Beating the index over meaningful timeframes — over, say, 20, 25 or 30 years — is extremely challenging. Only a very small proportion of actively managed funds succeed in doing it on a cost- and risk- adjusted basis. Not only that, most funds struggle to outperform over much shorter periods. In 2020, for example, just 12% of funds beat the headline index for the Candian equity market, the S&P/TSX Composite Index. Here’s S&P’s BERLINDA LIU wit the latest data.

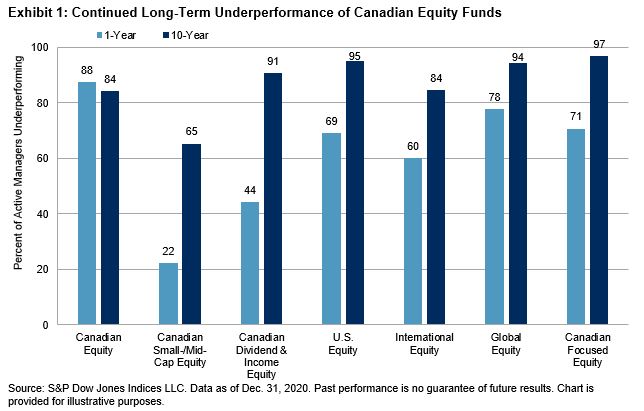

Although 2020 was a year that offered ample opportunities for stock pickers to shine, most Canadian active fund managers in five of the seven categories tracked by the SPIVA® Canada Year-End 2020 Scorecard underperformed their benchmarks over the past year.

The Canadian equity market was not spared from the COVID-19 shock in 2020. Nevertheless, major local equity benchmarks finished positive, with the exception of the S&P/TSX Canadian Dividend Aristocrats® Index. Among actively managed Canadian equity funds, 88% lagged the S&P/TSX Composite Index. Canadian Small-/Mid-Cap Equity funds had a banner year, as just 22% failed to beat the S&P/TSX Completion Index. Canadian Dividend & Income Equity funds took second place among fund categories, with just 44% lagging the S&P/TSX Canadian Dividend Aristocrats Index.

Results were more uniform and bleaker over longer horizons. At least 84% of Canadian fund managers underperformed their benchmarks in all but one category over the past decade.

Equity funds looking outside of Canada performed better than their domestic-focused peers on an absolute return basis, but still generally underperformed the benchmarks. Thanks to a strong rebound in the U.S., equity funds there posted the highest returns over the past year among all categories, with a 13.6% gain on an equal-weighted basis. However, this was still below the 16.3% return of the S&P 500® (CAD), and 69% of the funds still fell short of their benchmark.

Larger funds in Canada tended to outperform their smaller counterparts, as 22 of the 28 results showed higher asset-weighted returns across the seven fund categories and four investment horizons in the report.

The data from the SPIVA Canada Year-End 2020 Scorecard show disappointing performance of active funds relative to their respective benchmarks. Over the past decade, most Canadian fund managers in all categories failed to beat index investing.

BERLINDA LIU is Director, Global Research & Design, at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

MORE FROM S&PDJI

For more valuable insights from our friends at S&P Dow Jones Indices, you might like to read these other recent articles:

The impact of style bias on the latest SPIVA data

Three reasons for active managers to feel positive

What does GameStop mean for market efficiency?

Is equal weighting worth considering?

Beware spectacular success stories

2020 and the danger of extrapolation

PREVIOUSLY ON TEBI

Fintech is booming — but can Britain keep up?

Indexed annuities: Have you been framed?

Money is only one aspect of retirement planning

Woodford — a tale of complacency, incompetence and deceit

Should endowments persist with private investments?

Are YOLO traders undermining efficient markets?

CONTENT FOR ADVICE FIRMS

Through our partners at Regis Media, TEBI provides a wide range of content for financial advice and planning firms. The material is designed to help educate clients and to engage with prospects.

As well as exclusive content, we also offer pre-produced videos, eGuides and articles which explain how investing works and the valuable role that a good financial adviser can play.

If you would like to find out more, why not visit the Regis Media website and YouTube channel? If you have any specific enquiries, email Sam Willet, who will be happy to help you.

Picture: Nathaniel Bowman via Unsplash

© The Evidence-Based Investor MMXXI