By JOACHIM KLEMENT

One of the most common experiences every advisor and professional investor makes is that people readily remember their best investments but have a hard time remembering their worst investments. And admittedly, remembering the duds you invested in and that cost you a fortune is painful. But as every experienced investor knows, these terrible investments are school fees in the sense that you can learn from your mistakes to become a better investor in the future. Unfortunately, too many investors never learn that lesson because it is too painful for them to admit to mistakes or because after a string of mistakes they just give up and stop investing or delegate their investments to professionals.

But those who stick to investing seem to gradually learn their lessons in the sense that examining poor investment decisions is a way to improve performance. In an interesting laboratory experiment, two Chinese researchers recruited 211 individual investors in Hong Kong who are at least 25 years old and had various degrees of investment experience. Then they asked them if they could remember their best and their worst investment. Because the participants had to deliver their investment statements of the last 12 months, there was some degree of accountability involved, though, obviously, people could claim to have made their best investments many years ago.

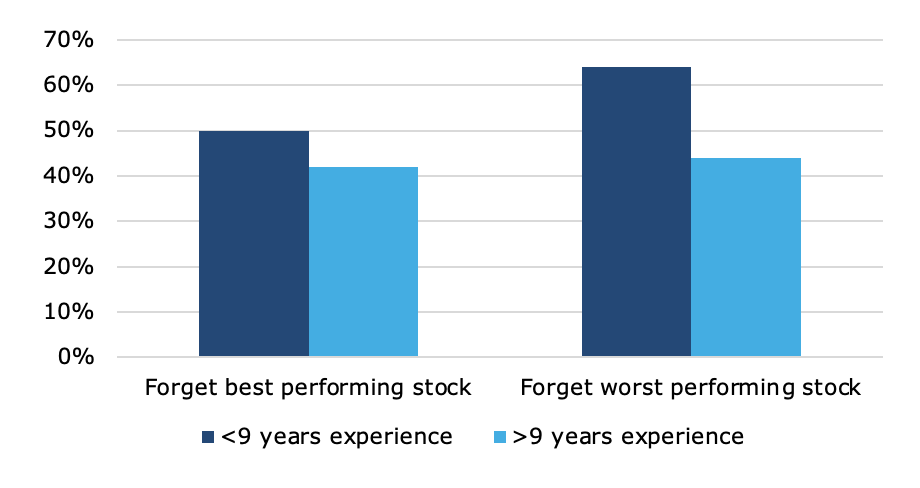

But instead of focusing on the best investments, the researchers were more interested in how well investors recalled their worst investments. The chart below shows the share of investors that were able to recall their best and their worst investments ever by experience.

Recall of best and worst investment

Source: Li and Rong (2020)

The notable observation here is that investors with more than 9 years of investment experience were far better at remembering their worst investments than investors with less experience. In laboratory experiments, more experienced investors were also more likely to actively choose to remember or note down bad experiences. In essence, these experienced investors had learned the lesson that you can improve more by remembering and examining past mistakes than past successes. For inexperienced investors, the first lesson to learn should thus be to focus on your mistakes. Once you have learned that lesson, your learnings curve becomes immediately much steeper.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

Joachim is a regular contributor to TEBI. Here are some of his most recent articles:

Another sign that market efficiency is increasing?

How hard is it to find the next Amazon?

Practitioners still pay too little attention to academia

Stocks have lagged bonds since 1970. Why?

No more room at the factor zoo

Boohoo teaches ESG investors a lesson

Stop admiring your successful trades

WHAT TO READ NEXT

If you found this article interesting, we think you’ll enjoy these too:

An investment lesson from the US election

No one consistently picks the winners in advance

Unique insight or common knowledge?

Three reasons why the index advantage will persist

What investors can learn from Moneyball

A wasted opportunity for Australia’s fund managers

Why we’re working with OpenMoney

Don’t judge people based on money

What do ageing populations mean for your portfolio?

There is such a thing as too much choice

FIND AN ADVISER

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we’re now offering a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

For compliance reasons, this service is currently unavailable to readers in the US.

Need help? Click here.

Picture: Scott Graham via Unsplash