Cricket world cup.

LOOK AT IT THIS WAY

Succeeding with a long-term investment goal often comes down to the simple act of sticking to your plan and staying in your seat. Many an investor comes unstuck by chopping and changing, only to miss the returns when they do eventually kick in.

The fact is: markets don’t move in a straight line. Returns are distributed unevenly across time and place. It’s tough to predict which individual securities, sectors, asset classes and countries will perform best. Events often appear random.

Like finance, sport can be unpredictable. Just as a particular result appears inevitable, circumstances can change. A fluke event or umpiring decision can swing a match and an outcome that seemed almost certain at one point suddenly reverses.

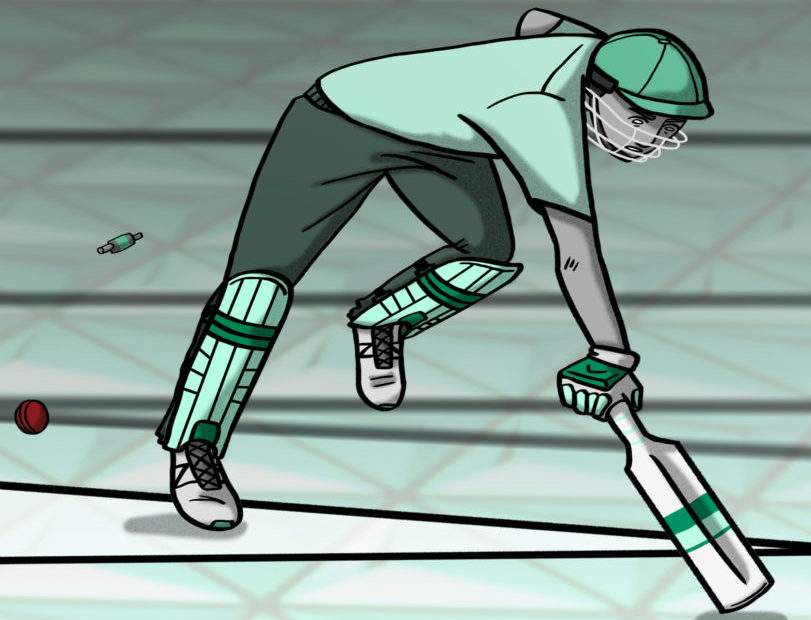

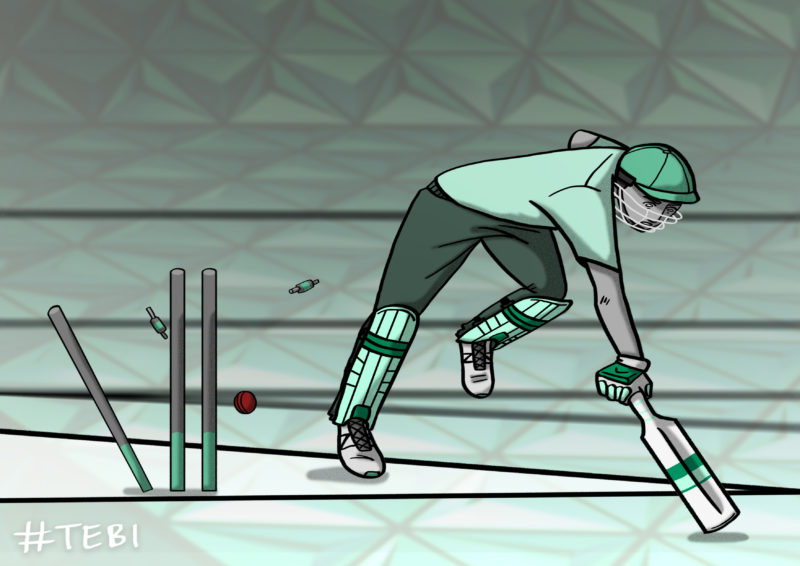

Think back to the Cricket World Cup cricket final of 2019 at Lords between England and New Zealand. The Kiwis batted first and scored what looked like a modest total of 241/8 from their 50 overs. A NZ supporter might have been tempted to get the early bus at that point.

But then, the England top order crashed and the home team were reduced to 86/4 by the 24th over. Likewise, an England fan might have decided on an early march around then.

Then, Ben Stokes steadied the ship for England. A seemingly impossible 15 off the final over suddenly looked almost doable when he hit a six of the third ball. Later in the over, a NZ fieldsman attempted to run Stokes out while he was attempting a second run, but the ball deflected off his bat and ricocheted to the boundary. England ended at 241 all out.

When the scores squared, a final ‘super’ over was called. England scored 15, which looked enough to win. But then, the Kiwis came back and matched it. The final was ultimately decided in England’s favour on a boundary countback. Unthinkable and totally unpredictable.

Those who quit the ground during that match, feeling certain of the outcome, would have rued their decisions. It was a nail-biter.

Investment can be seemingly unpredictable. When volatility, fear and uncertainty are at their peak is when many investors want out. But it is the nature of markets to assimilate the combined views of millions of participants and move onto the next thing. It’s foolish to think you know what will happen next or to base your approach on a forecast.

The truth is that the game of investment is won by those stay in their seats, who diversify broadly, who stay focused on what they can control and who understand that events ‘on the field’ can be unpredictable.

Howzat?

With our Look At It This Way series, we use visual metaphors to help demystify investing and personal finance. If you’ve found this metaphor helpful, you may want to try these:

What is the “all-roads vehicle” of investing?