Warren Buffett has consistently advised investors to use low-cost index funds in recent years — and he speaks from bitter experience. Even Buffett has been struggling to outperform the market. As CRAIG LAZZARA from S&P Dow Jones Indices explains, for the ten years ending in 2020, Berkshire Hathaway lagged the S&P 500 by 2.4% annually. So what’s gone wrong?

Berkshire Hathaway is scheduled to hold its annual shareholders’ meeting this Saturday. This is the second consecutive year in which the meeting will be virtual; in 2019, attendance was nearly 40,000, which makes social distancing somewhat difficult.

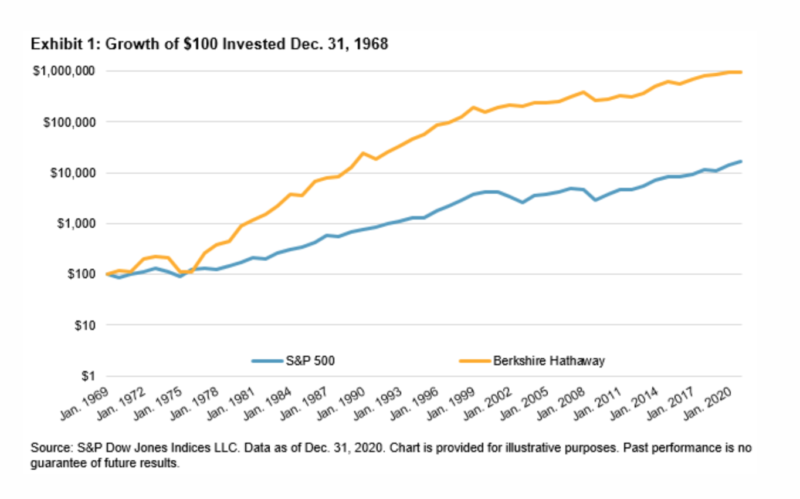

We noted two years ago that Berkshire’s investment performance, though formidable over the long run, had lately become more pedestrian. Neither conclusion has changed in the interim. $100 invested in Berkshire stock at the end of 1968 would have grown to more than $960,000 by the end of 2020; a comparable investment in the S&P 500 would have grown to $16,800.

Berkshire’s wealth generation has been all the more remarkable for having occurred at a time when most active portfolio managers underperformed index benchmarks. To cite the most recent evidence from our SPIVA reports, in the 20 years ending in 2020, 94% of all large-cap U.S. managers lagged the S&P 500. Mid- and small-cap results were almost equally disappointing.

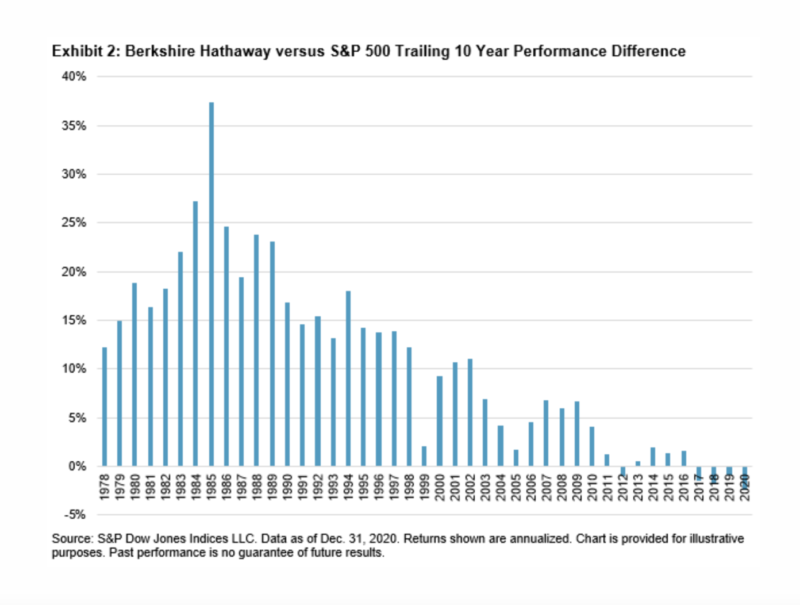

Despite the historical magnitude of Berkshire’s excess returns, they have recently been on a downtrend. Our comparison of Berkshire and the S&P 500 spans 52 years, or 43 (overlapping) ten-year windows. In the first 22, Berkshire beat the S&P 500 by an average of more than 17% per year. In the next 21 windows, Berkshire’s outperformance averaged 3.4%. The margin hit double digits for the last time in 2002. For the ten years ending in 2020, Berkshire Hathaway lagged the S&P 500 by 2.4% annually.

What’s gone wrong? The Berkshire portfolio is still being guided by Warren Buffett and Charlie Munger, whose abilities show no sign of deterioration with age, so that’s unlikely to be the source of the problem. Instead, the decisive variable is the improved quality of the competition. Mr. Munger himself (currently 97 years old) acknowledges that “we had idiot competition when we were young”.

In the game of professional investment management, the only source of outperformance for the winners is the underperformance of the losers. As the underperformers lose assets, either to passive funds or to more-capable active managers, the surviving active managers become better, and outperformance is harder to achieve.

When Warren Buffett was asked several years ago whether Berkshire or the S&P 500 would be the better investment for a long-term investor, he suggested that “the financial result would be very close to the same”. When the premier active investment manager in modern financial history says that, you know that active management is a hard game — and getting harder.

CRAIG LAZZARA is Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

MORE FROM S&PDJI

For more valuable insights from our friends at S&P Dow Jones Indices, you might like to read these other recent articles:

The case for looking beyond the S&P 500

The impact of style bias on the latest SPIVA data

Three reasons for active managers to feel positive

What does GameStop mean for market efficiency?

Is equal weighting worth considering?

Beware spectacular success stories

PREVIOUSLY ON TEBI

How to manage your cashflow properly

Why financial wellbeing matters

How useful are risk tolerance questionnaires?

The case for looking beyond the S&P 500

Is ESG a factor like size or value?

NEED AN ADVISER?

If you need a financial adviser, we may be able to help.

Wherever you are in the world, we will try to put you in contact with an adviser in your area whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help you. If we don’t know of anyone suitable we will tell you.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Click here and let’s get started.

© The Evidence-Based Investor MMXXI