By LARRY SWEDROE

Patient investing is the ability to endure long periods of underperformance — adhering to your well-thought-out plan in the form of an investment policy statement — in hopes of achieving your investment objective. Unfortunately, my more than 25 years of experience in advising investors has taught me that when it comes to judging the performance of investment strategies involving risk assets, far too many investors believe that three years is a long time, five years a very long time and 10 years an eternity. This is true even of most institutional investors — a State Street survey of senior executives with asset allocation responsibilities at 400 large institutional investors found that just 20 percent of respondents said they would tolerate underperformance of two years, and just one percent for three years, from their smart beta (factor) managers. On the other hand, financial economists and those with a knowledge of financial history know that when it comes to risk assets (such as factors), even 10 years of underperformance is likely to be “noise” that should not cause investors to abandon their strategy.

Vanguard’s Chris Tidmore and Andrew Hon contribute to the literature with their study Patience with Active Performance Cyclicality: It’s Harder Than You Think, published in the June 2021 issue of The Journal of Investing. They examined the amount of patience required of investors by quantifying the wide range of frequencies, durations and magnitudes of underperformance that both equity factor tilts and outperforming traditional active managers experience.

For their analysis of equity factors, Tidmore and Hon used data from the Kenneth R. French Data Library for the long-only size, value, momentum and low-volatility (beta) factor returns and the risk-free (one-month T-bill) rate. For the multi-factor return, they used a portfolio equally weighted across size, value, momentum and low volatility minus the market. They calculated the factor excess returns for overlapping one-, three- and five-year periods over the 25 years ending December 2019. Their sample of active funds, which excluded funds with less than 10 years of returns data, included almost 2,600 funds.

Following is a summary of their findings:

- The excess returns for the factors were: value, 1.1 percent; momentum, 2.9 percent; low volatility, 1.9 percent; size 0.9, percent; and multi-factor, 1.6 percent. The performance of the outperforming actively managed funds was similar, ranging from 0.4 percent to 2 percent.

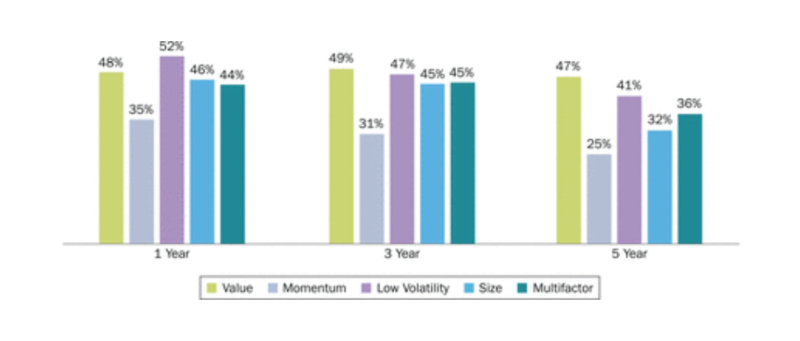

- Almost all outperforming traditional active equity managers and equity factors have frequent periods of underperformance relative to the equity market, some of which are long in duration and large in magnitude. The chart below shows the frequency of factor underperformance as measured by the percentage of overlapping time periods for which factors underperformed the market (1995–2019):

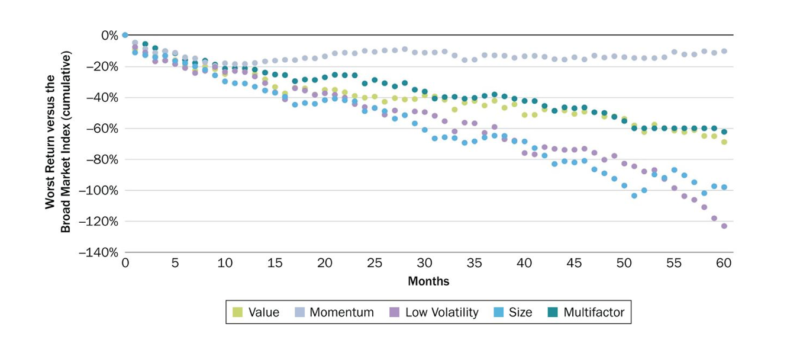

- The chart below shows the underperformance of factors across various horizons. Note that the multi-factor strategy doesn’t display the same magnitude or length of drawdowns as most single factors. This difference, in fact, is linked to one of the prime attractions of a multi-factor product — its diversification benefit, which lets the investor take advantage of the performance cyclicality of the single factors. An investor holding such a product may therefore need less patience.

- About 70 percent of outperforming funds underperformed their style benchmarks between 40 percent and 60 percent of all one-year evaluation periods.

- Almost 100 percent of outperforming funds had experienced a drawdown relative to their style and median peer benchmarks over one-, three- and five-year evaluation periods.

- Eight out of 10 outperforming funds had at least one five-year period when they were in the bottom quartile relative to their peers.

- Investors can expect to experience a drawdown of between 40 percent and 60 percent for all one-year evaluation periods. Additionally, an outperforming manager can expect to experience a continuous drawdown lasting two years or more every 10 years and a drawdown of at least 20 percent over time.

- More than half of outperforming active equity funds had underperformed their style and median peer benchmark by at least 20 percent, three-quarters of funds that recovered from their largest drawdown took more than three years to do so, and more than a quarter did so after seven or more years of underperformance.

- As the investment horizon increased, the median active manager’s worst performance increased and the dispersion of individual manager drawdowns increased dramatically, especially relative to style benchmarks—a risk of selecting active managers.

Their findings led Tidmore and Hon to conclude: “Success in investing requires patience; investing, in fact, probably requires more patience than most endeavours. You need patience when what you are invested in is performing poorly—and you need it when what you haven’t invested in is performing well. At any given time, you might need to have extra patience with the market, a sub-asset class, a particular region, a strategy, an individual manager, or even the cash you have on the sidelines. … The possible benefits of using outperforming managers and factor tilts can be significantly eroded, however, for an investor who fails to maintain a long-term patient perspective. This is because the inconsistency inherent in returns wears on patience. In theory, most investors are fine with drawdowns. They have been told to expect them. Evidence shows that investors struggle when the frequency, duration, and magnitude of drawdowns mount. … As Benjamin Graham once said, ‘The investor’s chief problem — even his worst enemy — is likely to be himself.’” They added that patience is ultimately rooted in one’s investment philosophy, conviction and emotional fortitude.

I would add that knowledge of financial history increases your conviction and emotional fortitude, providing the armour needed to protect you from your own emotions and the noise of the market, preparing you to be able to tolerate the inevitable periods of lengthy drawdowns that all strategies involving risk assets endure. Tidmore and Hon advised: “One of the major benefits of using professional financial advice is behavioural coaching, which includes helping investors manage their expectations and thereby increase their patience with their investment choices.”

Important Disclosure: The information presented herein is for educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Certain information may be based on third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Performance is historical and does not guarantee future results. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® or Buckingham Strategic Partners® (collectively Buckingham Wealth Partners). LSR-21-107

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

How to think differently about diversification

The impact of recency bias on equity markets

Passive growth makes it harder to generate alpha

Should you buy stocks with very negative recent returns?

Should investors we worried about US government debt?

Return signal momentum: a new strategy worth following?

PREVIOUSLY ON TEBI

Stock market games in schools are harmful

More pearls of wisdom from Buffett and Munger

How to think differently about diversification

Finding the total cost of investing is almost impossible

The pension time bomb: how worried should we be?

CONTENT FOR ADVICE FIRMS

Through our partners at Regis Media, TEBI provides a wide range of high-quality content for financial advice and planning firms. The material is designed to help educate clients and to engage with prospects.

As well as exclusive content, we also offer pre-produced videos, eGuides and articles which explain how investing works and the valuable role that a good financial adviser can play.

If you would like to find out more, why not visit the Regis Media website and YouTube channel? If you have any specific enquiries, email Sam Willet, who will be happy to help you.

© The Evidence-Based Investor MMXXI