By BERLINDA LIU

The author is Director of Global Research & Design at S&P Dow Jones Indices

In 1973, Princeton professor Burton Malkiel wrote the book, A Random Walk Down Wall Street, laying out a case against the mutual funds of the time as persistently underperforming market indices. Malkiel recommended[i] that the New York Stock Exchange create a fund that simply bought and held stock in the companies comprising the indices. Somewhat quaintly, he also suggested that the NYSE run the fund on a non-profit basis.[ii]

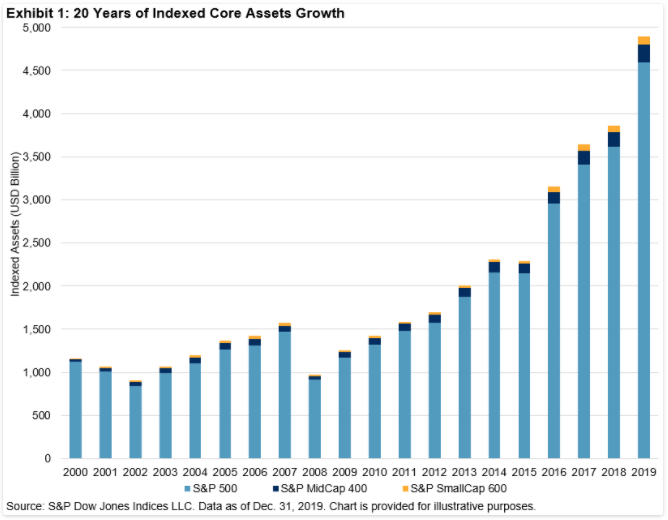

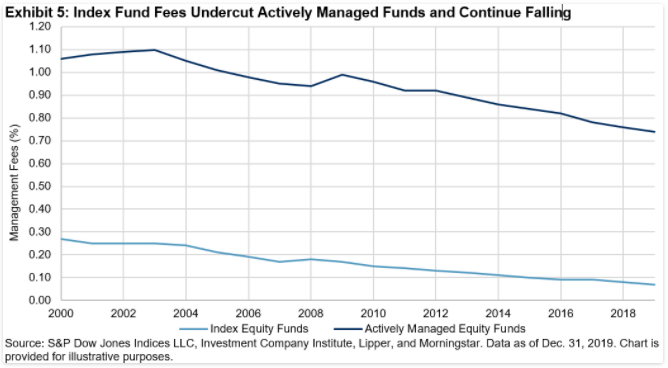

The 1976 initial offering for the first equity index mutual fund (tracking the S&P 500®) raised USD 11 million. Boosted by the proliferation of defined contribution retirement programs (401[k] plans in the U.S. arose from the Revenue Act of 1978) and turbocharged by ETFs starting in 1993 (again, first tracking the S&P 500), by 2019, USD 4.6 trillion was directly indexed to the S&P 500, with USD 6.4 trillion tracking all S&P DJI indices. S&P DJI estimates the cumulative savings from indexing versus active equity fund fees at USD 320 billion over 1996-2019, just for the S&P DJI benchmark indices.

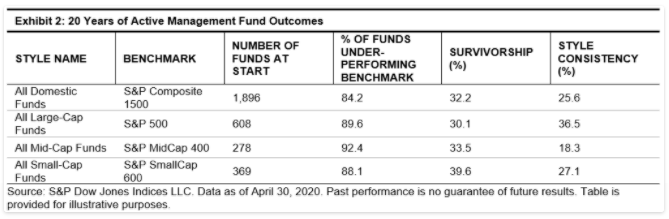

While S&P DJI’s SPIVA series regularly looks in more depth around the world and by fund style, perhaps now is a good time to review the longer-term trends and continued value behind indexing. Over the past 20 years (May 2000-April 2020), an investor in an active fund had a roughly 90% chance of being outperformed by the corresponding S&P DJI benchmark. If the underperformance wasn’t punishment enough, nearly two-thirds of funds were merged or liquidated in that time, while one-quarter of funds drifted away from their initial style. Furthermore, SPIVA Persistence reports have consistently shown that even the top funds of one measurement period are unlikely to retain their ranking in the next.

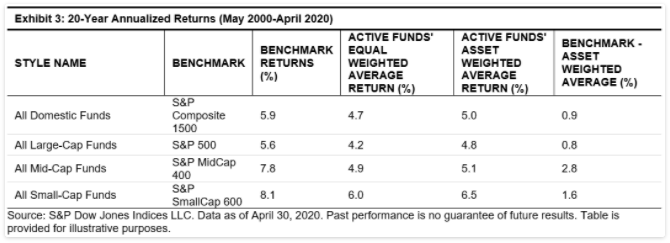

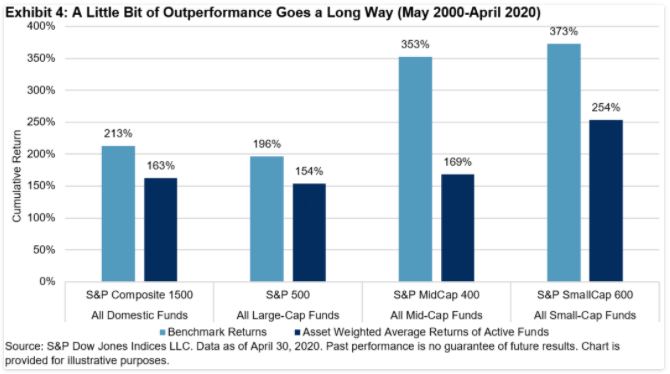

However, the story is more than a binary sieve of funds underperforming or surviving. Exhibits 3 and 4 show the superior returns of indices, benefiting from better stock picking (or, more accurately, no stock picking) and not having the fee drag. Reinforcing Einstein’s claim of compound interest as the Eighth Wonder of the World, a “satisfied-with-just-average investor” earned between 0.8% and 2.8% more in annualised terms, resulting in an impressive 42%-184% cumulative benefit over 20 years.

Malkiel’s seminal work helped launched a revolution in investments and personal finance, arguably putting the book in the same league as The Wealth of Nations (Adam Smith, 1776) and Das Kapital (Karl Marx, 1867) for its influence on asset accumulation. Malkiel’s vision of a low-cost fund for the masses has finally come to fruition: capitalism and technology have guillotined costs, with most U.S. brokerages now charging zero commissions and numerous index funds’ annual fees measured in low-single-digit basis points.

[i] Malkiel was neither the first nor the only person with this observation and recommendation, but his book was more widely read than previous academic publications, especially among non-professional investors.

[ii] In fairness, the NYSE was nominally structured as a non-profit exchange until its 2006 IPO.

This article was first published on the Indexology blog.

Here are some other recent articles from S&P Dow Jones Indices that we’ve featured on TEBI:

How long do top-quartile funds stay there?

Three hundred and twenty billion dollars

US fund managers flopped in the crisis

92% of Canadian fund managers underperformed in 2019

Does adjusting for risk make active performance any better?

How did Australian active managers handle Q1 volatility?

Enjoyed this article? We think you’ll like these too:

Put the odds of success in your favour

Safe yields RIP. What are your options now?

You don’t need to know the future to invest successfully

What’s the worst that could happen?

Could anyone have predicted Warren Buffett’s success?