI’s principal partner is Sparrows Capital, which manages assets for family offices and institutions and also provides model portfolios to advice firms. We also have a strategic partner in Ireland — PFP Financial Services, a financial planning firm in Dublin.

We are currently seeking partnerships in North America and Australasia with firms that share our evidence-based and client-focused philosophy. If you’re interested in finding out more, do get in touch.

Image: Cris Tagupa via Unsplash