Just because the vast majority of indexers use market-cap-weighted funds, that doesn’t mean that everyone has to. There are infinite ways to construct an index. A popular alternative to market-cap is equal weighting. An equal-weighted index invests an equal amount of money in the stock of each company that makes up the index. So is equal weighting worth considering? HAMISH PRESTON from S&P Dow Jones Indices has been taking a closer look.

2020 witnessed outperformance from some of the largest S&P 500® companies as investors expected these firms to be better placed to navigate the COVID-19 environment. Exhibit 1 shows that this outperformance led to the largest names accounting for an unusually high proportion of the U.S. large-cap equity benchmark, and therefore having a bigger impact on the index’s returns. For investors looking to gain large-cap exposure with lower sensitivity to the biggest names, and potentially to take advantage of reductions in market concentration, Equal Weight may be worth considering.

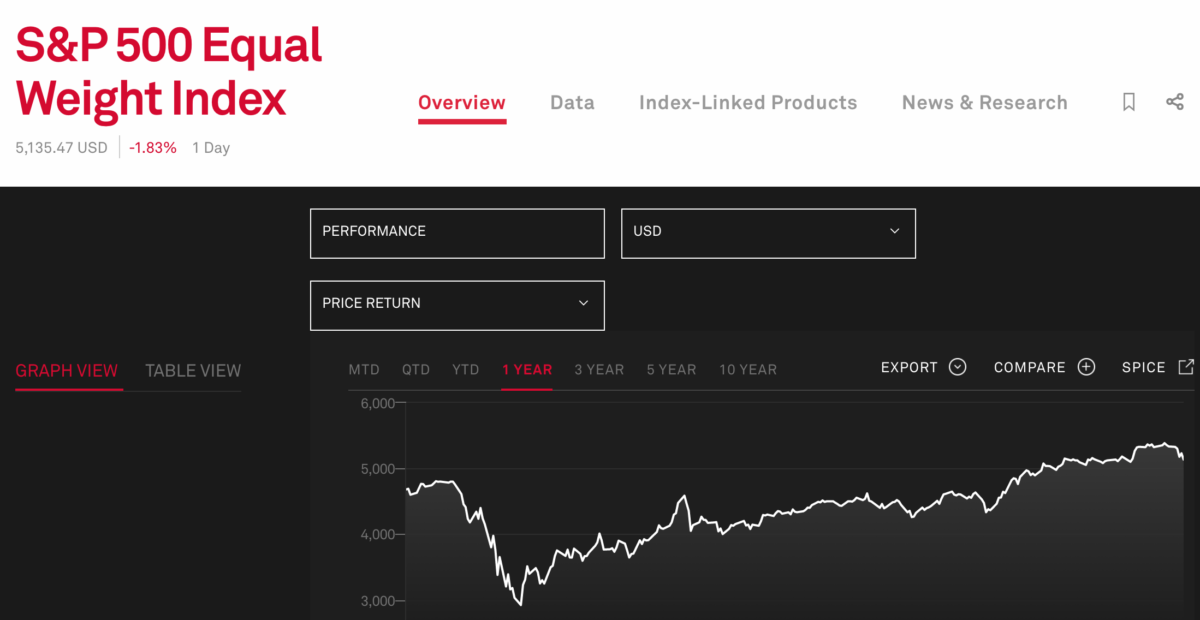

Launched in January 2003, the S&P 500 Equal Weight Index weights each S&P 500 company equally at each quarterly rebalance. Exhibit 2 shows the historical benefit from applying this weighting scheme within U.S. large caps; the S&P 500 Equal Weight outperformed since its launch as well as over its lengthier, back-tested history. Rather than being strictly a U.S. phenomenon, the outperformance in Equal Weight indices has been observed globally, including in Japan.

One of the key perspectives in explaining equal weight indices’ returns is their smaller size exposure: for example, over 50% of the historical variation in the S&P 500 Equal Weight Index’s relative returns is explained by size. This exposure occurs because, as Exhibit 3 illustrates, the distribution of weights within equal weight indices is far more even than within their market-cap weighted parents. For example, the S&P 500 Equal Weight Index is far less sensitive to the performance of the largest names in the market and offers more exposure to smaller S&P 500 companies.

Equal weight’s smaller size exposure helps to explain the link between market concentration and equal weight’s relative returns. All else equal, if the largest companies (to which equal weight has less sensitivity) outperform, concentration rises, and equal weight is likely to underperform its cap-weighted benchmark. Conversely, outperformance among smaller companies (to which equal weight has greater allocations) leads to reduced concentration and the likelihood of equal weight outperformance.

Exhibit 4 shows that this dynamic is exactly what has been observed historically. The S&P 500 Equal Weight Index’s cumulative relative total return versus the S&P 500 typically rose (fell) as concentration, measured by the cumulative weight of the largest five S&P 500 companies, fell (rose). This dynamic includes December 2020, when Equal Weight outperformed and concentration declined as the beginning of vaccine rollouts particularly benefited smaller companies that had been more impacted by the “COVID correction” last year.

The current market environment may present an opportunity for investors to consider Equal Weight in order to diversify away from some of the largest market constituents. The S&P 500 Equal Weight Index’s smaller size bias may also benefit investors anticipating reductions in market concentration.

HAMISH PRESTON is Associate Director, US Equity Indices, at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

For more valuable insights from our friends at S&P Dow Jones Indices, you might like to read these other recent articles:

Beware spectacular success stories

2020 and the danger of extrapolation

Three reasons why the index advantage will persist

PREVIOUSLY ON TEBI

How do target-date funds affect the markets?

Does a well-paid job make you happy?

People need advisers because they’re human

Is there a whelk in your fund portfolio?

FIND AN ADVISER

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we’re now offering a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Need help? Click here.

© The Evidence-Based Investor MMXXI